Region:Middle East

Author(s):Geetanshi

Product Code:KRAC9499

Pages:92

Published On:November 2025

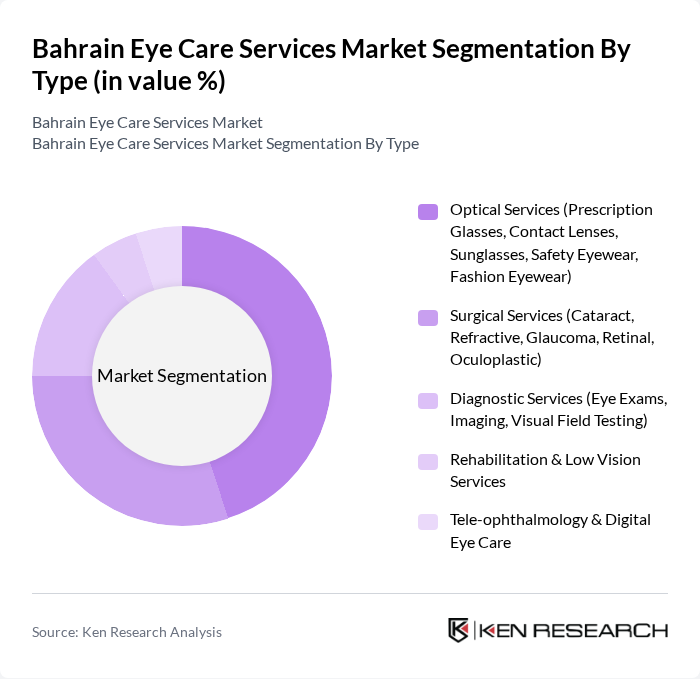

By Type:The market is segmented into various types of services, including Optical Services, Surgical Services, Diagnostic Services, Rehabilitation & Low Vision Services, and Tele-ophthalmology & Digital Eye Care. Among these,Optical Services, which encompass prescription glasses, contact lenses, and fashion eyewear, dominate the market due to the high demand for vision correction and aesthetic eyewear. The increasing prevalence of myopia and other refractive errors, as well as the trend toward personalized eyewear solutions, has led to a surge in the consumption of optical products .

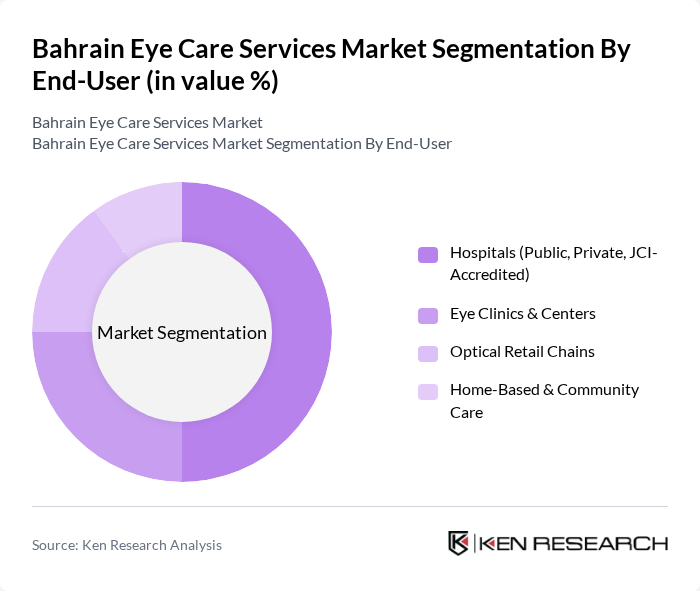

By End-User:The market is categorized by end-users, including Hospitals, Eye Clinics & Centers, Optical Retail Chains, and Home-Based & Community Care.Hospitals, particularly those that are JCI-accredited, lead the market due to their comprehensive service offerings and advanced medical technologies. The preference for hospital-based services is driven by the availability of specialized care, the assurance of quality and safety in treatment, and the integration of advanced diagnostic and surgical equipment .

The Bahrain Eye Care Services Market is characterized by a dynamic mix of regional and international players. Leading participants such as Bahrain Eye Hospital, Al Jazeera Eye Center, Noor Eye Hospital, Gulf Eye Center, Bahrain Specialist Hospital, Dr. Ayman Al-Mansoori Eye Clinic, Al-Moayed Eye Clinic, Eye Care Center Bahrain, Bahrain Medical Center, Vision Care Clinic, Al Hekma Optical, Eye Zone, Al Noor Optical, Optica, Al Mufeed Optical contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Bahrain eye care services market appears promising, driven by increasing investments in healthcare infrastructure and a growing emphasis on preventive care. As the population ages and awareness of eye health rises, the demand for comprehensive eye care services is expected to escalate. Additionally, the integration of telemedicine and AI technologies will likely enhance service delivery, making eye care more accessible and efficient, ultimately improving patient outcomes and satisfaction.

| Segment | Sub-Segments |

|---|---|

| By Type | Optical Services (Prescription Glasses, Contact Lenses, Sunglasses, Safety Eyewear, Fashion Eyewear) Surgical Services (Cataract, Refractive, Glaucoma, Retinal, Oculoplastic) Diagnostic Services (Eye Exams, Imaging, Visual Field Testing) Rehabilitation & Low Vision Services Tele-ophthalmology & Digital Eye Care |

| By End-User | Hospitals (Public, Private, JCI-Accredited) Eye Clinics & Centers Optical Retail Chains Home-Based & Community Care |

| By Age Group | Pediatric (0-17 years) Adult (18-64 years) Geriatric (65+ years) |

| By Service Delivery Model | In-person Services Telehealth/Remote Consultations Mobile Eye Care Units |

| By Geographic Distribution | Urban Areas Rural Areas |

| By Insurance Coverage | Private Insurance Public Insurance (Government Schemes) Out-of-Pocket Payments |

| By Treatment Type | Cataract Treatment Refractive Surgery (LASIK, PRK, etc.) Glaucoma Management Diabetic Retinopathy & Other Retinal Treatments Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Ophthalmology Clinics | 60 | Ophthalmologists, Clinic Managers |

| Optometry Services | 50 | Optometrists, Practice Owners |

| Patient Satisfaction Surveys | 100 | Patients, Caregivers |

| Healthcare Administrators | 40 | Hospital Administrators, Health Policy Makers |

| Insurance Providers | 40 | Insurance Underwriters, Claims Managers |

The Bahrain Eye Care Services Market is valued at approximately USD 300 million, driven by the increasing prevalence of eye disorders, an aging population, and advancements in eye care technology.