Region:Asia

Author(s):Rebecca

Product Code:KRAD5055

Pages:88

Published On:December 2025

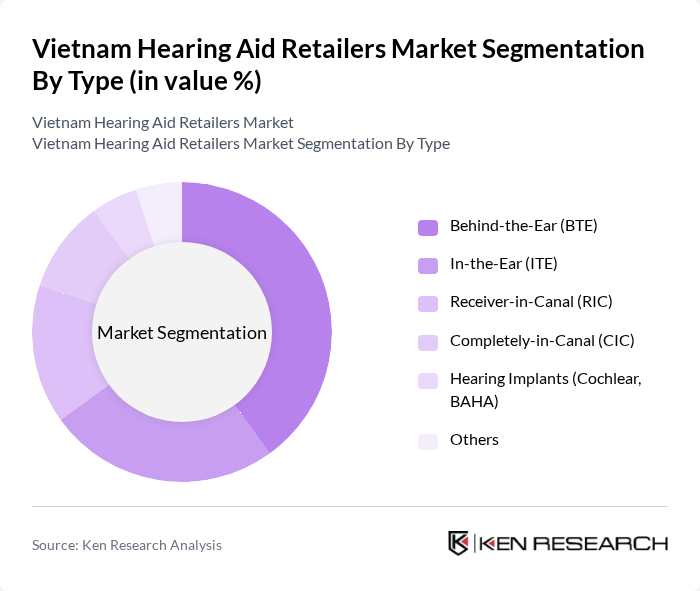

By Type:The market is segmented into various types of hearing aids, including Behind-the-Ear (BTE), In-the-Ear (ITE), Receiver-in-Canal (RIC), Completely-in-Canal (CIC), Hearing Implants (Cochlear, BAHA), and Others. Among these, the Behind-the-Ear (BTE) segment is currently leading the market due to its ease of use, durability, power output, and suitability for a wide range of hearing loss levels, from mild to profound. The growing preference for digital technology, including Bluetooth-enabled and rechargeable BTE and RIC devices, and the increasing availability of advanced features such as noise reduction, directionality, and smartphone app integration in these formats are driving consumer adoption in Vietnam.

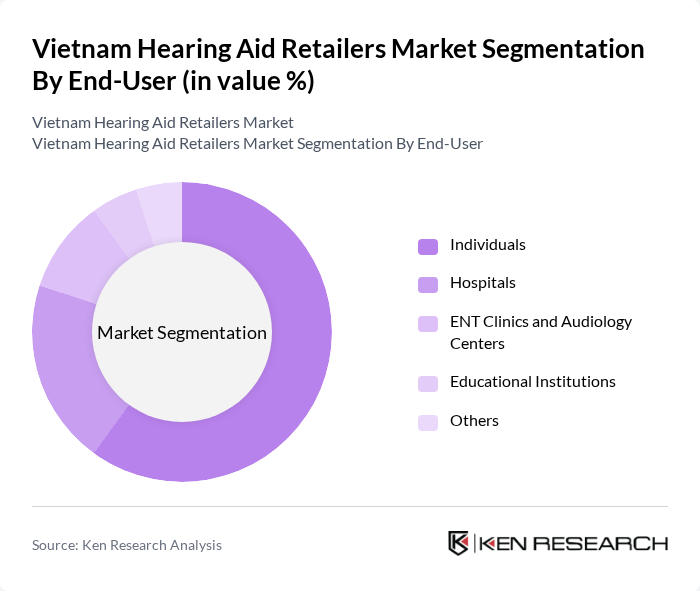

By End-User:The market is segmented by end-users, including Individuals, Hospitals, ENT Clinics and Audiology Centers, Educational Institutions, and Others. The Individuals segment is the largest, driven by the increasing number of people seeking personal hearing solutions in retail and clinic-based settings as awareness campaigns and screening programs identify more untreated hearing loss. The growing awareness of hearing health, rising disposable incomes, and the availability of installment payment plans, insurance reimbursement in selected schemes, and promotional discounts offered by hearing aid dispensers are contributing to the expansion of this segment.

The Vietnam Hearing Aid Retailers Market is characterized by a dynamic mix of regional and international players. Leading participants such as Widex Vietnam Co., Ltd., Sonova Vietnam Co., Ltd. (Phonak, Unitron), GN Hearing Vietnam Co., Ltd. (ReSound), Demant Vietnam Co., Ltd. (Oticon), MED-EL Vietnam Representative Office, Sivantos / WS Audiology Vietnam Co., Ltd. (Signia), Starkey Hearing Technologies Vietnam, Nam Hoang Hearing Care (Nam Hoang Audio), Dong Nai Hearing Aid Center, Hope Hearings Vietnam, Tai Thinh Hearing Care, Tâm ??c Hearing Care Center, Saigon Hearing Aid Center, Hanoi Audiology & Hearing Aid Center, Hear.com Vietnam contribute to innovation, geographic expansion, and service delivery in this space.

The Vietnam hearing aid market is poised for significant transformation, driven by technological innovations and increasing healthcare investments. As digital hearing aids become more prevalent, consumer adoption is expected to rise, particularly among younger demographics. Additionally, the government's commitment to improving healthcare infrastructure will facilitate better access to hearing solutions. With a focus on telehealth services and e-commerce platforms, the market is likely to witness enhanced distribution channels, making hearing aids more accessible to diverse populations across the country.

| Segment | Sub-Segments |

|---|---|

| By Type | Behind-the-Ear (BTE) In-the-Ear (ITE) Receiver-in-Canal (RIC) Completely-in-Canal (CIC) Hearing Implants (Cochlear, BAHA) Others |

| By End-User | Individuals Hospitals ENT Clinics and Audiology Centers Educational Institutions Others |

| By Region | Northern Vietnam Central Vietnam Southern Vietnam |

| By Age Group | Children (Pediatrics) Adults Seniors Others |

| By Distribution Channel | Online Retail (E-commerce Platforms, Brand Websites) Offline Retail (Dedicated Hearing Aid Stores) Hospitals and Clinics OTC Medical Stores and Pharmacies Others |

| By Price Range | Budget Mid-Range Premium |

| By Brand / Technology Preference | Premium International Brands Mid-range International and Local Brands Budget / Entry-level Brands Analog Hearing Aids Digital and Smart Hearing Aids |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Retail Hearing Aid Sales | 120 | Store Managers, Sales Representatives |

| Consumer Insights on Hearing Aids | 110 | Hearing Aid Users, Caregivers |

| Healthcare Provider Perspectives | 90 | Audiologists, ENT Specialists |

| Market Trends and Innovations | 70 | Product Managers, R&D Specialists |

| Distribution Channel Analysis | 60 | Logistics Managers, Retail Buyers |

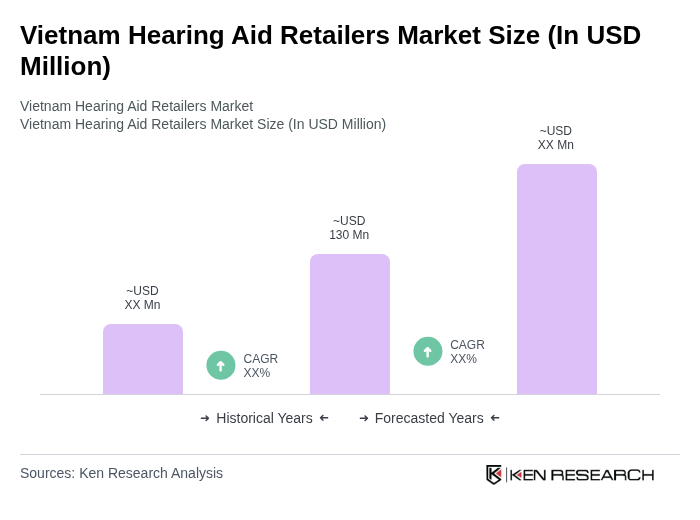

The Vietnam Hearing Aid Retailers Market is valued at approximately USD 130 million, reflecting a significant growth trend driven by the increasing prevalence of hearing loss among the aging population and advancements in hearing aid technology.