Region:Middle East

Author(s):Rebecca

Product Code:KRAC4017

Pages:92

Published On:October 2025

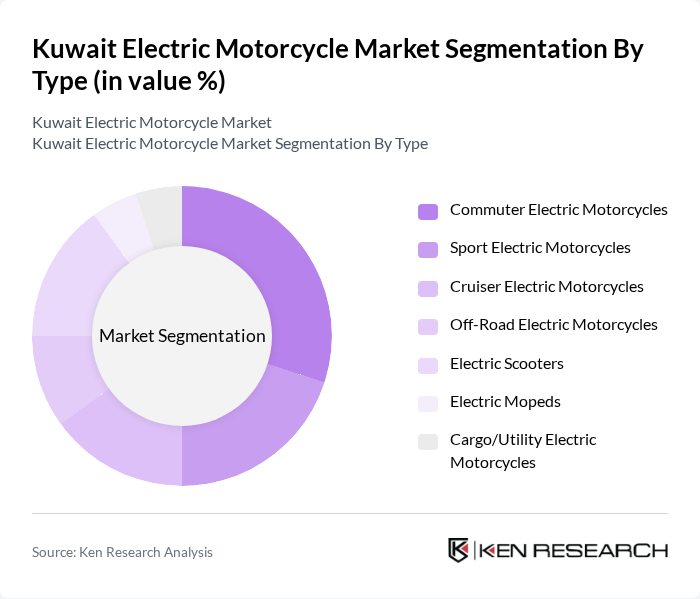

By Type:The electric motorcycle market is segmented into commuter electric motorcycles, sport electric motorcycles, cruiser electric motorcycles, off-road electric motorcycles, electric scooters, electric mopeds, and cargo/utility electric motorcycles. Each type addresses specific consumer needs, such as daily commuting, recreational riding, delivery services, and utility applications, shaping the competitive landscape and influencing purchasing decisions .

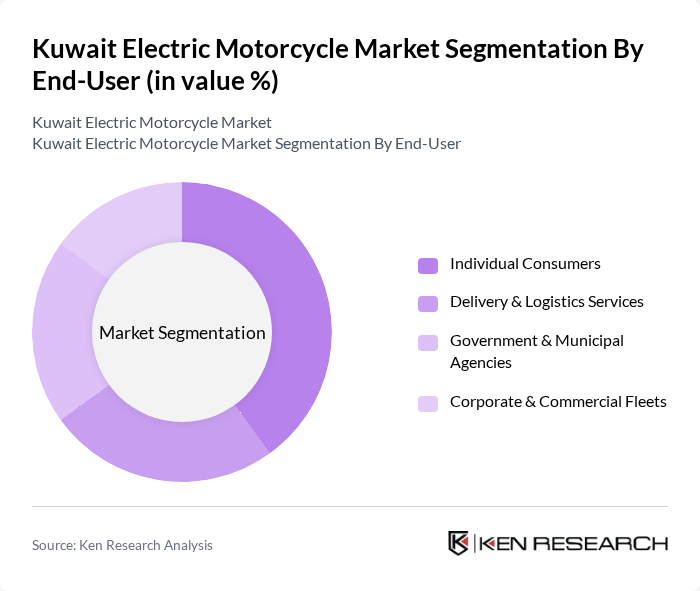

By End-User:The end-user segmentation includes individual consumers, delivery and logistics services, government and municipal agencies, and corporate and commercial fleets. Individual consumers primarily seek affordable and efficient commuting solutions, while delivery and logistics services focus on operational efficiency and cost savings. Government and municipal agencies prioritize sustainability and regulatory compliance, and corporate fleets emphasize total cost of ownership and brand image .

The Kuwait Electric Motorcycle Market is characterized by a dynamic mix of regional and international players. Leading participants such as Zero Motorcycles, Energica Motor Company, Harley-Davidson, Inc. (LiveWire), BMW Motorrad, KTM AG, Gogoro Inc., NIU Technologies, Super Soco (Vmoto Limited), Vespa (Piaggio Group), Honda Motor Co., Ltd., Yamaha Motor Co., Ltd., Segway-Ninebot, Lightning Motorcycles, Yadea Technology Group Co., Ltd., and Hero Electric contribute to innovation, geographic expansion, and service delivery in this space.

The future of the electric motorcycle market in Kuwait appears promising, driven by increasing environmental awareness and government support. As infrastructure improves and charging networks expand, consumer confidence is likely to grow. Additionally, technological advancements in battery efficiency will enhance the appeal of electric motorcycles. The market is expected to witness a shift towards more affordable models, catering to a broader audience, while partnerships with local businesses could further stimulate growth and adoption in the coming years.

| Segment | Sub-Segments |

|---|---|

| By Type | Commuter Electric Motorcycles Sport Electric Motorcycles Cruiser Electric Motorcycles Off-Road Electric Motorcycles Electric Scooters Electric Mopeds Cargo/Utility Electric Motorcycles |

| By End-User | Individual Consumers Delivery & Logistics Services Government & Municipal Agencies Corporate & Commercial Fleets |

| By Sales Channel | Online Retail Authorized Dealerships Direct Manufacturer Sales Rental & Sharing Services |

| By Price Range | Budget Electric Motorcycles (< KWD 1,000) Mid-Range Electric Motorcycles (KWD 1,000–3,000) Premium Electric Motorcycles (> KWD 3,000) |

| By Battery Type | Lithium-Ion Batteries Lead-Acid Batteries Nickel-Metal Hydride Batteries Solid-State Batteries |

| By Charging Type | Standard Charging Fast Charging Battery Swapping Wireless Charging |

| By Region | Kuwait City & Metropolitan Areas Suburban Areas Rural Areas Free Trade & Industrial Zones |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Potential Electric Motorcycle Buyers | 100 | Urban Commuters, Eco-conscious Consumers |

| Current Electric Vehicle Owners | 80 | Electric Motorcycle Users, EV Enthusiasts |

| Dealership Representatives | 40 | Sales Managers, Product Specialists |

| Government Officials on Transportation Policy | 40 | Policy Makers, Regulatory Authorities |

| Industry Experts and Analysts | 20 | Market Analysts, Research Consultants |

The Kuwait Electric Motorcycle Market is valued at approximately USD 20 million, driven by factors such as environmental awareness, government incentives, and advancements in battery technology that enhance performance and affordability.