Region:Asia

Author(s):Geetanshi

Product Code:KRAA0523

Pages:92

Published On:December 2025

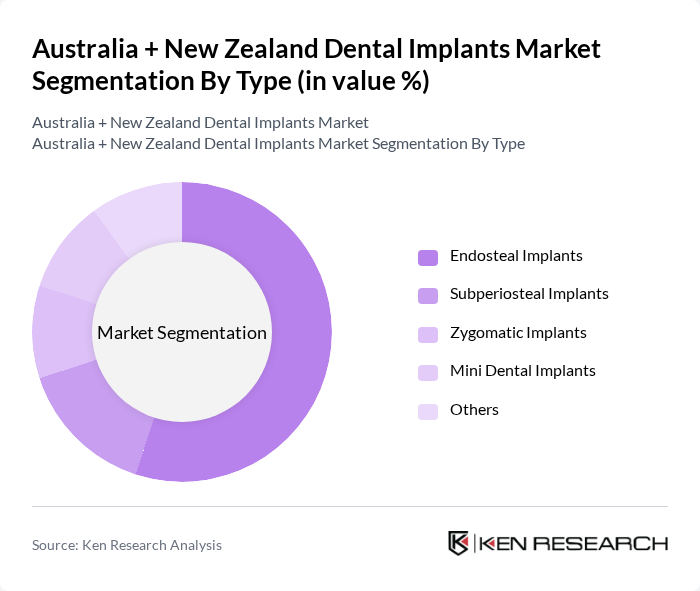

By Type:The dental implants market is segmented into various types, including Endosteal, Subperiosteal, Zygomatic, Mini Dental Implants, and Others. Among these, Endosteal implants dominate the market due to their widespread acceptance and effectiveness in osseointegration, making them the preferred choice for most dental professionals. The increasing prevalence of dental issues and the growing awareness of dental aesthetics further drive the demand for these implants.

By End-User:The end-user segmentation includes Dental Clinics, Hospitals, Research Institutions, and Others. Dental Clinics hold a significant share of the market as they are the primary providers of dental implant procedures. The increasing number of dental clinics and the rising trend of cosmetic dentistry contribute to the growth of this segment, as patients seek more personalized and accessible dental care solutions.

The Australia + New Zealand Dental Implants Market is characterized by a dynamic mix of regional and international players. Leading participants such as Nobel Biocare, Straumann Group, Dentsply Sirona, Zimmer Biomet, Osstem Implant, BioHorizons, Megagen Implant, Bicon Dental Implants, Implant Direct, Southern Implants, Alpha-Bio Tec, Hiossen Implant, Neodent, Dentium, 3M ESPE contribute to innovation, geographic expansion, and service delivery in this space.

The future of the dental implants market in Australia and New Zealand appears promising, driven by technological advancements and an increasing focus on patient-centered care. Emerging technologies, such as AI-guided diagnostics and 3D printing, are streamlining procedures and enhancing patient experiences. Additionally, the growing demand for aesthetic solutions, particularly zirconia implants, reflects a shift towards more biocompatible and visually appealing options. These trends are expected to foster innovation and expand market access, ultimately improving patient outcomes and satisfaction.

| Segment | Sub-Segments |

|---|---|

| By Type | Endosteal Implants Subperiosteal Implants Zygomatic Implants Mini Dental Implants Others |

| By End-User | Dental Clinics Hospitals Research Institutions Others |

| By Material | Titanium Implants Zirconia Implants Others |

| By Procedure Type | Single Tooth Replacement Multiple Teeth Replacement Full Arch Replacement Others |

| By Distribution Channel | Direct Sales Online Sales Distributors Others |

| By Region | New South Wales Victoria Queensland Western Australia Others |

| By Patient Demographics | Age Group (Adults, Seniors) Gender (Male, Female) Income Level (Low, Middle, High) Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Dental Clinics in Major Cities | 150 | Dentists, Clinic Managers |

| Hospitals with Dental Departments | 100 | Oral Surgeons, Hospital Administrators |

| Dental Implant Manufacturers | 80 | Product Managers, Sales Directors |

| Patient Experience Surveys | 200 | Dental Implant Patients, General Public |

| Dental Associations and Regulatory Bodies | 50 | Policy Makers, Industry Experts |

The Australia + New Zealand Dental Implants Market is valued at approximately USD 240 million, driven by demographic shifts, technological advancements, and increasing demand for dental solutions among older populations experiencing tooth loss.