Region:Middle East

Author(s):Dev

Product Code:KRAC2032

Pages:95

Published On:October 2025

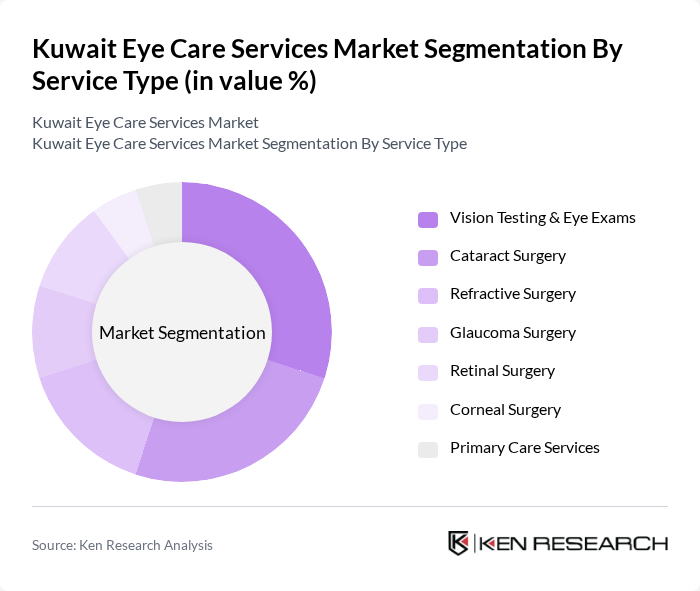

By Service Type:The service type segmentation includes various categories such as Vision Testing & Eye Exams, Cataract Surgery, Refractive Surgery, Glaucoma Surgery, Retinal Surgery, Corneal Surgery, and Primary Care Services. Among these, Vision Testing & Eye Exams is the leading sub-segment, driven by the increasing awareness of regular eye check-ups and the rising incidence of refractive errors. The demand for early detection and preventive care has led to a significant rise in the number of patients seeking these services.

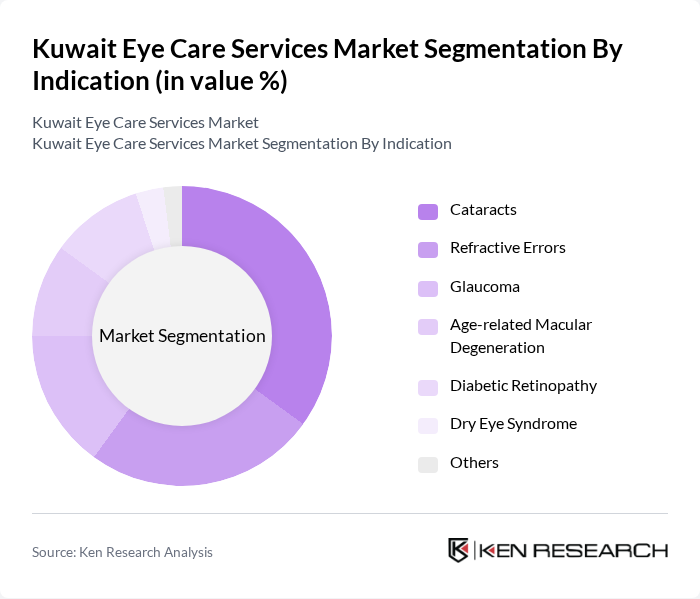

By Indication:The indication segmentation encompasses Refractive Errors, Cataracts, Glaucoma, Age-related Macular Degeneration, Diabetic Retinopathy, Dry Eye Syndrome, and Others. Cataracts represent the dominant sub-segment, primarily due to the aging population and the high prevalence of cataract-related issues. The increasing number of surgical procedures performed for cataract removal has significantly contributed to the growth of this segment.

The Kuwait Eye Care Services Market is characterized by a dynamic mix of regional and international players. Leading participants such as Al-Bahar Ophthalmology Center, New Mowasat Hospital Eye Department, Dar Al Shifa Hospital Eye Center, Taiba Hospital Ophthalmology Department, Hadi Clinic for Eyes, Kuwait Eye Centre, Al Rashid Hospital Eye Services, International Clinic Eye Department, Al Salam International Hospital Eye Care, Sabah Hospital Ophthalmology Department, Ibn Sina Hospital Eye Center, Al Seef Hospital Eye Care Services, Royale Hayat Hospital Ophthalmology, Adan Hospital Eye Department, Alcon Vision Care Kuwait (International Provider) contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Kuwait eye care services market appears promising, driven by increasing investments in healthcare infrastructure and a growing emphasis on preventive care. As the government allocates more resources to eye health initiatives, the integration of telemedicine and AI technologies is expected to enhance service delivery. Additionally, partnerships with international organizations will likely facilitate knowledge transfer and improve service standards, ultimately benefiting patient outcomes and expanding market reach.

| Segment | Sub-Segments |

|---|---|

| By Service Type | Vision Testing & Eye Exams Cataract Surgery Refractive Surgery Glaucoma Surgery Retinal Surgery Corneal Surgery Primary Care Services |

| By Indication | Refractive Errors Cataracts Glaucoma Age-related Macular Degeneration Diabetic Retinopathy Dry Eye Syndrome Others |

| By Provider Type | Standalone Eye Clinics Multispecialty Hospitals Optical Retail Chains with Eye Care Services Academic & Research Institutions Others |

| By Age Group | Pediatric Adult Geriatric |

| By Distribution Channel | Direct Services Telemedicine & Online Consultations Referral Networks |

| By Geographic Coverage | Urban Areas Rural Areas |

| By Payment Method | Private Insurance Public Insurance Out-of-Pocket Payments |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Ophthalmology Clinics | 60 | Ophthalmologists, Clinic Managers |

| Patient Experience Surveys | 120 | Eye Care Patients, Caregivers |

| Healthcare Administrators | 50 | Hospital Administrators, Policy Makers |

| Optometry Services | 40 | Optometrists, Optical Store Managers |

| Eye Surgery Centers | 40 | Surgeons, Surgical Center Directors |

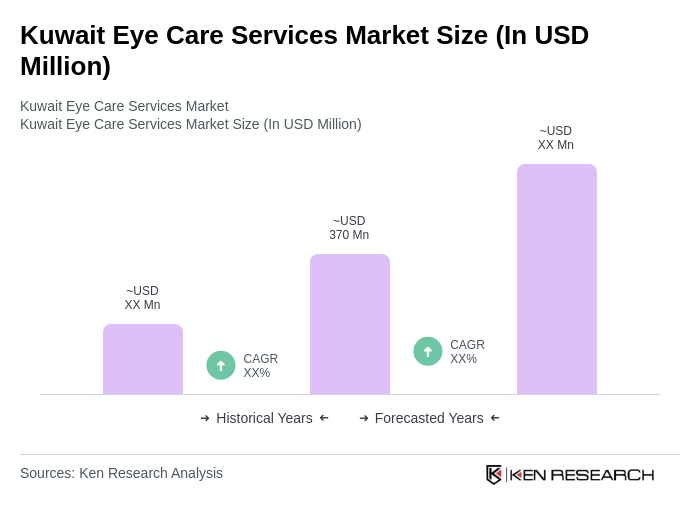

The Kuwait Eye Care Services Market is valued at approximately USD 370 million, reflecting a significant growth driven by the increasing prevalence of eye disorders, heightened awareness of eye health, and advancements in medical technology.