Region:Middle East

Author(s):Shubham

Product Code:KRAD5376

Pages:92

Published On:December 2025

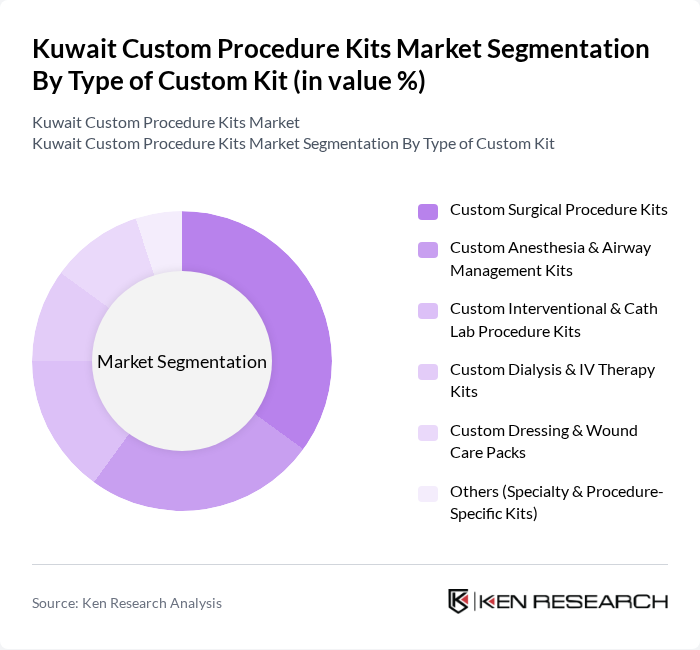

By Type of Custom Kit:

The Custom Surgical Procedure Kits segment is the leading sub-segment in the market, driven by the increasing number of surgical procedures including colorectal, thoracic, orthopedic, ophthalmology, neurosurgery, and cardiac surgery, and the demand for tailored solutions that enhance operational efficiency. Hospitals and surgical centers prefer these kits as they provide all necessary instruments and supplies in a single package, reducing preparation time and improving workflow. The trend towards minimally invasive surgeries further boosts the demand for these kits, as they often include specialized instruments designed for such procedures.

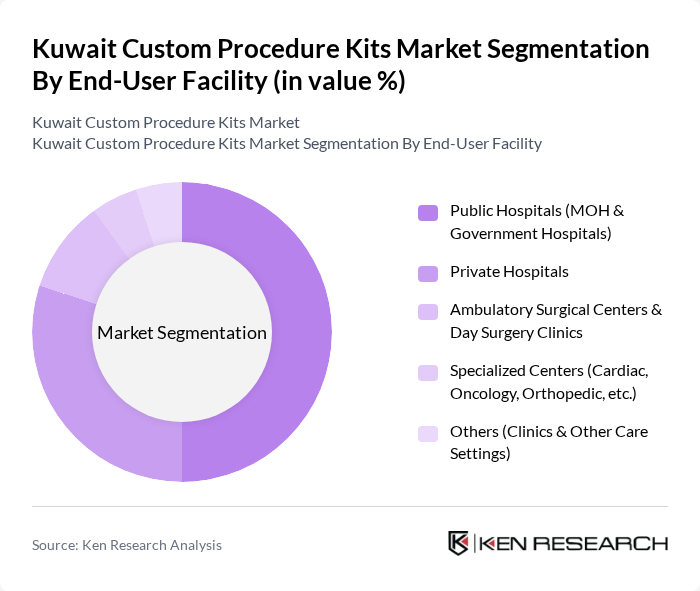

By End-User Facility:

Public Hospitals dominate the market due to their large patient volumes and the government's commitment to providing high-quality healthcare services. These facilities often require a wide range of custom procedure kits to cater to various medical needs, which drives significant procurement. The increasing focus on public health initiatives and the expansion of healthcare facilities further enhance the demand for custom kits in this segment.

The Kuwait Custom Procedure Kits Market is characterized by a dynamic mix of regional and international players. Leading participants such as Medline Industries, LP, Mölnlycke Health Care AB, Cardinal Health, Inc., Owens & Minor, Inc., B. Braun Melsungen AG, Halyard Health (Owens & Minor Global Products), STERIS plc, Medtronic plc, 3M Health Care, Smith & Nephew plc, Ansell Limited, Paul Hartmann AG, Nipro Corporation, ICU Medical, Inc., Local & Regional Distributors (Kuwait Saudi Pharmaceutical Industries Co. (KSPICO), Gulf Medical Co. Kuwait, International Medical Supplies Co.) contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Kuwait custom procedure kits market appears promising, driven by ongoing advancements in medical technology and a growing emphasis on patient-centric care. As healthcare providers increasingly adopt innovative solutions, the integration of artificial intelligence and machine learning is expected to enhance the customization of medical kits. Additionally, the expansion of telemedicine services will facilitate remote consultations, further driving the demand for personalized healthcare solutions tailored to individual patient needs.

| Segment | Sub-Segments |

|---|---|

| By Type of Custom Kit | Custom Surgical Procedure Kits Custom Anesthesia & Airway Management Kits Custom Interventional & Cath Lab Procedure Kits Custom Dialysis & IV Therapy Kits Custom Dressing & Wound Care Packs Others (Specialty & Procedure-Specific Kits) |

| By End-User Facility | Public Hospitals (MOH & Government Hospitals) Private Hospitals Ambulatory Surgical Centers & Day Surgery Clinics Specialized Centers (Cardiac, Oncology, Orthopedic, etc.) Others (Clinics & Other Care Settings) |

| By Distribution Channel | Direct Tenders to Hospitals & Government Bodies Local Medical Device Distributors Manufacturer Direct Sales Offices in GCC Online Procurement Platforms & E-tendering Others |

| By Material & Component Type | Single-use Disposable Components (Non-woven, Plastics) Reusable Metal Instruments Sterile Drapes & Gowns Sterilization & Packaging Materials Others |

| By Customization Level | Fully Customized Procedure-specific Kits Semi-customized Kits (Modular Components) Standardized Pre-configured Kits Others |

| By Clinical Application | General & Laparoscopic Surgery Orthopedic & Trauma Procedures Cardiovascular & Interventional Procedures Obstetrics & Gynecology Procedures Oncology & Day-care Procedures Others |

| By Region in Kuwait | Al Asimah (Kuwait City) Hawalli Governorate Farwaniya Governorate Ahmadi Governorate Jahra & Mubarak Al-Kabeer Governorates |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Hospital Procurement Departments | 60 | Procurement Managers, Supply Chain Coordinators |

| Private Clinics and Medical Centers | 50 | Clinic Owners, Medical Directors |

| Healthcare Regulatory Bodies | 40 | Regulatory Affairs Specialists, Compliance Officers |

| Medical Device Distributors | 50 | Sales Managers, Product Specialists |

| Healthcare Technology Innovators | 40 | R&D Managers, Technology Officers |

The Kuwait Custom Procedure Kits Market is valued at approximately USD 145 million, reflecting a significant growth driven by the increasing demand for customized medical solutions and advancements in healthcare technology.