Region:Asia

Author(s):Shubham

Product Code:KRAD0864

Pages:85

Published On:November 2025

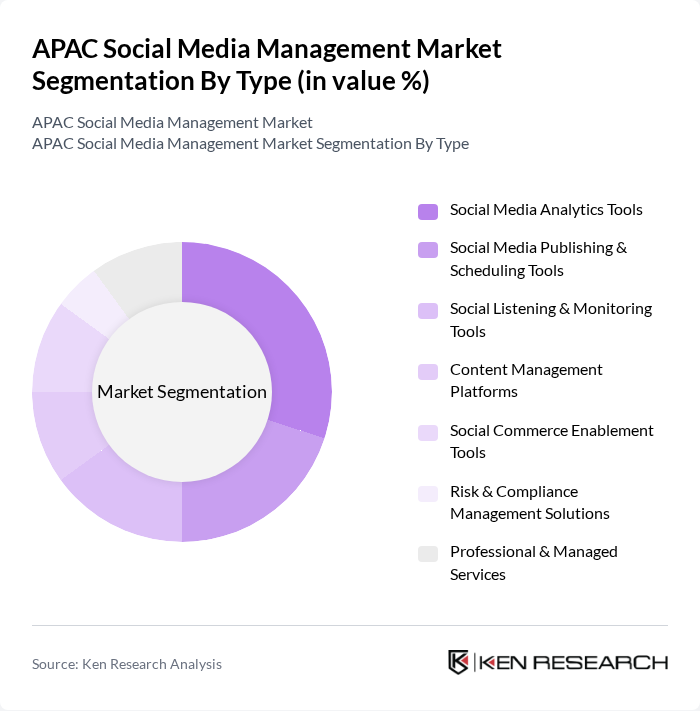

By Type:The market is segmented into various types of social media management tools that cater to different business needs. The subsegments include Social Media Analytics Tools, Social Media Publishing & Scheduling Tools, Social Listening & Monitoring Tools, Content Management Platforms, Social Commerce Enablement Tools, Risk & Compliance Management Solutions, and Professional & Managed Services. Among these, Social Media Analytics Tools are gaining traction due to the increasing need for data-driven decision-making in marketing strategies. Social commerce enablement tools are also emerging as a fast-growing segment, driven by the integration of e-commerce and social platforms .

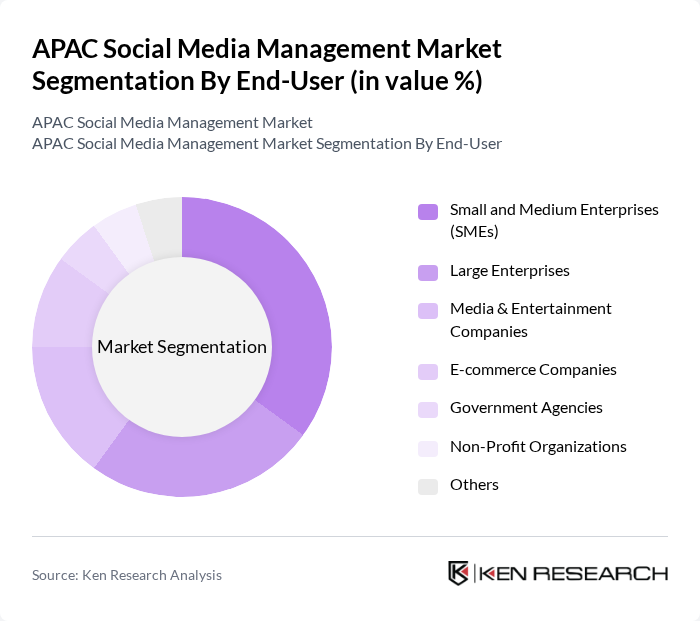

By End-User:The end-user segmentation includes Small and Medium Enterprises (SMEs), Large Enterprises, Media & Entertainment Companies, E-commerce Companies, Government Agencies, Non-Profit Organizations, and Others. The increasing adoption of social media platforms by SMEs for marketing and customer engagement is driving the demand for social media management tools in this segment. Additionally, media and entertainment companies are leveraging advanced monitoring and analytics tools to optimize content and audience engagement strategies .

The APAC Social Media Management Market is characterized by a dynamic mix of regional and international players. Leading participants such as Hootsuite, Sprout Social, Buffer, Socialbakers (now part of Emplifi), HubSpot, Agorapulse, Zoho Social, Sendible, Falcon.io (now part of Brandwatch), Later, CoSchedule, MeetEdgar, Planoly, SocialBee, eClincher, Sprinklr, Khoros, Brandwatch, SocialPilot, BrainPad Inc., Kin, FoxyMoron contribute to innovation, geographic expansion, and service delivery in this space .

The APAC social media management market is poised for transformative growth, driven by technological advancements and evolving consumer behaviors. As businesses increasingly leverage artificial intelligence and automation, the efficiency of social media strategies will improve significantly. Additionally, the rise of social commerce is expected to reshape how brands interact with consumers, creating new avenues for engagement. Companies that adapt to these trends will likely thrive, positioning themselves favorably in a dynamic and competitive landscape.

| Segment | Sub-Segments |

|---|---|

| By Type | Social Media Analytics Tools Social Media Publishing & Scheduling Tools Social Listening & Monitoring Tools Content Management Platforms Social Commerce Enablement Tools Risk & Compliance Management Solutions Professional & Managed Services |

| By End-User | Small and Medium Enterprises (SMEs) Large Enterprises Media & Entertainment Companies E-commerce Companies Government Agencies Non-Profit Organizations Others |

| By Region | China Japan India Australia South Korea Southeast Asia (Singapore, Indonesia, Malaysia, Philippines, Vietnam, Thailand) Rest of Asia Pacific |

| By Technology | Cloud-Based Solutions On-Premise Solutions Mobile Applications AI-Driven Solutions Others |

| By Application | Brand Management Customer Service & Engagement Campaign Management Market Research & Sentiment Analysis Influencer Marketing Social Commerce Others |

| By Investment Source | Venture Capital Private Equity Government Grants Corporate Investments Others |

| By Policy Support | Tax Incentives Subsidies for Digital Marketing Training Programs Digital Transformation Initiatives Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Brand Social Media Managers | 120 | Marketing Directors, Social Media Strategists |

| Digital Marketing Agencies | 90 | Agency Owners, Account Managers |

| Consumer Engagement Analysts | 60 | Data Analysts, Insights Managers |

| SME Owners Utilizing Social Media | 50 | Business Owners, Marketing Managers |

| Content Creators and Influencers | 40 | Content Strategists, Influencer Managers |

The APAC Social Media Management Market is valued at approximately USD 21 billion, driven by the increasing smartphone penetration, mobile-first digital platforms, and a growing number of social media users in the region.