Region:Europe

Author(s):Dev

Product Code:KRAA2620

Pages:92

Published On:August 2025

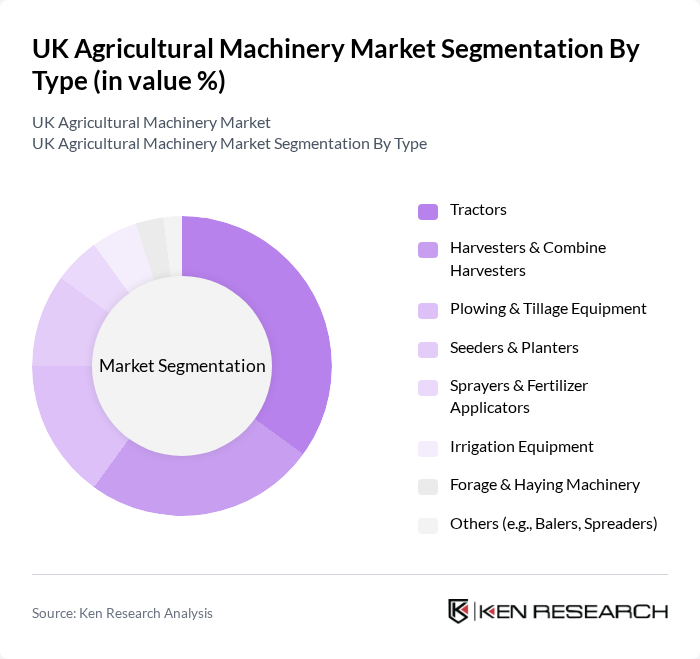

By Type:The agricultural machinery market can be segmented into various types, including tractors, harvesters, plowing and tillage equipment, seeders and planters, sprayers and fertilizer applicators, irrigation equipment, forage and haying machinery, and others. Each of these segments plays a crucial role in enhancing agricultural productivity and efficiency. Among these, tractors and harvesters are the most dominant due to their essential functions in large-scale farming operations. Tractors hold the largest market share, driven by their versatility and the government's support for mechanisation, while harvesting machinery is gaining traction due to the adoption of precision farming and the need to reduce post-harvest losses .

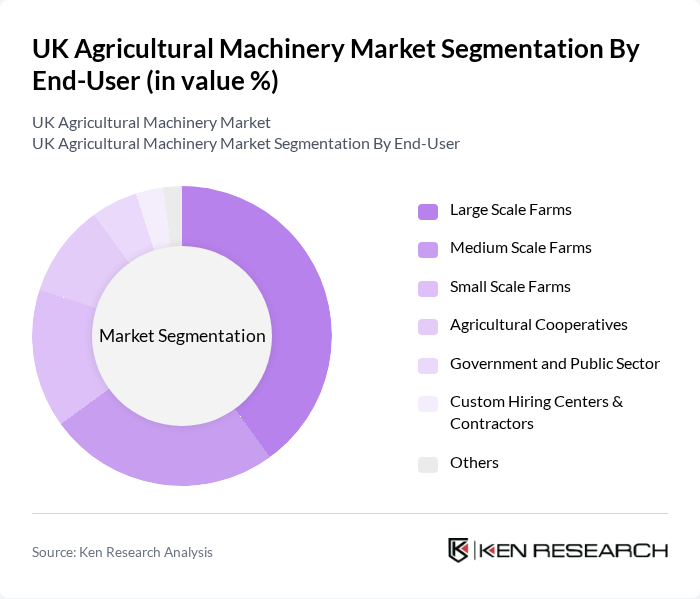

By End-User:The end-user segmentation includes large scale farms, medium scale farms, small scale farms, agricultural cooperatives, government and public sector, custom hiring centers and contractors, and others. Large scale farms dominate the market due to their significant investment in advanced machinery to enhance productivity and efficiency. The trend towards mechanization in agriculture has led to increased demand for specialized equipment tailored to the needs of these larger operations. Agricultural cooperatives and custom hiring centers also play a growing role in expanding access to modern machinery for smaller farms .

The UK Agricultural Machinery Market is characterized by a dynamic mix of regional and international players. Leading participants such as John Deere, AGCO Corporation (including Massey Ferguson, Fendt, Valtra), CNH Industrial (including New Holland Agriculture, Case IH), Kubota Holdings Europe B.V., CLAAS KGaA mbH, JCB (J.C. Bamford Excavators Limited), SDF Group (including Deutz-Fahr), SAME Deutz-Fahr UK Ltd, Grimme UK Ltd, Kuhn Group, Amazone Ltd, Lemken UK Ltd, Kverneland Group UK Ltd, Trimble Inc., AG Leader Technology contribute to innovation, geographic expansion, and service delivery in this space .

The UK agricultural machinery market is poised for significant transformation, driven by technological advancements and a growing emphasis on sustainability. As farmers increasingly adopt electric and hybrid machinery, the market is expected to witness a shift towards more eco-friendly solutions. Additionally, the integration of IoT and data analytics in farm management will enhance operational efficiency. These trends, coupled with government support for modernization, will create a dynamic environment for growth and innovation in the agricultural machinery sector.

| Segment | Sub-Segments |

|---|---|

| By Type | Tractors Harvesters & Combine Harvesters Plowing & Tillage Equipment Seeders & Planters Sprayers & Fertilizer Applicators Irrigation Equipment Forage & Haying Machinery Others (e.g., Balers, Spreaders) |

| By End-User | Large Scale Farms Medium Scale Farms Small Scale Farms Agricultural Cooperatives Government and Public Sector Custom Hiring Centers & Contractors Others |

| By Application | Crop Production Livestock Farming Horticulture Aquaculture Others |

| By Sales Channel | Direct Sales Distributors & Dealers Online Sales Retail Outlets Others |

| By Distribution Mode | Wholesale Distribution Retail Distribution Direct-to-Consumer Others |

| By Price Range | Budget Mid-Range Premium |

| By Brand Preference | Established Brands Emerging Brands Private Labels Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Tractor Market Insights | 100 | Farm Owners, Agricultural Equipment Dealers |

| Harvesting Equipment Usage | 80 | Farm Managers, Equipment Operators |

| Tillage Machinery Adoption | 60 | Agricultural Consultants, Crop Specialists |

| Precision Agriculture Technologies | 50 | Agri-tech Innovators, Farm Technology Users |

| Market Trends in Sustainable Machinery | 40 | Environmental Officers, Sustainable Farming Advocates |

The UK Agricultural Machinery Market is valued at approximately GBP 3.3 billion, reflecting a significant growth trend driven by technological advancements and the increasing demand for efficient and sustainable farming practices.