Region:North America

Author(s):Rebecca

Product Code:KRAB0262

Pages:92

Published On:August 2025

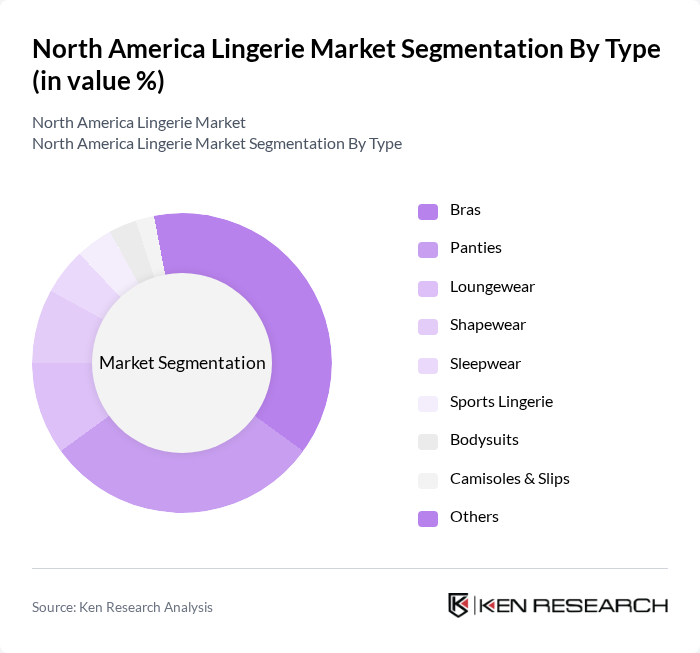

By Type:The lingerie market can be segmented into various types, including bras, panties, loungewear, shapewear, sleepwear, sports lingerie, bodysuits, camisoles & slips, and others. Among these, bras and panties remain the most dominant segments, driven by their essential nature in women's wardrobes and the increasing variety of styles, sizes, and inclusive fits available. Loungewear and shapewear are also gaining traction due to the growing demand for comfort and body-positive apparel, while sports lingerie and bodysuits are expanding with the rise of athleisure and versatile fashion trends .

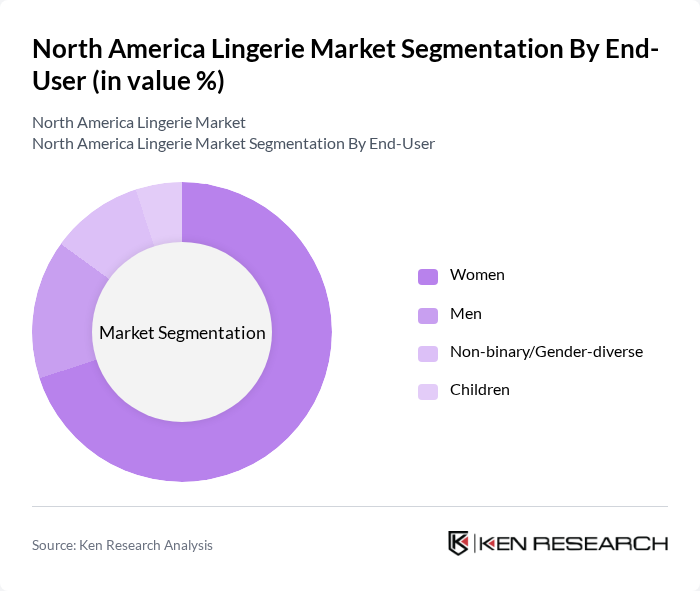

By End-User:The lingerie market is segmented by end-user into women, men, non-binary/gender-diverse individuals, and children. The women's segment is the largest, driven by a wide range of products tailored to various body types and preferences. There is a growing acceptance and visibility of gender diversity, leading to increased offerings for non-binary and gender-diverse consumers. The men’s segment is expanding as brands introduce more inclusive and functional designs, while the children’s segment remains niche .

The North America Lingerie Market is characterized by a dynamic mix of regional and international players. Leading participants such as Victoria's Secret & Co., Aerie (American Eagle Outfitters, Inc.), ThirdLove, Savage X Fenty, Bali (Hanesbrands Inc.), Playtex (Hanesbrands Inc.), Maidenform (Hanesbrands Inc.), Hanky Panky, Natori, Wacoal America, Commando, Lively, Cosabella, Adore Me, Soma (Chico's FAS, Inc.), Parfait, Knix, Fleur du Mal, and La Perla North America contribute to innovation, geographic expansion, and service delivery in this space .

The North America lingerie market is poised for significant transformation, driven by evolving consumer preferences and technological advancements. As brands increasingly adopt personalized shopping experiences and focus on inclusivity, the market is expected to witness a shift towards more diverse product offerings. Additionally, the integration of technology in marketing and product design will enhance consumer engagement, paving the way for innovative solutions that cater to the growing demand for comfort and sustainability in lingerie.

| Segment | Sub-Segments |

|---|---|

| By Type | Bras Panties Loungewear Shapewear Sleepwear Sports Lingerie Bodysuits Camisoles & Slips Others |

| By End-User | Women Men Non-binary/Gender-diverse Children |

| By Sales Channel | Online Retail (Brand Websites, E-commerce Marketplaces) Offline Retail (Department Stores, Specialty Stores, Supermarkets/Hypermarkets) Direct Sales (Brand Outlets, Pop-up Stores) |

| By Price Range | Budget Mid-range Premium |

| By Material | Cotton Lace Synthetic (Nylon, Polyester, Spandex) Silk Modal/Bamboo |

| By Brand Positioning | Luxury Mass Market Niche (Sustainable, Plus-size, Gender-neutral) |

| By Distribution Mode | Direct-to-Consumer Wholesale Franchise Subscription Box Services |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Consumer Preferences in Lingerie | 120 | Female Consumers aged 18-45 |

| Retail Insights from Lingerie Stores | 60 | Store Managers, Sales Associates |

| E-commerce Lingerie Sales Trends | 50 | E-commerce Managers, Digital Marketing Specialists |

| Brand Perception and Loyalty | 80 | Brand Loyalists, Occasional Buyers |

| Market Trends and Innovations | 40 | Product Development Managers, Fashion Designers |

The North America lingerie market is valued at approximately USD 3.8 billion, reflecting a significant growth trend driven by consumer demand for comfort, style, and inclusivity in lingerie products.