Region:Middle East

Author(s):Rebecca

Product Code:KRAD6146

Pages:80

Published On:December 2025

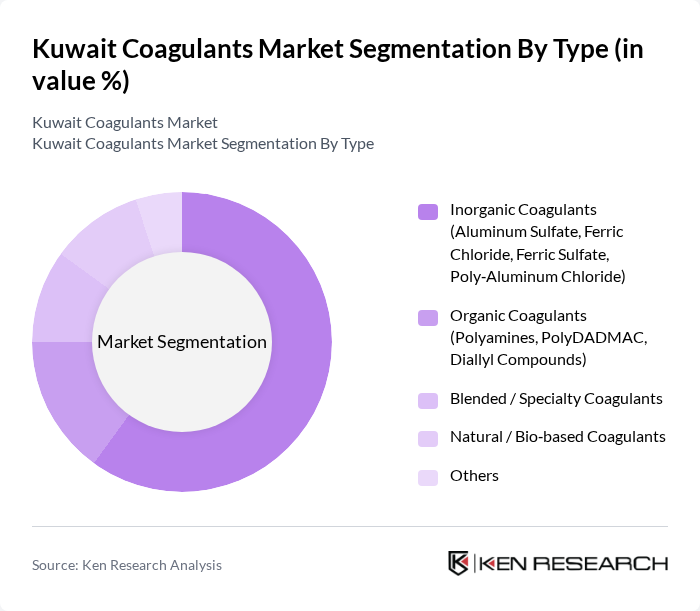

By Type:The coagulants market can be segmented into various types, including Inorganic Coagulants, Organic Coagulants, Blended/Specialty Coagulants, Natural/Bio-based Coagulants, and Others. Among these, Inorganic Coagulants, particularly Aluminum Sulfate and Ferric Chloride, dominate the market due to their widespread application in municipal water treatment and industrial processes and their proven performance in clarifying surface and groundwater. The preference for these coagulants is driven by their effectiveness, cost-efficiency, ease of dosing and handling in large plants, and established approvals within international and regional drinking water and wastewater standards.

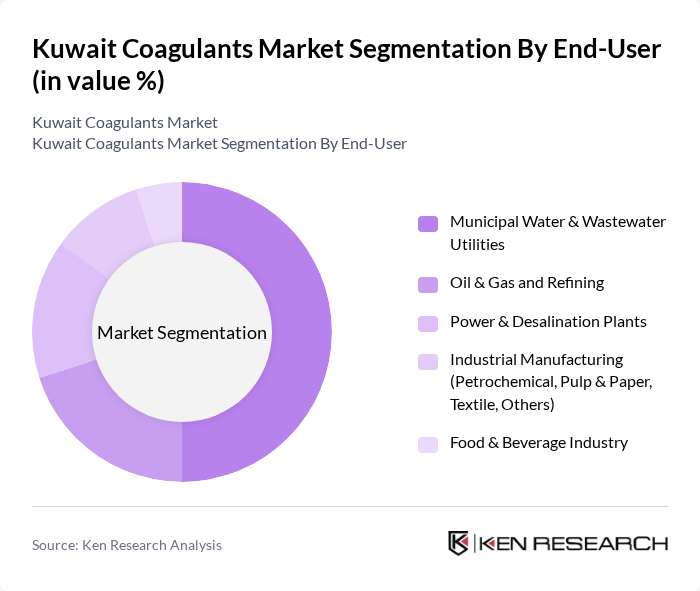

By End-User:The end-user segmentation includes Municipal Water & Wastewater Utilities, Oil & Gas and Refining, Power & Desalination Plants, Industrial Manufacturing (Petrochemical, Pulp & Paper, Textile, Others), Food & Beverage Industry, and Others. The Municipal Water & Wastewater Utilities segment is the largest consumer of coagulants, driven by the need for effective surface water clarification, tertiary treatment of wastewater, and compliance with drinking water and effluent standards. In addition, strong demand from oil and gas, petrochemical, and power and desalination facilities further supports coagulant consumption, as these sectors require reliable treatment of process water, cooling water, and produced water in Kuwait.

The Kuwait Coagulants Market is characterized by a dynamic mix of regional and international players. Leading participants such as BASF SE, SNF Floerger, Kemira Oyj, Solenis LLC, Veolia Water Technologies (Veolia Environnement S.A.), SUEZ Group, Nalco Water (An Ecolab Company), Kurita Water Industries Ltd., ARKEMA S.A., Saudi Basic Industries Corporation (SABIC), Gulf Cryo Holding KSCC, Kuwait Chemical Manufacturing Co. (KCMC), Al?Kout Industrial Projects Company K.S.C.P., Kuwait Wastewater Treatment Company K.S.C., Local & Regional Distributors (e.g., Tazez Advanced Industrial Co., regional chemical traders) contribute to innovation, geographic expansion, and service delivery in this space.

The Kuwait coagulants market is poised for significant growth, driven by increasing investments in water treatment infrastructure and a shift towards sustainable practices. As the government prioritizes environmental sustainability, the demand for eco-friendly coagulants is expected to rise. Additionally, advancements in digital technologies for monitoring water quality will enhance operational efficiency. Companies that adapt to these trends and invest in innovative solutions will likely capture a larger market share, positioning themselves favorably in the evolving landscape.

| Segment | Sub-Segments |

|---|---|

| By Type | Inorganic Coagulants (Aluminum Sulfate, Ferric Chloride, Ferric Sulfate, Poly?Aluminum Chloride) Organic Coagulants (Polyamines, PolyDADMAC, Diallyl Compounds) Blended / Specialty Coagulants Natural / Bio?based Coagulants Others |

| By End-User | Municipal Water & Wastewater Utilities Oil & Gas and Refining Power & Desalination Plants Industrial Manufacturing (Petrochemical, Pulp & Paper, Textile, Others) Food & Beverage Industry Others |

| By Application | Drinking Water Treatment Municipal Wastewater Treatment Industrial Effluent Treatment Desalination Pretreatment Sludge Conditioning & Dewatering Others |

| By Distribution Channel | Direct Sales to End Users Local Chemical Distributors International Traders / EPC Channel Online / Tender?based Procurement Platforms Others |

| By Packaging Type | Bulk Packaging (Tankers, IBCs) Bagged / Sack Packaging Drum & Intermediate Packaging Others |

| By Region | Kuwait City & Suburbs Southern Industrial & Oil Fields (Ahmadi, Shuaiba, Mina Al?Abdullah) Northern Kuwait & Oil Fields (Raudhatain, Sabriya, Abdali) Western & Other Governorates |

| By Customer Type | Government & Municipal Utilities State?Owned Enterprises (Oil, Power, Desalination) Private Industrial Customers Engineering, Procurement & Construction (EPC) Contractors Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Municipal Water Treatment Facilities | 110 | Water Treatment Managers, Environmental Engineers |

| Industrial Water Treatment Plants | 90 | Plant Managers, Chemical Engineers |

| Construction Sector Water Management | 70 | Project Managers, Site Engineers |

| Research Institutions and Universities | 55 | Academic Researchers, Environmental Scientists |

| Regulatory Bodies and Environmental Agencies | 45 | Policy Makers, Compliance Officers |

The Kuwait Coagulants Market is valued at approximately USD 160 million, driven by increasing demand for water treatment solutions in municipal and industrial sectors, along with expanding wastewater treatment infrastructure and rising industrial activities in oil and gas and petrochemicals.