Region:Asia

Author(s):Dev

Product Code:KRAA8394

Pages:96

Published On:November 2025

By Type:The market is segmented into various types of vitamin supplements, including multivitamins, vitamin D, vitamin C, vitamin B complex, vitamin E, herbal supplements, protein & amino acid supplements, omega fatty acids, probiotics, and others. Among these, multivitamins remain the most popular due to their comprehensive health benefits and appeal to a broad consumer base seeking overall wellness. Vitamin C and D continue to see significant demand, particularly among those focused on immune health and bone strength. The market also shows rising interest in protein & amino acid supplements, driven by fitness awareness and sports nutrition trends .

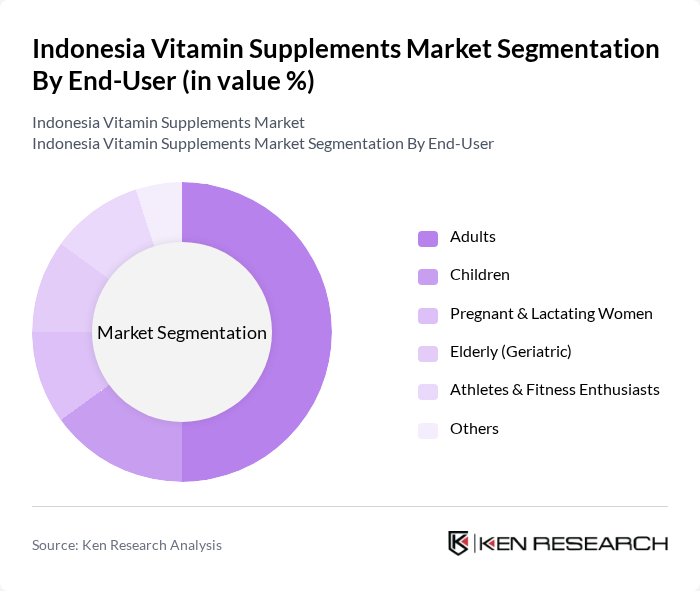

By End-User:The end-user segmentation includes adults, children, pregnant & lactating women, the elderly (geriatric), athletes & fitness enthusiasts, and others. Adults represent the largest segment, driven by a growing focus on health and wellness, as well as increased adoption of preventive healthcare practices. The elderly segment is also significant, with rising demand for supplements supporting bone, joint, and cognitive health. Children’s supplements are gaining traction as parents become more aware of the importance of nutrition in early development. Fitness enthusiasts and athletes are increasingly seeking protein, amino acids, and performance supplements .

The Indonesia Vitamin Supplements Market is characterized by a dynamic mix of regional and international players. Leading participants such as PT Kalbe Farma Tbk, PT Industri Jamu dan Farmasi Sido Muncul Tbk, PT Amerta Indah Otsuka, PT Nutrifood Indonesia, PT Deltomed Laboratories, Herbalife Nutrition Indonesia, Blackmores Indonesia, PT Unilever Indonesia Tbk, PT Nestlé Indonesia, PT Darya-Varia Laboratoria Tbk, PT Pharos Indonesia, PT Sanbe Farma, PT Soho Global Health, PT Kimia Farma Tbk, PT Indofarma Tbk contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Indonesian vitamin supplements market appears promising, driven by increasing health awareness and a shift towards preventive healthcare. As consumers prioritize wellness, the demand for innovative and personalized nutrition solutions is expected to rise. Additionally, the integration of technology in product development, such as app-based health tracking, will likely enhance consumer engagement. Brands that adapt to these trends and invest in education will be well-positioned to capture market share in this evolving landscape.

| Segment | Sub-Segments |

|---|---|

| By Type | Multivitamins Vitamin D Vitamin C Vitamin B Complex Vitamin E Herbal Supplements Protein & Amino Acid Supplements Omega Fatty Acids Probiotics Others (e.g., Enzymes, Antioxidants) |

| By End-User | Adults Children Pregnant & Lactating Women Elderly (Geriatric) Athletes & Fitness Enthusiasts Others |

| By Distribution Channel | Online Retail (E-commerce, Marketplaces) Pharmacies/Drug Stores Supermarkets/Hypermarkets Health Food Stores Direct Sales (MLM, Direct-to-Consumer) Others (Clinics, Specialty Stores) |

| By Formulation | Tablets Capsules Powders Liquids Gummies Effervescent Tablets Others |

| By Packaging Type | Bottles Blister Packs Pouches Jars Sachets Others |

| By Price Range | Economy Mid-Range Premium Others |

| By Brand Loyalty | Brand Loyal Customers Price-Sensitive Customers New Customers Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Consumer Preferences for Vitamin Supplements | 120 | Health-conscious Consumers, Fitness Enthusiasts |

| Healthcare Professional Insights | 70 | Nutritionists, General Practitioners |

| Retailer Perspectives on Vitamin Sales | 60 | Pharmacy Owners, Health Store Managers |

| Market Trends and Innovations | 50 | Product Developers, Marketing Managers |

| Regulatory Impact on Supplement Market | 40 | Regulatory Affairs Specialists, Compliance Officers |

The Indonesia Vitamin Supplements Market is valued at approximately USD 3.2 billion, reflecting significant growth driven by increasing health awareness, rising disposable incomes, and a focus on preventive healthcare among consumers.