Kuwait Dental Consumables Market Overview

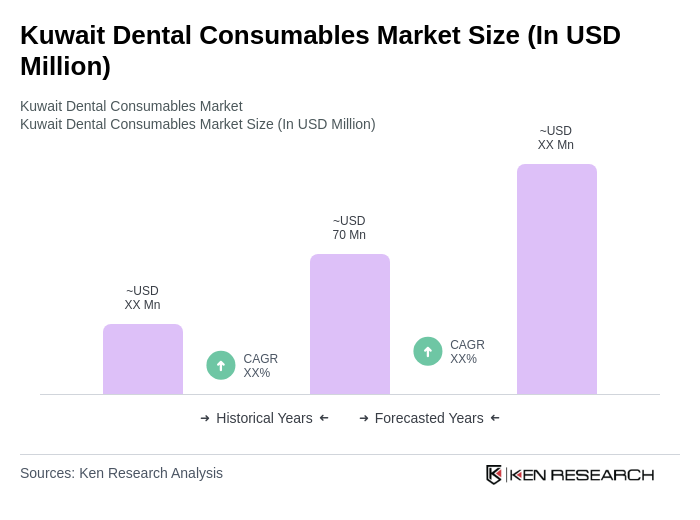

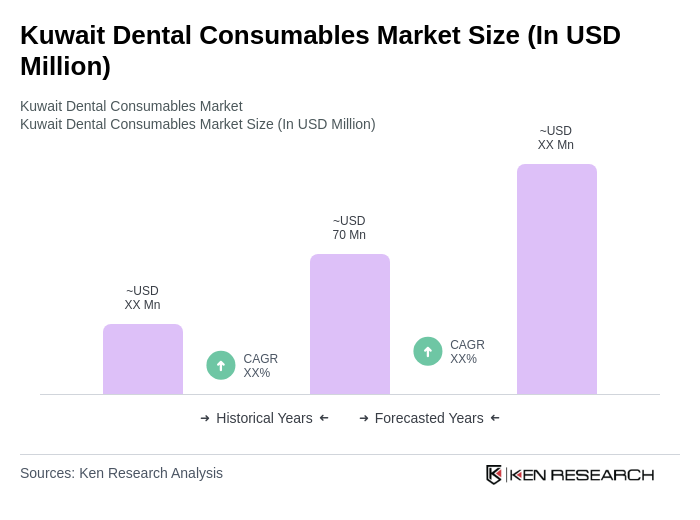

- The Kuwait Dental Consumables Market is valued at USD 70 million, based on a five-year historical analysis. This growth is primarily driven by increasing dental health awareness, a rise in dental procedures, and advancements in dental technology. The demand for high-quality dental consumables, including implants and orthodontic materials, has surged as more individuals seek preventive and cosmetic dental care. Recent market trends include the adoption of digital dentistry, growth in minimally invasive procedures, and increased preference for premium dental materials among both practitioners and patients.

- Kuwait City is the dominant hub in the market, attributed to its advanced healthcare infrastructure and a high concentration of dental clinics and hospitals. The city’s strategic location and economic stability also attract international dental product manufacturers, enhancing the availability of diverse dental consumables. Other notable areas include Hawalli and Al Ahmadi, which contribute significantly to the market due to their growing populations and healthcare facilities.

- In 2023, the Kuwaiti government implemented the “Dental Consumables Quality Standards Regulation, 2023” issued by the Ministry of Health. This regulation mandates that all dental consumables must meet specific quality standards regarding safety, efficacy, and traceability. Compliance with these standards is essential for manufacturers and distributors to operate within the market, requiring product registration, batch certification, and periodic audits by the Ministry of Health.

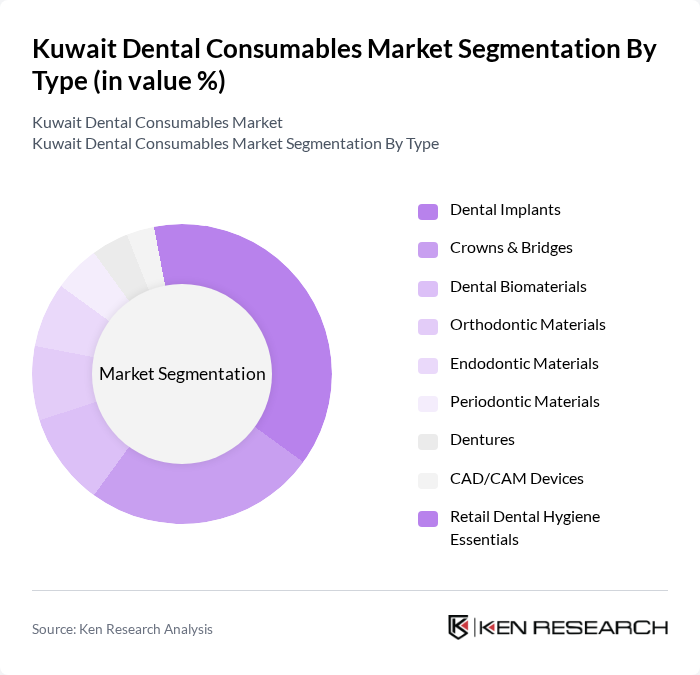

Kuwait Dental Consumables Market Segmentation

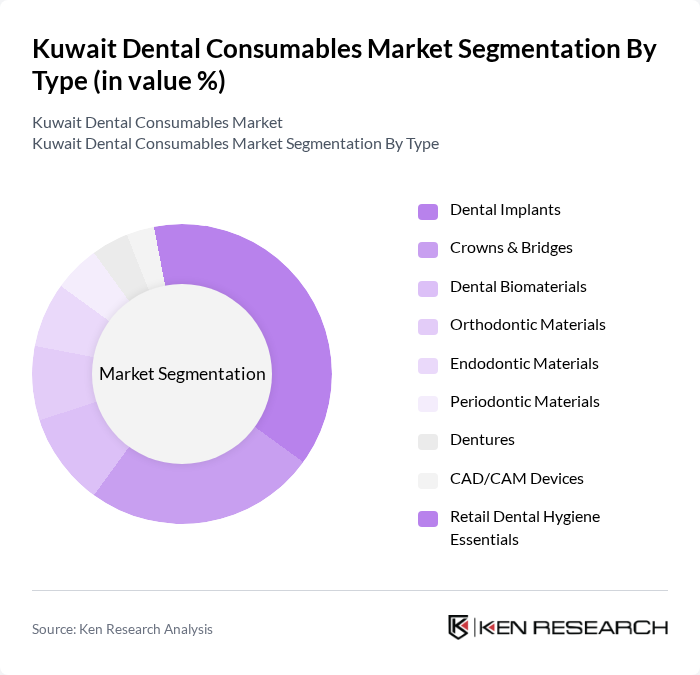

By Type:The dental consumables market can be segmented into various types, including Dental Implants, Crowns & Bridges, Dental Biomaterials, Orthodontic Materials, Endodontic Materials, Periodontic Materials, Dentures, CAD/CAM Devices, and Retail Dental Hygiene Essentials. Among these, Dental Implants and Crowns & Bridges are the leading segments due to their high demand in restorative and cosmetic dentistry. The increasing prevalence of dental issues, rising awareness of oral health, and the growing trend of aesthetic dentistry are driving the growth of these sub-segments. The market also reflects increased adoption of digital workflows and biocompatible materials in these categories.

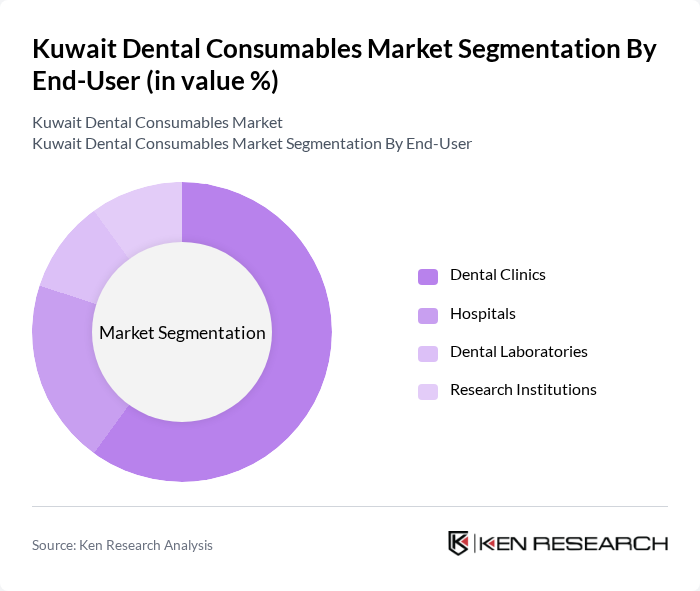

By End-User:The end-user segmentation includes Dental Clinics, Hospitals, Dental Laboratories, and Research Institutions. Dental Clinics dominate the market as they are the primary providers of dental services, driving the demand for consumables. The increasing number of dental clinics, expansion of private dental practices, and the rise in dental procedures contribute significantly to the growth of this segment. Hospitals and laboratories are also expanding their offerings, particularly in advanced restorative and cosmetic procedures.

Kuwait Dental Consumables Market Competitive Landscape

The Kuwait Dental Consumables Market is characterized by a dynamic mix of regional and international players. Leading participants such as Dentsply Sirona Inc., Straumann Holding AG, 3M Company, Henry Schein, Inc., Patterson Companies, Inc., Danaher Corporation (includes Nobel Biocare Services AG), Zimmer Biomet Holdings Inc., Ivoclar Vivadent AG, Coltene Holding AG, GC Corporation, Kuraray Noritake Dental Inc., Benco Dental, Zhermack S.p.A., Voco GmbH, DMG Chemisch-Pharmazeutische Fabrik GmbH, Shofu Inc. contribute to innovation, geographic expansion, and service delivery in this space.

Kuwait Dental Consumables Market Industry Analysis

Growth Drivers

- Increasing Dental Health Awareness:The growing awareness of dental health among Kuwait's population is a significant driver for the dental consumables market. In future, approximately 75% of Kuwaitis are expected to prioritize regular dental check-ups, reflecting a rise from 60%. This shift is supported by government health campaigns, which have allocated around USD 5 million to promote oral hygiene education, leading to increased demand for dental products and services.

- Rise in Cosmetic Dentistry:The cosmetic dentistry sector in Kuwait is experiencing robust growth, with an estimated market value of USD 55 million in future. This growth is fueled by a cultural shift towards aesthetic enhancements, with 45% of dental patients seeking cosmetic procedures. The increasing disposable income, projected to reach USD 32,000 per capita, allows more individuals to invest in cosmetic dental treatments, driving demand for consumables used in these procedures.

- Technological Advancements in Dental Procedures:The integration of advanced technologies in dental practices is revolutionizing the industry in Kuwait. In future, around 65% of dental clinics are expected to adopt digital tools such as CAD/CAM systems and 3D printing, enhancing efficiency and patient outcomes. This technological shift is supported by a USD 12 million investment in dental technology by local clinics, leading to increased demand for high-quality dental consumables that complement these innovations.

Market Challenges

- High Cost of Dental Consumables:The dental consumables market in Kuwait faces challenges due to the high costs associated with quality products. In future, the average price of essential dental consumables is projected to be 25% higher than in neighboring countries, limiting accessibility for many dental practices. This price disparity is exacerbated by import tariffs, which can reach up to 15%, further straining the budgets of dental clinics and impacting patient care.

- Limited Access to Advanced Dental Care:Access to advanced dental care remains a significant challenge in Kuwait, particularly in rural areas. Approximately 30% of the population lives outside urban centers, where dental facilities are scarce. In future, only 55% of dental clinics are equipped with the latest technology, limiting the availability of advanced treatments. This disparity creates a gap in the market, hindering the growth of dental consumables that support these advanced procedures.

Kuwait Dental Consumables Market Future Outlook

The future of the Kuwait dental consumables market appears promising, driven by increasing investments in dental infrastructure and a growing emphasis on preventive care. As the population becomes more health-conscious, the demand for innovative dental products is expected to rise. Additionally, the integration of digital solutions and teledentistry will likely enhance patient engagement and accessibility, fostering a more robust market environment. Overall, the sector is poised for significant growth, supported by evolving consumer preferences and technological advancements.

Market Opportunities

- Expansion of Dental Clinics:The expansion of dental clinics across Kuwait presents a significant opportunity for the dental consumables market. With an estimated 20% increase in new dental practices expected in future, there will be a heightened demand for consumables. This growth is driven by the rising population and increased awareness of dental health, creating a favorable environment for suppliers to introduce innovative products.

- Development of Eco-Friendly Dental Products:The growing trend towards sustainability offers a unique opportunity for the dental consumables market. In future, the demand for eco-friendly dental products is projected to increase by 30%, as consumers become more environmentally conscious. Manufacturers that invest in sustainable materials and practices can capture this emerging market segment, enhancing their competitive edge and appealing to a broader customer base.