Region:Middle East

Author(s):Rebecca

Product Code:KRAC8580

Pages:92

Published On:November 2025

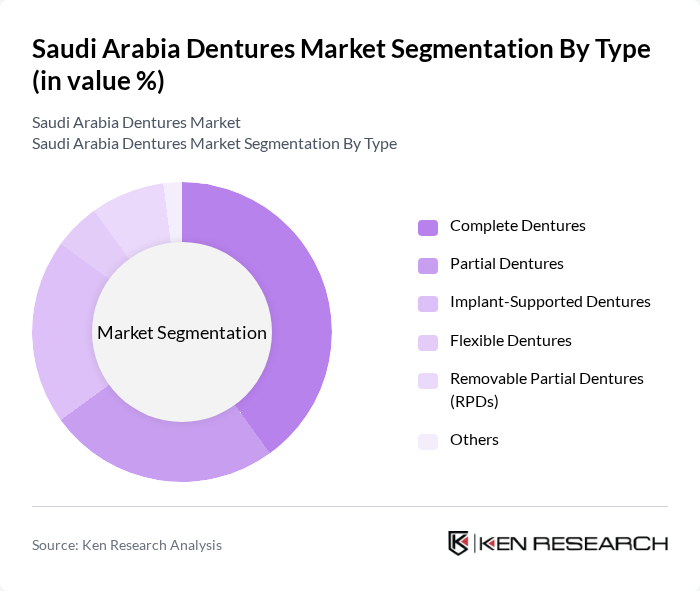

By Type:The market is segmented into various types of dentures, including Complete Dentures, Partial Dentures, Implant-Supported Dentures, Flexible Dentures, Removable Partial Dentures (RPDs), and Others. Each type serves different consumer needs based on factors such as dental health, aesthetic preferences, and budget considerations. Among these, Complete Dentures are particularly popular due to their comprehensive coverage for individuals with no remaining natural teeth, while Implant-Supported Dentures are gaining traction for their stability and comfort. The market is also witnessing increased adoption of flexible and digital dentures, reflecting a shift toward personalized and technologically advanced solutions .

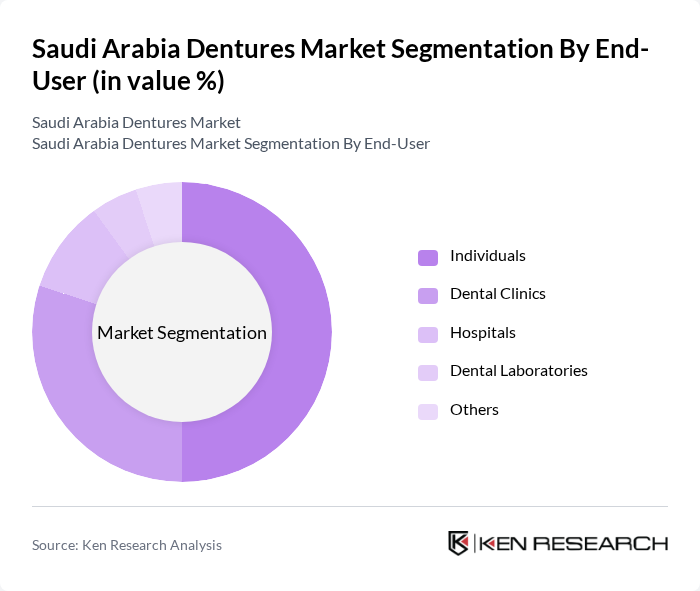

By End-User:The end-user segmentation includes Individuals, Dental Clinics, Hospitals, Dental Laboratories, and Others. Individuals represent the largest segment, driven by the increasing number of people seeking dental solutions for aesthetic and functional purposes. Dental Clinics and Hospitals also play a significant role, as they provide professional services and products directly to consumers, contributing to the overall market growth. Dental Laboratories are increasingly important due to the rise in customized and advanced denture fabrication, supporting the demand from clinics and hospitals .

The Saudi Arabia Dentures Market is characterized by a dynamic mix of regional and international players. Leading participants such as Dentsply Sirona, Nobel Biocare, Straumann Group, Ivoclar, Zimmer Biomet, GC Corporation, KaVo Kerr, Henry Schein, 3M Health Care, Align Technology, Bicon Dental Implants, BioHorizons, Dentatus, Modern Dental Group Limited, National Dentex Labs, Aspen Dental Management, Saudi German Dental (SGD), Al Farabi Dental Center, Dr. Sulaiman Al Habib Medical Group (Dental Division), Al-Mouwasat Dental contribute to innovation, geographic expansion, and service delivery in this space.

The future of the dentures market in Saudi Arabia appears promising, driven by demographic changes and technological advancements. As the population ages and awareness of oral health increases, demand for dentures is expected to rise significantly. Additionally, the integration of digital technologies in dental practices will enhance the customization and efficiency of denture production, making them more accessible. The market is likely to see innovative solutions that cater to diverse consumer needs, fostering growth and improving overall dental health outcomes.

| Segment | Sub-Segments |

|---|---|

| By Type | Complete Dentures Partial Dentures Implant-Supported Dentures Flexible Dentures Removable Partial Dentures (RPDs) Others |

| By End-User | Individuals Dental Clinics Hospitals Dental Laboratories Others |

| By Material | Acrylic Resin Porcelain Metal (e.g., Cobalt-Chromium Alloys) Composite Resins Flexible Polymers (e.g., Nylon, Valplast) Others |

| By Distribution Channel | Online Retail Offline Retail Direct Sales Dental Clinics Dental Laboratories Others |

| By Region | Central Region Eastern Region Western Region Southern Region |

| By Age Group | Seniors (65+ years) Adults (35-64 years) Young Adults (18-34 years) Children (Under 18 years) |

| By Insurance Coverage | Insured Uninsured Government-Sponsored Programs Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Dental Clinics | 100 | Dentists, Clinic Managers |

| Prosthodontic Specialists | 60 | Prosthodontists, Dental Technicians |

| Patient Surveys | 120 | Denture Users, Potential Patients |

| Dental Laboratories | 40 | Lab Managers, Technicians |

| Healthcare Policy Makers | 40 | Health Ministry Officials, Dental Association Representatives |

The Saudi Arabia Dentures Market is valued at approximately USD 120 million, reflecting growth driven by an aging population, increased dental awareness, and advancements in dental technology.