Region:Middle East

Author(s):Dev

Product Code:KRAC2081

Pages:100

Published On:October 2025

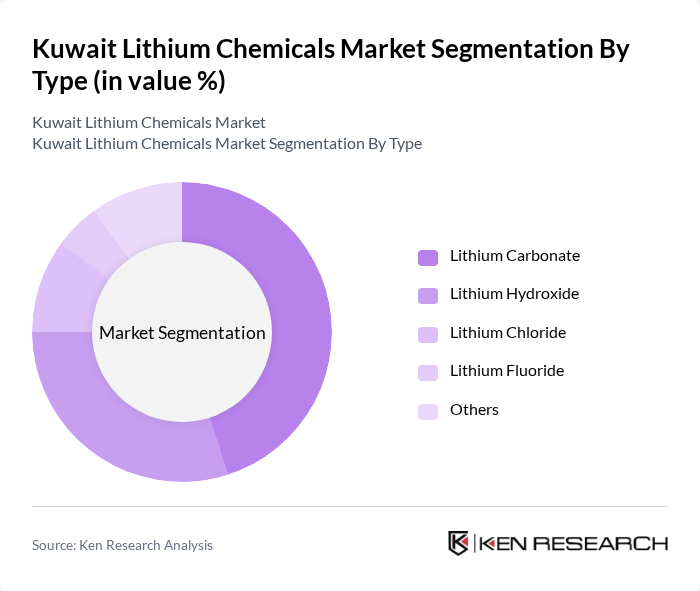

By Type:The lithium chemicals market can be segmented into various types, including Lithium Carbonate, Lithium Hydroxide, Lithium Chloride, Lithium Fluoride, and Others. Each of these subsegments plays a crucial role in different applications, with Lithium Carbonate being the most widely used due to its extensive application in battery production and industrial uses such as glass, ceramics, and pharmaceuticals. The carbonate segment holds the largest revenue share in the Middle East due to its dominant role in battery cathode manufacturing and strong demand from electric vehicles .

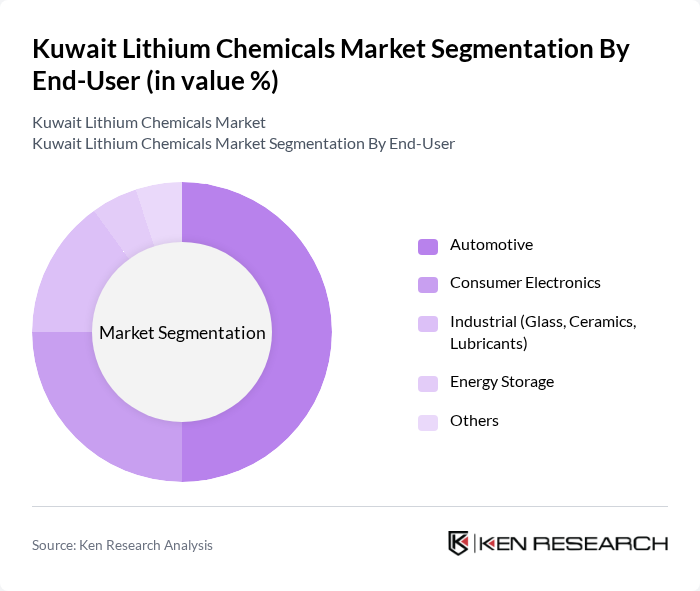

By End-User:The end-user segmentation includes Automotive, Consumer Electronics, Industrial (Glass, Ceramics, Lubricants), Energy Storage, and Others. The automotive sector is the leading end-user, driven by the surge in electric vehicle production and the need for efficient energy storage solutions. Industrial demand is also rising due to the expansion of glass, ceramics, and specialty chemicals manufacturing in the region .

The Kuwait Lithium Chemicals Market is characterized by a dynamic mix of regional and international players. Leading participants such as Albemarle Corporation, SQM (Sociedad Química y Minera de Chile), Livent Corporation, Ganfeng Lithium Co., Ltd., Tianqi Lithium Industries, Inc., Orocobre Limited, Galaxy Resources Limited, Nemaska Lithium Inc., Lithium Americas Corp., Piedmont Lithium Inc., Titan Lithium, Lepidico Ltd., Saudi Aramco, LiHytech, Critical Elements Lithium Corporation contribute to innovation, geographic expansion, and service delivery in this space .

The future of the lithium chemicals market in Kuwait appears promising, driven by increasing investments in sustainable technologies and a growing focus on energy storage solutions. As the government continues to support renewable energy initiatives, the demand for lithium chemicals is expected to rise. Additionally, advancements in lithium extraction and processing technologies will likely enhance efficiency and reduce environmental impacts, positioning Kuwait as a competitive player in the global lithium market landscape.

| Segment | Sub-Segments |

|---|---|

| By Type | Lithium Carbonate Lithium Hydroxide Lithium Chloride Lithium Fluoride Others |

| By End-User | Automotive Consumer Electronics Industrial (Glass, Ceramics, Lubricants) Energy Storage Others |

| By Application | Batteries (EV, ESS, Consumer Devices) Glass and Ceramics Lubricating Greases Polymers and Specialty Chemicals Others |

| By Distribution Channel | Direct Sales Distributors Online Sales Others |

| By Pricing Strategy | Premium Pricing Competitive Pricing Value-Based Pricing Others |

| By Region | Kuwait Saudi Arabia UAE Qatar Oman Bahrain Others |

| By Product Form | Powder Liquid Granules Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Batteries Manufacturing Sector | 60 | Production Managers, R&D Heads |

| Ceramics and Glass Industry | 50 | Quality Control Managers, Procurement Officers |

| Pharmaceutical Applications | 45 | Product Development Managers, Regulatory Affairs Specialists |

| Research Institutions and Universities | 40 | Academic Researchers, Industry Analysts |

| Government Regulatory Bodies | 30 | Policy Makers, Environmental Compliance Officers |

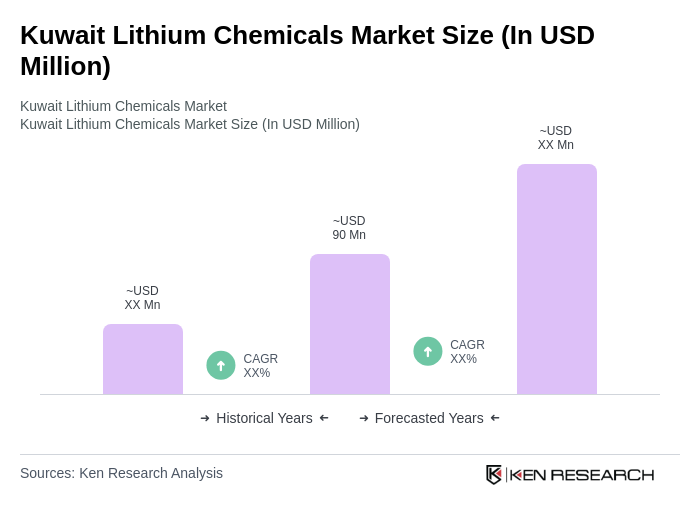

The Kuwait Lithium Chemicals Market is valued at approximately USD 90 million, reflecting its growth driven by the increasing demand for lithium-ion batteries, particularly in the automotive and consumer electronics sectors.