Region:Middle East

Author(s):Shubham

Product Code:KRAC2835

Pages:89

Published On:October 2025

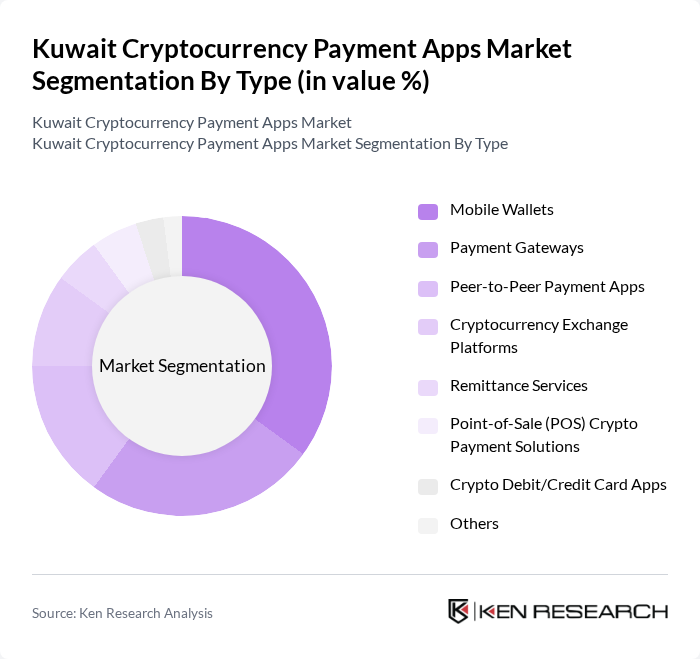

By Type:The market is segmented into various types of cryptocurrency payment applications, including mobile wallets, payment gateways, peer-to-peer payment apps, cryptocurrency exchange platforms, remittance services, point-of-sale (POS) crypto payment solutions, crypto debit/credit card apps, and others. Among these, mobile wallets and payment gateways are particularly prominent due to their user-friendly interfaces, integration with local payment systems, and widespread acceptance among consumers and merchants.

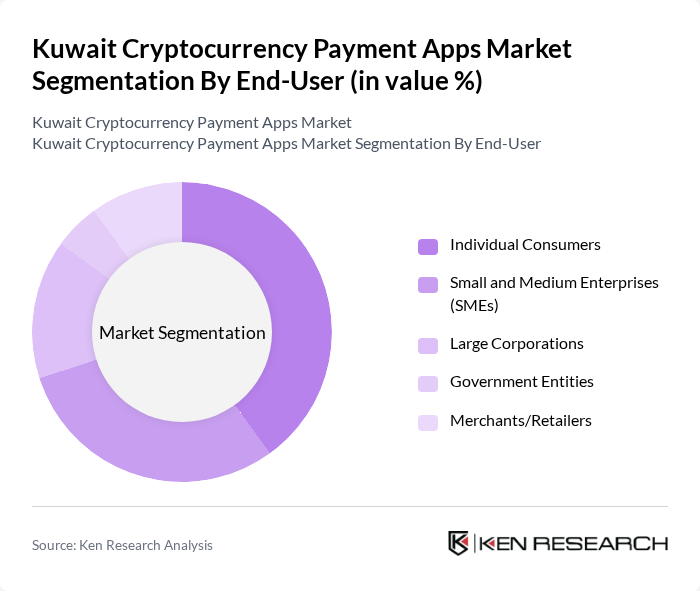

By End-User:The end-user segmentation includes individual consumers, small and medium enterprises (SMEs), large corporations, government entities, and merchants/retailers. Individual consumers and SMEs are the primary users of cryptocurrency payment apps, driven by the increasing need for efficient, low-cost, and borderless payment solutions.

The Kuwait Cryptocurrency Payment Apps Market is characterized by a dynamic mix of regional and international players. Leading participants such as BitOasis, Rain Financial, CoinMENA, Binance, Kraken, LocalBitcoins, Paxful, eToro, Bitstamp, CEX.IO, Huobi, OKX, Gemini, KuCoin, Bitfinex, Coinbase, BitPay, Coinomi, Paytomat, CoinJar contribute to innovation, geographic expansion, and service delivery in this space.

The future of cryptocurrency payment apps in Kuwait appears promising, driven by increasing digital payment adoption and government initiatives supporting blockchain technology. As e-commerce continues to expand, the integration of cryptocurrency solutions will likely become more prevalent. Additionally, advancements in security measures and user-friendly interfaces will enhance consumer confidence. The collaboration between fintech companies and traditional banks may further streamline the payment process, fostering a more inclusive financial ecosystem that embraces digital currencies.

| Segment | Sub-Segments |

|---|---|

| By Type | Mobile Wallets Payment Gateways Peer-to-Peer Payment Apps Cryptocurrency Exchange Platforms Remittance Services Point-of-Sale (POS) Crypto Payment Solutions Crypto Debit/Credit Card Apps Others |

| By End-User | Individual Consumers Small and Medium Enterprises (SMEs) Large Corporations Government Entities Merchants/Retailers |

| By Payment Method | Credit/Debit Card Payments Bank Transfers Cash Payments Cryptocurrency Payments Stablecoin Payments |

| By User Demographics | Age Groups Income Levels Geographic Distribution Tech-Savvy vs. General Users |

| By Security Features | Two-Factor Authentication Biometric Security End-to-End Encryption Cold Storage Integration |

| By Integration Capability | API Integration Third-Party Service Integration Blockchain Integration POS System Integration |

| By Customer Support | /7 Support Multilingual Support Community Forums In-App Chat Support |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Cryptocurrency Users | 120 | Active cryptocurrency wallet holders, frequent app users |

| Small Business Owners | 60 | Owners of businesses accepting cryptocurrency payments |

| Fintech Experts | 40 | Industry analysts, blockchain developers, and consultants |

| Regulatory Authorities | 40 | Officials from the Central Bank of Kuwait and financial regulators |

| Consumers Interested in Cryptocurrency | 80 | Individuals considering using cryptocurrency for payments |

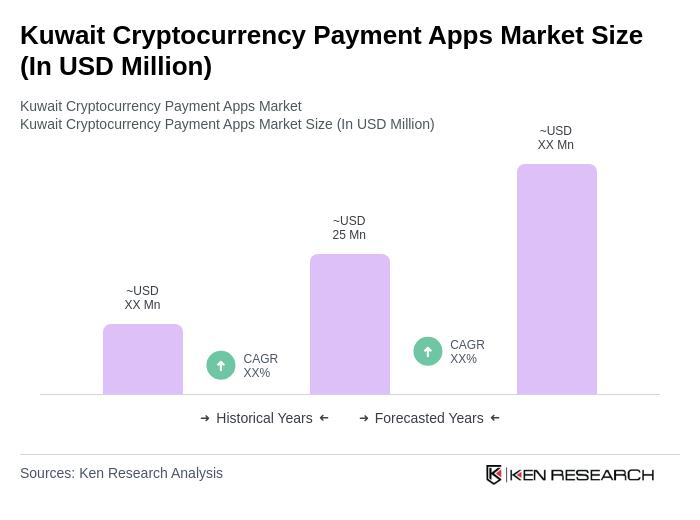

The Kuwait Cryptocurrency Payment Apps Market is valued at approximately USD 25 million, reflecting a significant increase in user engagement and transaction volumes driven by the growing adoption of digital currencies and e-commerce transactions.