Region:North America

Author(s):Geetanshi

Product Code:KRAC9561

Pages:80

Published On:November 2025

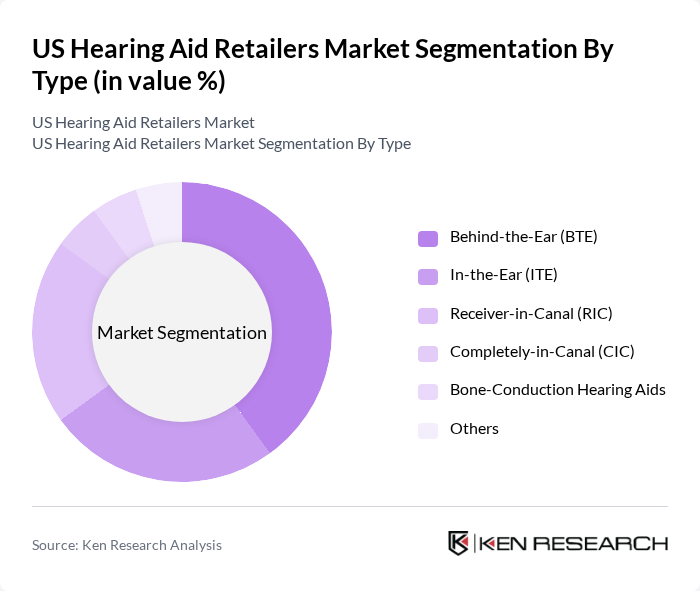

By Type:The market is segmented into various types of hearing aids, including Behind-the-Ear (BTE), In-the-Ear (ITE), Receiver-in-Canal (RIC), Completely-in-Canal (CIC), Bone-Conduction Hearing Aids, and Others. Among these, the Behind-the-Ear (BTE) segment is the most dominant due to its versatility, comfort, and advanced technology features. BTE devices are suitable for a wide range of hearing loss levels and are preferred by both adults and the elderly. The increasing adoption of digital technology in BTE devices, such as Bluetooth connectivity and rechargeable batteries, has further enhanced their appeal, making them a popular choice among consumers.

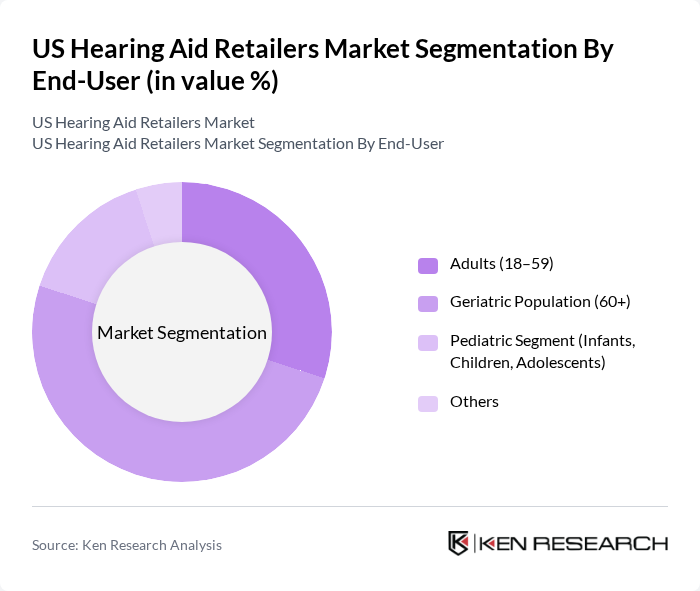

By End-User:The market is segmented by end-users into Adults (18–59), Geriatric Population (60+), Pediatric Segment (Infants, Children, Adolescents), and Others. The Geriatric Population segment holds the largest share due to the higher prevalence of hearing loss in older adults. As the population ages, the demand for hearing aids among seniors continues to rise, driven by increased awareness of hearing health and the availability of advanced hearing solutions tailored to their needs. This segment's growth is further supported by healthcare initiatives and government awareness campaigns aimed at improving the quality of life for the elderly.

The US Hearing Aid Retailers Market is characterized by a dynamic mix of regional and international players. Leading participants such as Sonova Holding AG (Phonak, AudioNova), Demant A/S (Oticon, Bernafon, HearingLife), GN Store Nord A/S (ReSound, Beltone, Jabra Enhance), Cochlear Limited, Amplifon S.p.A. (Miracle-Ear, Elite Hearing Centers of America), Starkey Hearing Technologies, WS Audiology A/S (Widex, Signia, HearUSA), Eargo, Inc., Costco Wholesale Corporation (Hearing Aid Centers), Lucid Hearing Holding Company, LLC, Audicus, Hear.com, MDHearingAid, Lively (Jabra Enhance Select), Otofonix, Walmart Inc. (Hearing Aid Services), Walgreens Boots Alliance, Inc. (Hearing Aid Services), Sam's Club (Hearing Aid Centers), Target Corporation (Hearing Aid Retail), Embrace Hearing contribute to innovation, geographic expansion, and service delivery in this space.

The future of the U.S. hearing aid market appears promising, driven by ongoing technological advancements and a growing emphasis on hearing health. As telehealth services expand, more consumers will have access to audiology consultations, facilitating timely interventions. Additionally, the anticipated introduction of over-the-counter hearing aids will likely democratize access, making devices more affordable and appealing to a broader audience. These trends suggest a dynamic market landscape poised for significant growth in the coming years.

| Segment | Sub-Segments |

|---|---|

| By Type | Behind-the-Ear (BTE) In-the-Ear (ITE) Receiver-in-Canal (RIC) Completely-in-Canal (CIC) Bone-Conduction Hearing Aids Others |

| By End-User | Adults (18–59) Geriatric Population (60+) Pediatric Segment (Infants, Children, Adolescents) Others |

| By Distribution Channel | Manufacturer-Owned Retail Networks National Retailers (e.g., Costco, Walmart) Independent Retailers/Small Chains Online Retailers (Brand-Owned Portals, E-Commerce Platforms) Audiology Clinics (ENT Hospitals, Independent Audiologists) Retail Pharmacies (Chain Pharmacies, Independent Drugstores) Tele-Audiology Platforms Others |

| By Price Range | Budget Mid-Range Premium Others |

| By Brand | Major Brands Emerging Brands Private Labels Others |

| By Technology | Analog Hearing Aids Digital Hearing Aids Smart Hearing Aids Others |

| By Customer Segment | Individual Consumers Healthcare Providers Institutions Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Hearing Aid Retailers | 50 | Store Managers, Sales Representatives |

| Audiologists and Hearing Specialists | 40 | Licensed Audiologists, Hearing Aid Fitters |

| Hearing Aid Users | 100 | Current Users, Recent Buyers |

| Potential Hearing Aid Consumers | 60 | Individuals with Hearing Loss, Caregivers |

| Industry Experts and Analysts | 40 | Market Analysts, Healthcare Consultants |

The US Hearing Aid Retailers Market is valued at approximately USD 3.5 billion, reflecting a significant growth trend driven by the increasing prevalence of hearing loss, advancements in technology, and heightened awareness of hearing health among the population.