Region:Middle East

Author(s):Geetanshi

Product Code:KRAC8321

Pages:96

Published On:November 2025

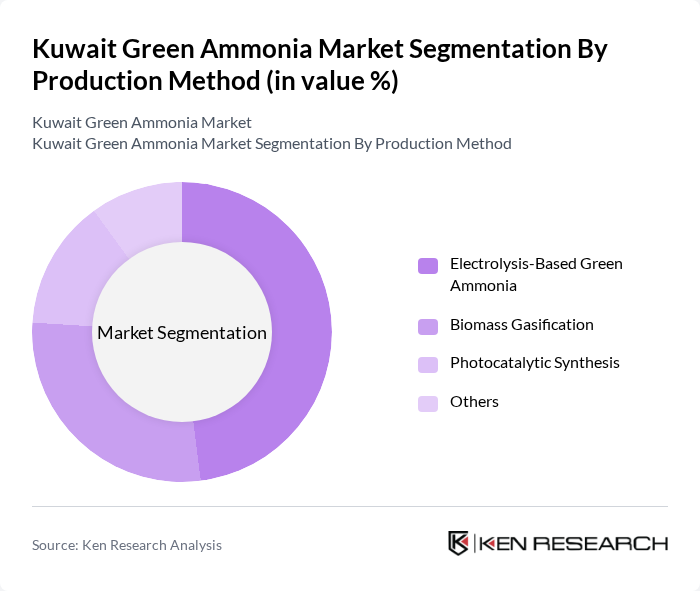

By Production Method:The production methods for green ammonia include various technologies that convert renewable energy into ammonia. The primary methods are electrolysis, biomass gasification, photocatalysis, and others. Each method has its unique advantages and applications, influencing the overall market dynamics .

The electrolysis-based green ammonia production method is currently dominating the market due to its efficiency and scalability. This method utilizes renewable electricity to split water into hydrogen and oxygen, with the hydrogen then combined with nitrogen to produce ammonia. The increasing availability of renewable energy sources, such as solar and wind, has made this method more viable and cost-effective. Additionally, the growing emphasis on reducing carbon emissions and the rapid adoption of electrolyzer technologies have led to a surge in investments in electrolysis technology, further solidifying its market leadership .

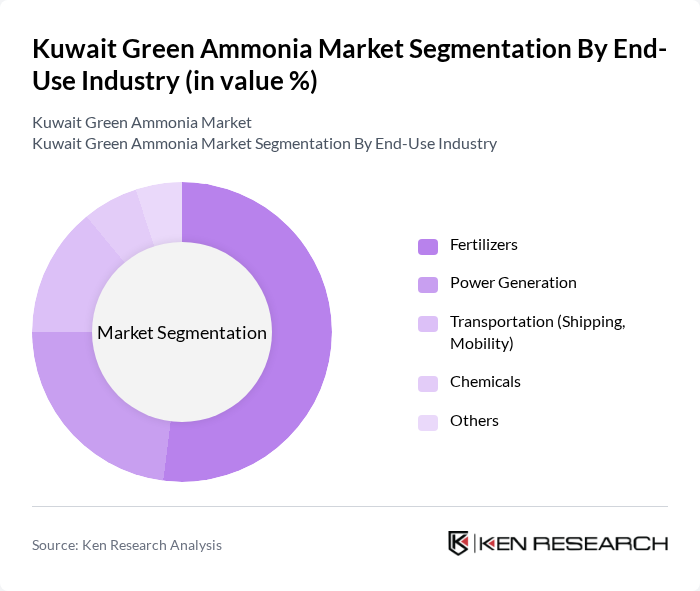

By End-Use Industry:The end-use industries for green ammonia include fertilizers, power generation, transportation, chemicals, and others. Each sector utilizes green ammonia differently, contributing to the overall demand and market growth .

The fertilizers segment is the leading end-use industry for green ammonia, accounting for a significant portion of the market. This is primarily due to the essential role of ammonia in producing nitrogen-based fertilizers, which are crucial for global food production. The increasing agricultural activities and the need for sustainable farming practices have driven the demand for green ammonia as a cleaner alternative to traditional ammonia production methods. Additionally, the push for environmentally friendly fertilizers and regulatory support for low-carbon agriculture have further solidified this segment's dominance in the market .

The Kuwait Green Ammonia Market is characterized by a dynamic mix of regional and international players. Leading participants such as SABIC, Yara International ASA, Air Products and Chemicals, Inc., Siemens Energy AG, Thyssenkrupp AG, ENGIE S.A., Haldor Topsoe A/S, Uniper SE, Linde plc, Green Hydrogen Systems A/S, ENOWA (NEOM), Kuwait National Petroleum Company (KNPC), Kuwait Institute for Scientific Research (KISR), Nel ASA, Plug Power Inc. contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Kuwait green ammonia market appears promising, driven by increasing investments in renewable energy and technological advancements. As the country enhances its infrastructure and regulatory framework, the market is expected to attract more players. Additionally, the global push for sustainable energy solutions will likely create new avenues for Kuwait to export green ammonia, positioning it as a key player in the hydrogen economy. Continued government support will further bolster market growth and innovation.

| Segment | Sub-Segments |

|---|---|

| By Production Method (Electrolysis, Biomass Gasification, Photocatalysis, Others) | Electrolysis-Based Green Ammonia Biomass Gasification Photocatalytic Synthesis Others |

| By End-Use Industry (Fertilizers, Power Generation, Transportation, Chemicals, Others) | Fertilizers Power Generation Transportation (Shipping, Mobility) Chemicals Others |

| By Region (Kuwait City, Al Ahmadi, Shuaiba Industrial Area, Al Jahra, Others) | Kuwait City Al Ahmadi Shuaiba Industrial Area Al Jahra Others |

| By Plant Size (Small-scale, Medium-scale, Large-scale) | Small-scale (<10 ktpa) Medium-scale (10–50 ktpa) Large-scale (>50 ktpa) |

| By Application (Energy Storage, Hydrogen Carrier, Export, Industrial Feedstock, Others) | Energy Storage Hydrogen Carrier Export Industrial Feedstock Others |

| By Investment Source (Domestic, Foreign Direct Investment, Public-Private Partnership, Government Schemes) | Domestic Foreign Direct Investment (FDI) Public-Private Partnership (PPP) Government Schemes Others |

| By Policy Support (Subsidies, Tax Exemptions, Renewable Energy Certificates, Others) | Subsidies Tax Exemptions Renewable Energy Certificates (RECs) Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Green Ammonia Production Facilities | 45 | Plant Managers, Production Engineers |

| Renewable Energy Project Developers | 40 | Project Managers, Business Development Executives |

| Agricultural Sector Stakeholders | 50 | Agronomists, Supply Chain Managers |

| Government Regulatory Bodies | 40 | Policy Makers, Environmental Analysts |

| Research Institutions and Universities | 45 | Researchers, Academic Professors |

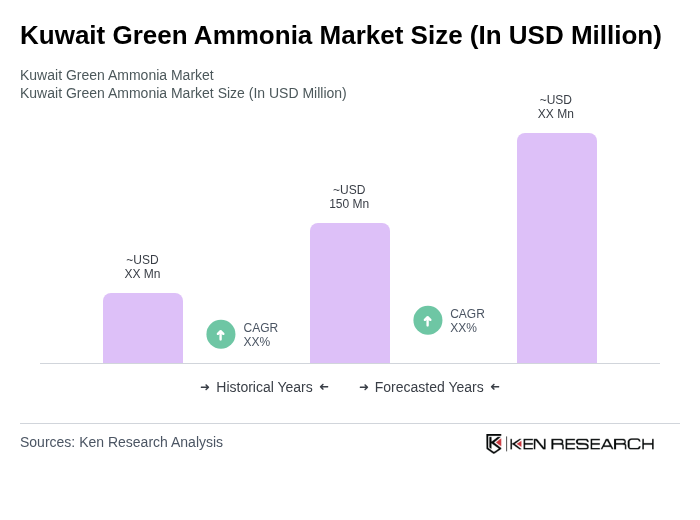

The Kuwait Green Ammonia Market is valued at approximately USD 150 million, driven by the increasing demand for sustainable energy solutions and the global shift towards decarbonization, alongside significant investments in renewable energy projects.