Kuwait Eye Health Supplements Market Overview

- The Kuwait Eye Health Supplements Market is valued at USD 15 million, based on a five-year historical analysis. This growth is primarily driven by increasing awareness of eye health, rising prevalence of vision-related issues such as myopia and age-related macular degeneration, and a growing aging population that demands nutritional support for eye health. The market has seen a surge in demand for supplements that promote eye health, particularly those containing vitamins, antioxidants, and carotenoids such as lutein and zeaxanthin. The adoption of digital devices and prolonged screen time have further contributed to the increased demand for eye health supplements among younger demographics as well .

- Kuwait City is the dominant hub for the eye health supplements market due to its high population density, urban lifestyle, and access to advanced healthcare facilities. The concentration of pharmacies and health stores in urban areas facilitates the availability of these products, while the affluent population is more inclined to invest in health and wellness products, further driving market growth .

- The registration and sale of eye health supplements in Kuwait are governed by the “Regulation for Registration, Pricing, and Clearance of Pharmaceutical Products and Food Supplements, 2022” issued by the Kuwait Ministry of Health. This regulation mandates that all eye health supplements must undergo safety and efficacy evaluation, including submission of clinical data and quality certification, before market approval. The regulation covers product labeling, permissible ingredients, and requires importers to obtain a license from the Ministry of Health, thereby ensuring consumer safety and enhancing product quality in the market.

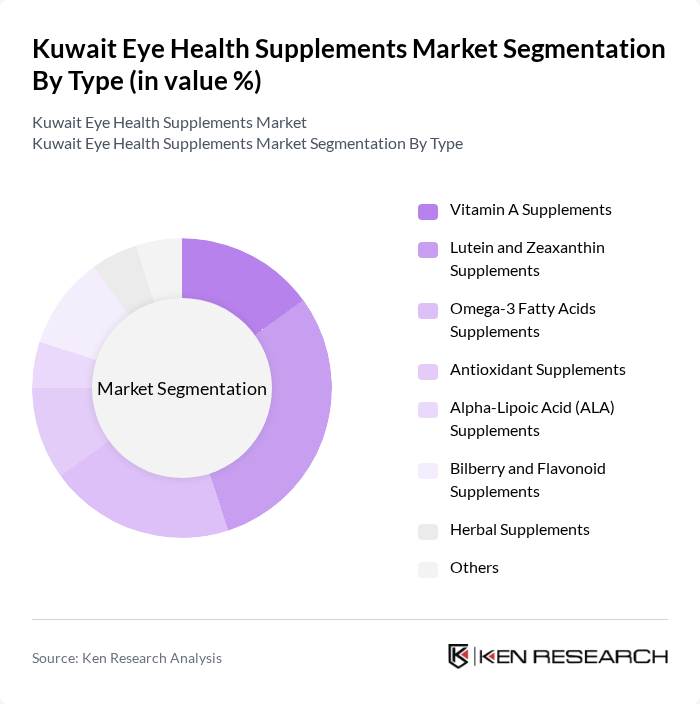

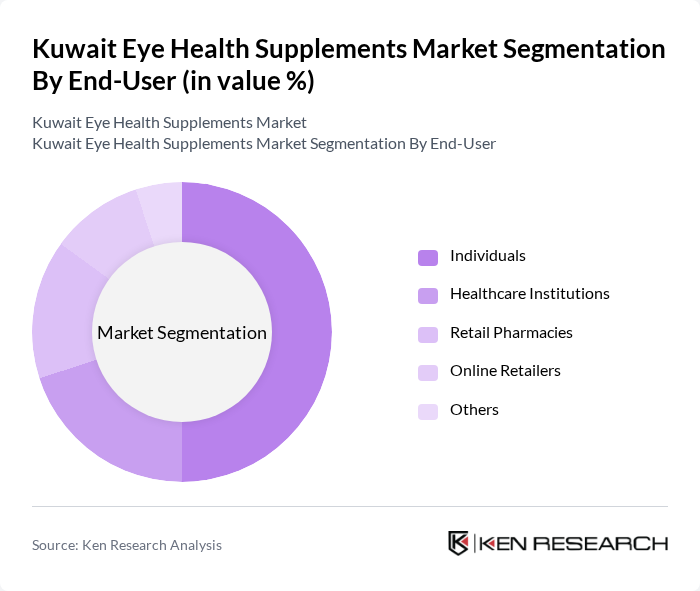

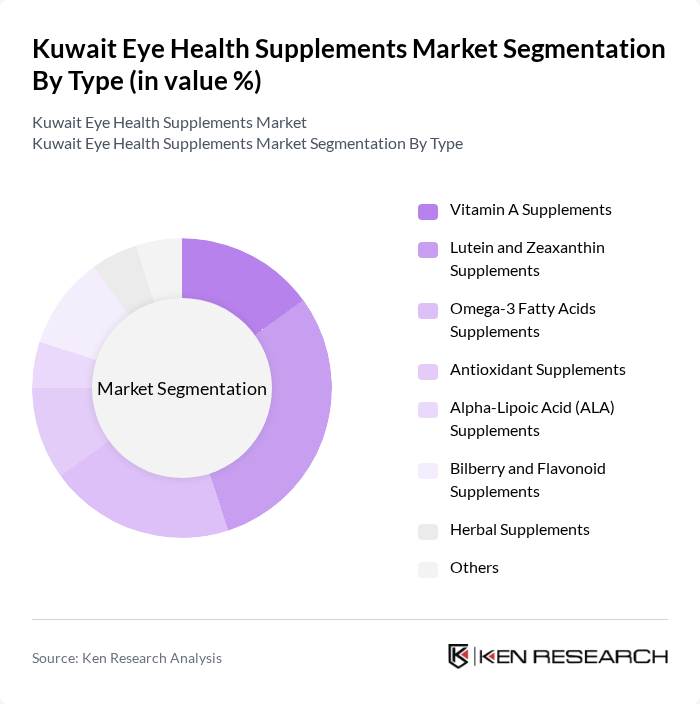

Kuwait Eye Health Supplements Market Segmentation

By Type:The market is segmented into various types of eye health supplements, including Vitamin A Supplements, Lutein and Zeaxanthin Supplements, Omega-3 Fatty Acids Supplements, Antioxidant Supplements, Alpha-Lipoic Acid (ALA) Supplements, Bilberry and Flavonoid Supplements, Herbal Supplements, and Others. Among these,Lutein and Zeaxanthin Supplementsare gaining significant traction due to their proven benefits in reducing the risk of age-related macular degeneration and improving visual performance. The increasing consumer awareness regarding the importance of these nutrients in maintaining eye health is driving their popularity. Additionally, Alpha-Lipoic Acid and Bilberry supplements are witnessing rising demand due to their antioxidant properties and role in relieving eye fatigue and supporting retinal health .

By End-User:The end-user segmentation includes Individuals, Healthcare Institutions, Retail Pharmacies, Online Retailers, and Others.Individualsrepresent the largest segment, driven by the increasing health consciousness among consumers and the growing trend of self-medication. The rise in online shopping has also made it easier for individuals to access a variety of eye health supplements, contributing to the segment's dominance. Healthcare institutions and retail pharmacies continue to play a significant role in the distribution of these products, especially for patients with chronic eye conditions .

Kuwait Eye Health Supplements Market Competitive Landscape

The Kuwait Eye Health Supplements Market is characterized by a dynamic mix of regional and international players. Leading participants such as Alcon, Bausch + Lomb, Herbalife Nutrition Ltd., GNC Holdings, Inc., Amway Corporation, Nature's Way, NOW Foods, Solgar, Vitabiotics Ltd., EyePromise (ZeaVision LLC), The Nature's Bounty Co., Jarrow Formulas, Swanson Health Products, Nutrivein, Pfizer Inc. contribute to innovation, geographic expansion, and service delivery in this space .

Kuwait Eye Health Supplements Market Industry Analysis

Growth Drivers

- Increasing Prevalence of Eye Disorders:The prevalence of eye disorders in Kuwait is rising, with approximately 1.5 million people affected by conditions such as cataracts and diabetic retinopathy. According to the World Health Organization, the number of individuals with visual impairments is projected to increase by 20% in future. This growing incidence drives demand for eye health supplements, as consumers seek preventive measures and treatments to maintain their vision and overall eye health.

- Rising Awareness About Eye Health:Awareness campaigns and educational initiatives have significantly increased public knowledge regarding eye health in Kuwait. Reports indicate that 65% of the population now recognizes the importance of eye care, leading to a surge in the consumption of eye health supplements. The Ministry of Health's efforts to promote regular eye check-ups and healthy lifestyles further contribute to this trend, encouraging consumers to invest in preventive health measures.

- Growth in the Aging Population:Kuwait's aging population is projected to reach 1.2 million in future, with individuals aged 60 and above constituting 15% of the total population. This demographic shift is associated with an increased risk of eye disorders, prompting higher demand for eye health supplements. As older adults become more health-conscious, they are likely to seek products that support their vision, driving market growth in this segment.

Market Challenges

- High Competition Among Brands:The Kuwait eye health supplements market is characterized by intense competition, with over 50 brands vying for market share. This saturation leads to price wars and aggressive marketing strategies, making it challenging for new entrants to establish themselves. As a result, established brands often dominate the market, limiting opportunities for innovation and differentiation, which can stifle overall market growth.

- Regulatory Hurdles:The regulatory landscape for dietary supplements in Kuwait is complex, with stringent requirements for product approval and safety standards. Companies must navigate a lengthy approval process, which can take up to 12 months, delaying product launches. Additionally, compliance with labeling and advertising regulations adds to operational costs, creating barriers for smaller firms and potentially limiting the variety of products available to consumers.

Kuwait Eye Health Supplements Market Future Outlook

The future of the Kuwait eye health supplements market appears promising, driven by increasing consumer awareness and a growing aging population. As more individuals prioritize preventive healthcare, the demand for innovative and personalized supplements is expected to rise. Additionally, the expansion of e-commerce platforms will facilitate easier access to these products, allowing brands to reach a broader audience. Companies that adapt to these trends will likely thrive in this evolving market landscape.

Market Opportunities

- Introduction of Innovative Products:There is a significant opportunity for companies to develop innovative eye health supplements that incorporate advanced ingredients and formulations. With the global market for nutraceuticals projected to reach USD 300 billion in future, Kuwaiti brands can capitalize on this trend by offering unique products that cater to specific consumer needs, enhancing their competitive edge.

- Expansion into Online Sales:The growth of e-commerce in Kuwait presents a lucrative opportunity for eye health supplement brands. With online retail sales expected to exceed USD 1 billion in future, companies can leverage digital platforms to reach tech-savvy consumers. By investing in online marketing strategies and user-friendly websites, brands can significantly increase their market presence and sales volume.