Region:Middle East

Author(s):Dev

Product Code:KRAC1973

Pages:95

Published On:October 2025

By Type:The electric utility vehicle market can be segmented into various types, including light duty, medium duty, heavy duty, specialty vehicles, and two- and three-wheel electric utility vehicles. Each sub-segment caters to different operational needs and consumer preferences, with light-duty vehicles being popular for urban deliveries and heavy-duty vehicles for industrial applications. The market is witnessing a growing trend towards specialty vehicles, which are tailored for specific applications.

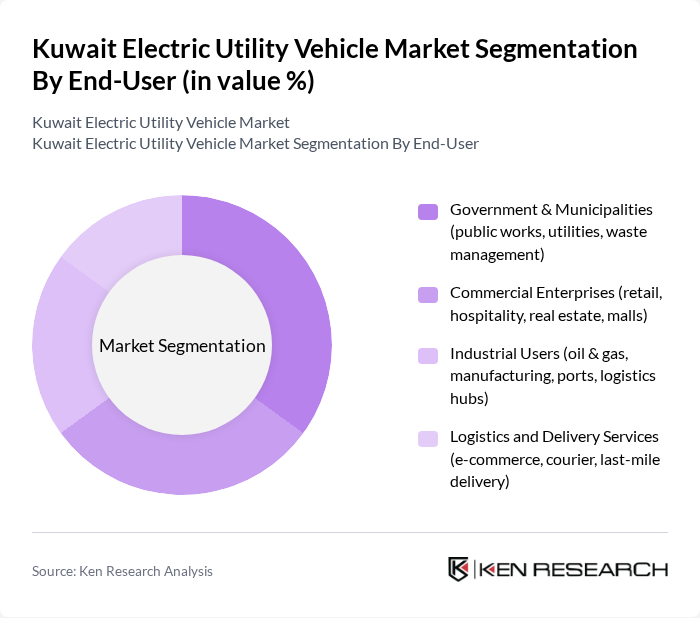

By End-User:The end-user segmentation of the electric utility vehicle market includes government and municipalities, commercial enterprises, industrial users, and logistics and delivery services. Each segment has unique requirements, with government and municipalities leading the charge due to regulatory support and sustainability goals. Commercial enterprises are increasingly adopting electric vehicles to enhance their operational efficiency and reduce costs.

The Kuwait Electric Utility Vehicle Market is characterized by a dynamic mix of regional and international players. Leading participants such as Tesla, Inc., BYD Company Limited, Nissan Motor Corporation, Renault Group, Hyundai Motor Company, Ashok Leyland, Volvo Bus Corporation, CITA EV Charger, GreenPower Motor Company Inc., Ford Motor Company, BMW AG, Chevrolet (General Motors Company), Porsche Middle East & Africa, Toyota Motor Corporation, Xos Trucks, Inc. contribute to innovation, geographic expansion, and service delivery in this space.

The future of the electric utility vehicle market in Kuwait appears promising, driven by increasing government initiatives and consumer demand for sustainable transportation solutions. With a projected rise in electric vehicle sales to 30,000 units, the market is set to expand significantly. Additionally, the integration of smart technologies and renewable energy sources will enhance the appeal of electric utility vehicles, positioning them as a viable alternative to traditional vehicles in future.

| Segment | Sub-Segments |

|---|---|

| By Type | Light Duty Electric Utility Vehicles (e.g., electric vans, compact delivery trucks) Medium Duty Electric Utility Vehicles (e.g., electric box trucks, shuttle buses) Heavy Duty Electric Utility Vehicles (e.g., refuse trucks, electric buses, construction vehicles) Specialty Electric Utility Vehicles (e.g., airport ground support, utility carts, municipal service vehicles) Two- and Three-Wheel Electric Utility Vehicles (e.g., electric scooters, cargo trikes) |

| By End-User | Government & Municipalities (public works, utilities, waste management) Commercial Enterprises (retail, hospitality, real estate, malls) Industrial Users (oil & gas, manufacturing, ports, logistics hubs) Logistics and Delivery Services (e-commerce, courier, last-mile delivery) |

| By Application | Urban Delivery Services Waste Management & Sanitation Public Transportation (electric buses, shuttles) Construction and Maintenance (utility trucks, site vehicles) |

| By Charging Type | Fast Charging (DC) Standard Charging (AC) Wireless Charging / Inductive Charging |

| By Vehicle Range | Short Range (up to 100 km) Medium Range (100-200 km) Long Range (over 200 km) |

| By Ownership Model | Owned Fleet Leased Fleet Shared Fleet / Mobility-as-a-Service |

| By Policy Support | Subsidies Tax Exemptions Grants and Funding Programs |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Electric Vehicle Manufacturers | 50 | Product Managers, Sales Directors |

| Utility Companies | 60 | Operations Managers, Strategic Planners |

| Charging Infrastructure Providers | 50 | Business Development Managers, Technical Leads |

| Government Regulatory Bodies | 40 | Policy Makers, Environmental Analysts |

| Consumers of Electric Vehicles | 100 | Current EV Owners, Potential Buyers |

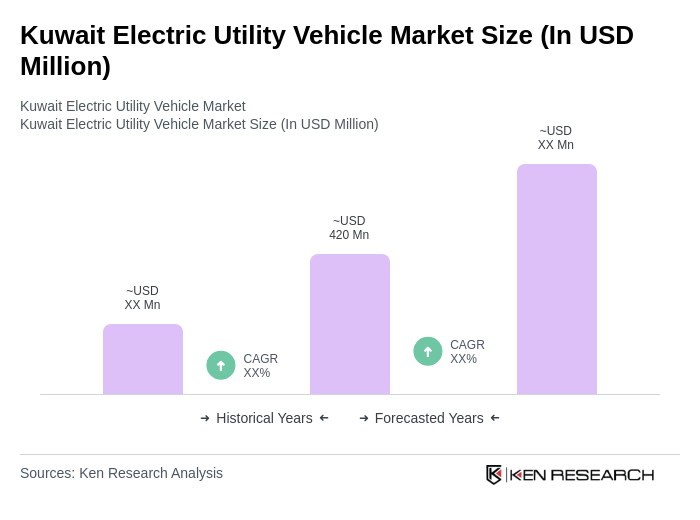

The Kuwait Electric Utility Vehicle Market is valued at approximately USD 420 million, reflecting a significant growth trend driven by government initiatives, rising fuel prices, and increasing consumer awareness regarding environmental sustainability.