Region:North America

Author(s):Rebecca

Product Code:KRAD4988

Pages:86

Published On:December 2025

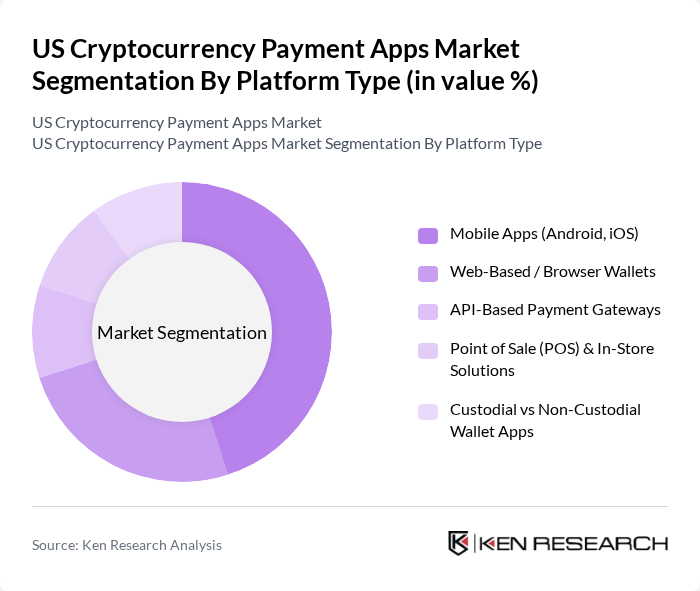

By Platform Type:The platform type segmentation includes various subsegments such as Mobile Apps (Android, iOS), Web-Based / Browser Wallets, API-Based Payment Gateways, Point of Sale (POS) & In-Store Solutions, and Custodial vs Non-Custodial Wallet Apps. Among these, Mobile Apps are leading the market due to their convenience and accessibility, allowing users to make transactions on-the-go. The increasing smartphone penetration, improved mobile security, and app-based integrations with exchanges and payment gateways have significantly contributed to the popularity of mobile applications in the cryptocurrency payment landscape, while in-store and online crypto payment flows are increasingly initiated via mobile wallets and QR code-based interfaces.

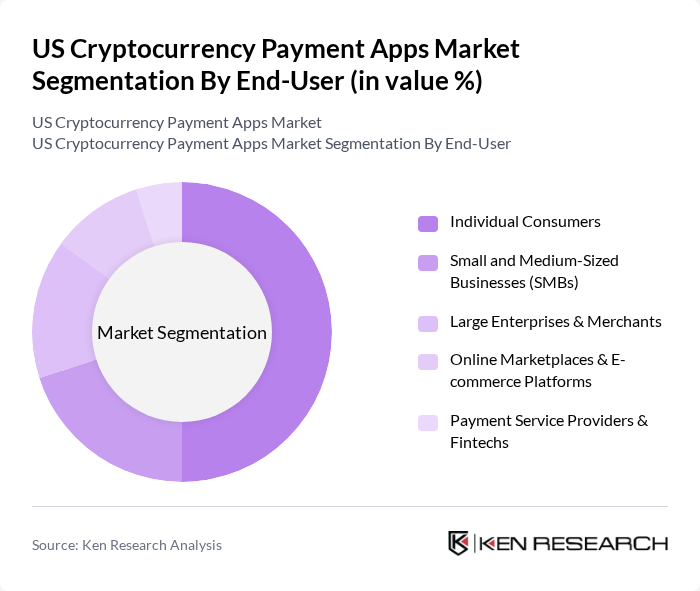

By End-User:This segmentation includes Individual Consumers, Small and Medium-Sized Businesses (SMBs), Large Enterprises & Merchants, Online Marketplaces & E-commerce Platforms, and Payment Service Providers & Fintechs. Individual Consumers dominate this segment as they increasingly utilize cryptocurrency payment apps for personal transactions, investments, and remittances, supported by rising general awareness of cryptocurrencies and growing ownership among the US population. The growing trend of peer-to-peer transactions, the use of stablecoins and crypto for cross-border transfers, and the desire for financial autonomy and diversified payment options are driving the adoption of these applications among individual users, while businesses and marketplaces progressively add crypto to their accepted payment methods.

The US Cryptocurrency Payment Apps Market is characterized by a dynamic mix of regional and international players. Leading participants such as PayPal Holdings, Inc. (PayPal & Venmo), Block, Inc. (Square & Cash App), Coinbase Global, Inc., BitPay, Inc., Binance.US (BAM Trading Services Inc.), Crypto.com (Foris DAX, Inc.), Gemini Trust Company, LLC, Kraken (Payward, Inc.), Blockchain.com, Robinhood Markets, Inc., eToro USA LLC, Bitstamp USA, Inc., Circle Internet Financial, LLC (USDC Payments), Stripe, Inc. (Crypto Payments & On-Ramps), MoonPay USA, Inc. contribute to innovation, geographic expansion, and service delivery in this space, with many of these platforms supporting both trading and payment functionalities, merchant tools, and integration APIs for online and in-store crypto acceptance.

The future of the U.S. cryptocurrency payment apps market appears promising, driven by technological advancements and increasing consumer demand for digital payment solutions. As blockchain technology continues to evolve, we can expect enhanced transaction speeds and lower fees, making cryptocurrencies more appealing. Additionally, the growing trend of integrating cryptocurrencies with traditional banking systems will likely facilitate broader acceptance, paving the way for innovative payment solutions that cater to diverse consumer needs and preferences.

| Segment | Sub-Segments |

|---|---|

| By Platform Type | Mobile Apps (Android, iOS) Web-Based / Browser Wallets API-Based Payment Gateways Point of Sale (POS) & In-Store Solutions Custodial vs Non-Custodial Wallet Apps |

| By End-User | Individual Consumers Small and Medium-Sized Businesses (SMBs) Large Enterprises & Merchants Online Marketplaces & E-commerce Platforms Payment Service Providers & Fintechs |

| By Payment Use Case | Peer-to-Peer (P2P) Transfers Online Checkout & In-App Payments In-Store / POS Payments Cross-Border Remittances Bill Payments & Subscriptions |

| By Cryptocurrency Type Supported | Bitcoin (BTC) Ethereum (ETH) Stablecoins (USDC, USDT, DAI, etc.) Altcoins (LTC, XRP, and others) |

| By Payment Type | Online Payments In-Store Payments Offline / QR-Code-Based Payments |

| By Revenue Model | Transaction & Network Fees FX / Spread & Conversion Fees Subscription & SaaS Fees Value-Added Services (rewards, cards, lending) |

| By Security & Compliance Features | KYC / AML & Compliance Tooling Multi-Factor & Biometric Authentication Cold Storage & Custody Solutions Insurance & Fraud-Protection Features |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Cryptocurrency Payment App Users | 150 | Active Users, New Users, Infrequent Users |

| Fintech Industry Experts | 60 | Product Managers, Market Analysts, Compliance Officers |

| Retail Merchants Accepting Cryptocurrency | 80 | Business Owners, Payment Processors, IT Managers |

| Regulatory Bodies and Compliance Experts | 40 | Regulators, Legal Advisors, Compliance Managers |

| Investors in Cryptocurrency Startups | 70 | Venture Capitalists, Angel Investors, Financial Advisors |

The US Cryptocurrency Payment Apps Market is valued at approximately USD 160 million, reflecting significant growth driven by the increasing adoption of cryptocurrencies for everyday transactions and the integration of crypto-compatible payment systems by merchants.