Region:Middle East

Author(s):Rebecca

Product Code:KRAD5023

Pages:93

Published On:December 2025

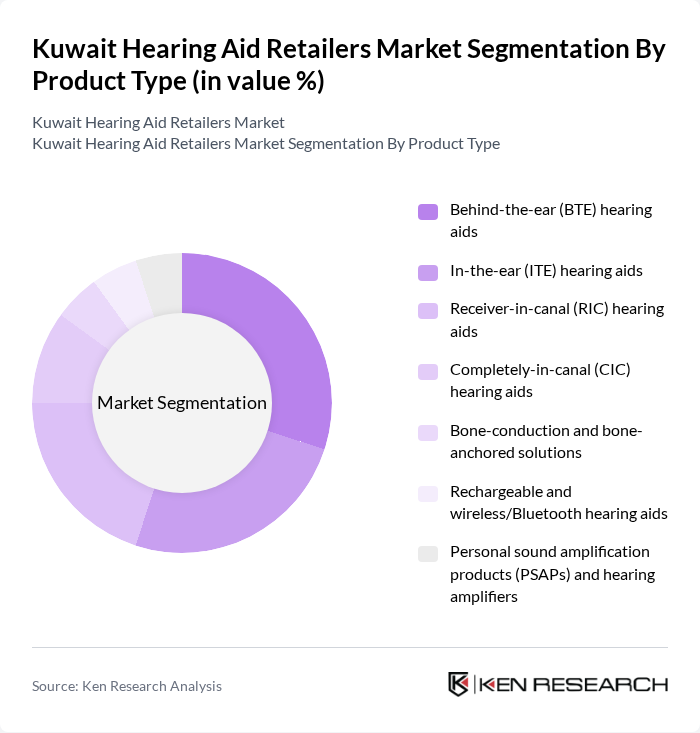

By Product Type:The product type segmentation includes various categories of hearing aids that cater to different consumer needs and preferences, from basic amplification to advanced digital and smart solutions. The market is characterized by a diverse range of products, including traditional behind?the?ear and in?the?ear devices as well as receiver?in?canal, completely?in?canal, and bone?conduction options that address different degrees and types of hearing loss. The demand for specific types of hearing aids is increasingly influenced by user comfort, cosmetic considerations, wireless connectivity, rechargeable batteries, and price sensitivity, with many consumers opting for mid?range digital devices that balance performance and affordability.

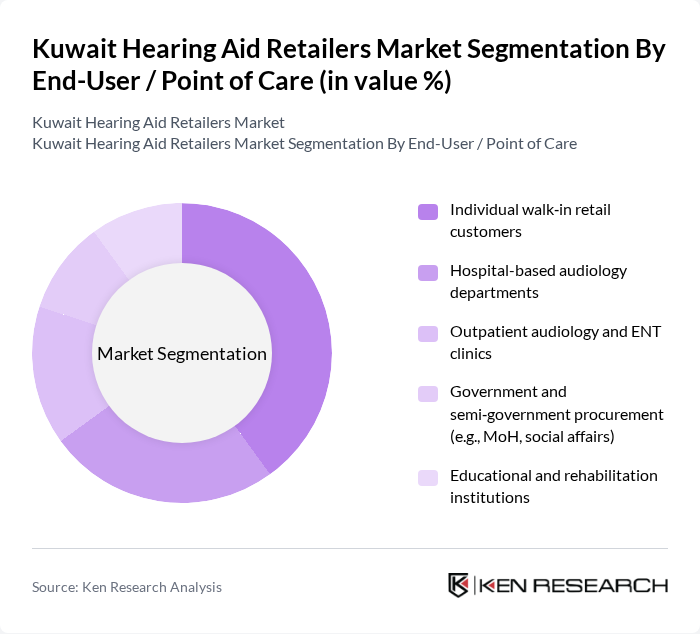

By End-User / Point of Care:The end-user segmentation highlights the various channels through which hearing aids are sold, including direct retail and healthcare facilities. This segmentation is crucial as it reflects the different consumer demographics and their purchasing behaviors, which are influenced by factors such as accessibility, reimbursement or subsidy eligibility, and the level of professional guidance required for device selection and fitting.

The Kuwait Hearing Aid Retailers Market is characterized by a dynamic mix of regional and international players. Leading participants such as Al Mufeed Hearing Aids Center (Kuwait), Al Nahda International Hearing Center (Kuwait), Widex Hearing Center Kuwait (WS Audiology / Widex distributor), Phonak (Sonova) – Authorized distributors and clinics in Kuwait, GN Hearing (ReSound) – Kuwait distribution partners, Starkey Hearing Technologies – Kuwait authorized dealers, Oticon (WS Audiology) – Kuwait retail and clinical partners, Siemens / Signia Hearing Aids – Kuwait distributors, Cochlear Limited – Implant and processor distribution in Kuwait, Amplifon – Regional presence and supply into Kuwait market, Eargo – Online and direct?to?consumer availability for Kuwait, Hearing Life – Regional network and service offerings, Beurer – Hearing amplifiers and PSAPs available in Kuwait retail, Sound World Solutions – Personal sound amplification devices, Other regional audiology and hearing care chains active in GCC & Kuwait contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Kuwait hearing aid market appears promising, driven by technological innovations and increasing public awareness. As the population ages, the demand for hearing aids is expected to rise, with more individuals seeking solutions for hearing loss. Retailers are likely to focus on enhancing customer experience through online platforms and personalized services. Additionally, partnerships with healthcare providers will facilitate better access to hearing assessments, further expanding the market and improving overall hearing health in the region.

| Segment | Sub-Segments |

|---|---|

| By Product Type | Behind-the-ear (BTE) hearing aids In-the-ear (ITE) hearing aids Receiver-in-canal (RIC) hearing aids Completely-in-canal (CIC) hearing aids Bone-conduction and bone-anchored solutions Rechargeable and wireless/Bluetooth hearing aids Personal sound amplification products (PSAPs) and hearing amplifiers |

| By End-User / Point of Care | Individual walk?in retail customers Hospital-based audiology departments Outpatient audiology and ENT clinics Government and semi?government procurement (e.g., MoH, social affairs) Educational and rehabilitation institutions |

| By Retail Format / Distribution Channel | Dedicated hearing aid retail chains and specialty stores Independent audiology clinics and ENT centers Hospital pharmacies and medical equipment retailers Online and e?commerce platforms Cross?border / medical tourism purchases |

| By Price Tier | Entry-level / budget devices Mid-range devices Premium and ultra?premium devices |

| By Technology & Feature Set | Analog hearing aids Basic digital hearing aids Advanced digital with wireless and smartphone connectivity Smart / AI?enabled and app?connected hearing aids |

| By Age Group | Pediatric (0–17 years) Adult (18–59 years) Geriatric (60+ years) |

| By Governorate | Capital Governorate (Al Asimah) Hawalli Governorate Al Ahmadi Governorate Farwaniya Governorate Al Jahra Governorate Mubarak Al-Kabeer Governorate |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Consumer Insights on Hearing Aids | 140 | Hearing Aid Users, Family Members of Users |

| Retailer Perspectives on Market Trends | 100 | Store Managers, Sales Representatives |

| Healthcare Professional Opinions | 80 | Audiologists, ENT Specialists |

| Market Demand from Elderly Population | 120 | Elderly Individuals, Caregivers |

| Insurance Coverage Insights | 70 | Insurance Agents, Policyholders |

The Kuwait Hearing Aid Retailers Market is valued at approximately USD 11 million, reflecting a five-year historical analysis of hearing aid revenues and trade data, driven by an aging population and advancements in hearing aid technology.