Kuwait Lingerie Market Overview

- The Kuwait Lingerie Market is valued at USD 170 million, based on a five-year historical analysis and normalization against regional GCC benchmarks. This growth is primarily driven by increasing consumer demand for fashionable and comfortable lingerie, a rise in disposable income, and the proliferation of online shopping platforms, which have expanded consumer access to a wider variety of brands and products. The market is further supported by the influx of international brands and a growing focus on personalized and sustainable lingerie offerings.

- Kuwait City remains the dominant hub for the lingerie market, benefiting from its role as the primary commercial center with a high concentration of retail outlets and shopping malls. The presence of international brands, specialized lingerie stores offering personalized fittings, and a growing middle-class population contribute to the market’s vibrancy. Additionally, the increasing cultural acceptance of lingerie as a fashion statement and the body positivity movement have led to higher sales in urban areas.

- In 2023, the Kuwaiti government implemented the Consumer Protection Law No. 39 of 2014, enforced by the Ministry of Commerce and Industry, which includes provisions for retail sectors such as lingerie. This regulation mandates clear labeling of products, including details on materials and care instructions, and requires retailers to ensure product authenticity and safety. These measures are designed to enhance product quality and consumer trust in the market.

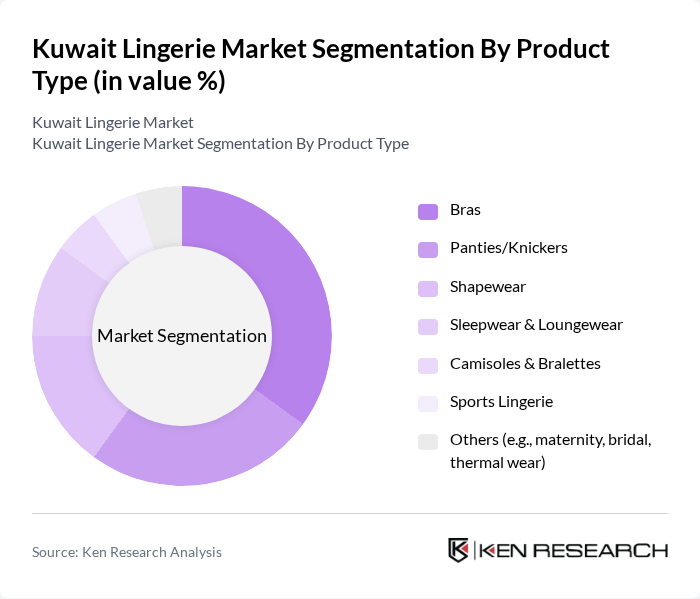

Kuwait Lingerie Market Segmentation

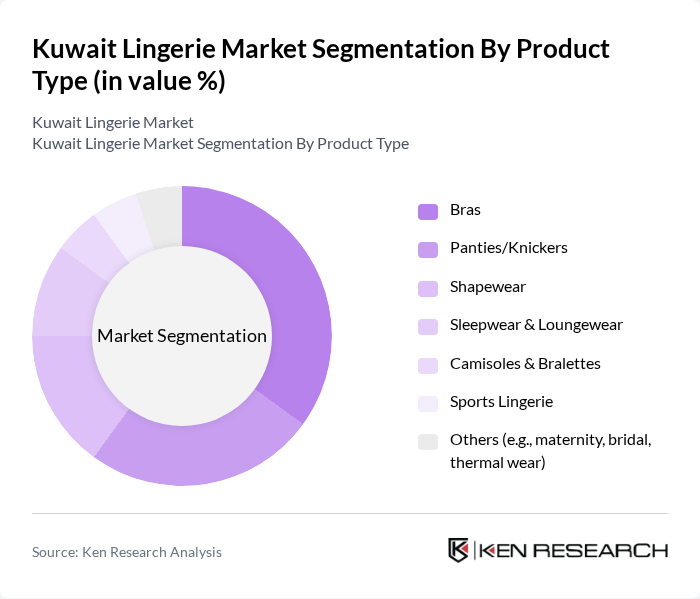

By Product Type:The product type segmentation includes bras, panties/knickers, shapewear, sleepwear & loungewear, camisoles & bralettes, sports lingerie, and others (e.g., maternity, bridal, thermal wear). Among these, bras hold the largest share due to their essential role in women's lingerie collections, supported by ongoing fashion trends and the increasing focus on comfort, fit, and innovative fabrics. Shapewear is experiencing notable growth, driven by consumer interest in body contouring and special occasion wear. The market is also seeing rising demand for sleepwear and loungewear, reflecting a broader trend toward comfort and versatility in apparel.

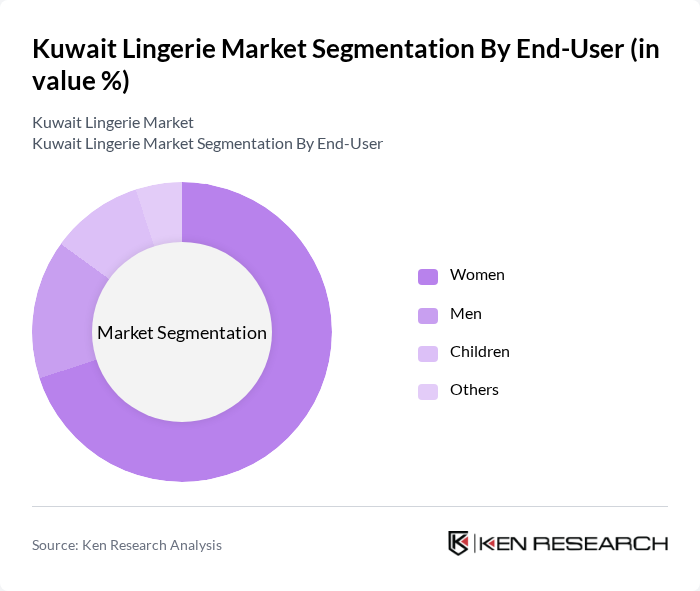

By End-User:The end-user segmentation includes women, men, children, and others. Women represent the largest segment, driven by a diverse range of products tailored to their preferences and needs, as well as increasing awareness of body positivity and self-expression. The men's segment is expanding as brands introduce more stylish and comfortable options, while demand among children and other groups remains steady, supported by broader retail offerings.

Kuwait Lingerie Market Competitive Landscape

The Kuwait Lingerie Market is characterized by a dynamic mix of regional and international players. Leading participants such as Alshaya Group (operator of Victoria's Secret, H&M, La Senza in Kuwait), Al Yasra Fashion, Victoria's Secret, Marks & Spencer, H&M, La Senza, Boux Avenue, Intimissimi, Triumph International, Nayomi, Oysho, Next, Etam, Calvin Klein Underwear, Aerie contribute to innovation, geographic expansion, and service delivery in this space.

Kuwait Lingerie Market Industry Analysis

Growth Drivers

- Increasing Disposable Income:The disposable income in Kuwait is projected to reach approximately $32,000 per capita in future, reflecting a significant increase from previous years. This rise in income allows consumers to allocate more funds towards discretionary spending, including lingerie. As a result, the demand for premium and luxury lingerie products is expected to grow, driven by consumers' willingness to invest in quality and fashionable items that enhance their personal style and comfort.

- Rising Fashion Consciousness:Kuwait's fashion industry is experiencing a notable transformation, with a growing emphasis on personal style and trends. The fashion retail sector is estimated to generate over $1.5 billion in revenue, indicating a robust interest in fashion-forward products, including lingerie. This trend is fueled by social media influencers and local fashion events, encouraging consumers to seek out stylish and contemporary lingerie options that align with their evolving fashion sensibilities.

- Growth of E-commerce Platforms:The e-commerce sector in Kuwait is estimated to exceed $1.1 billion, driven by increased internet penetration and smartphone usage. This growth facilitates easier access to a wide range of lingerie brands and styles, allowing consumers to shop conveniently from home. The rise of online shopping is particularly appealing to younger demographics, who prefer the privacy and variety offered by e-commerce platforms, thus significantly boosting lingerie sales in the market.

Market Challenges

- Intense Competition:The Kuwaiti lingerie market is characterized by fierce competition among both local and international brands. With over 100 established lingerie retailers operating in the region, brands must continuously innovate and differentiate their offerings to capture market share. This competitive landscape can lead to price wars, which may erode profit margins and challenge smaller brands that lack the resources to compete effectively against larger, well-established players.

- Cultural Sensitivities:Cultural norms in Kuwait significantly influence consumer behavior and purchasing decisions in the lingerie market. The conservative nature of Kuwaiti society can limit the types of lingerie products that are acceptable for public consumption. Brands must navigate these cultural sensitivities carefully, ensuring that their marketing strategies and product offerings align with local values while still appealing to modern consumer preferences, which can be a complex balancing act.

Kuwait Lingerie Market Future Outlook

The future of the Kuwait lingerie market appears promising, driven by evolving consumer preferences and technological advancements. As disposable incomes rise and fashion consciousness increases, brands are likely to focus on innovative designs and sustainable practices. Additionally, the expansion of e-commerce will continue to reshape the retail landscape, providing consumers with greater access to diverse lingerie options. Companies that adapt to these trends and prioritize customer engagement will be well-positioned to thrive in this dynamic market environment.

Market Opportunities

- Introduction of Sustainable Products:There is a growing demand for sustainable lingerie options in Kuwait, with consumers increasingly prioritizing eco-friendly materials and ethical production practices. Brands that invest in sustainable practices can tap into this emerging market segment, appealing to environmentally conscious consumers and enhancing their brand reputation in a competitive landscape.

- Customization and Personalization Trends:The trend towards customization in the lingerie market presents a significant opportunity for brands to differentiate themselves. By offering personalized products tailored to individual preferences, companies can enhance customer satisfaction and loyalty. This approach not only meets the unique needs of consumers but also fosters a deeper emotional connection with the brand, driving repeat purchases.