Region:Middle East

Author(s):Rebecca

Product Code:KRAD7462

Pages:94

Published On:December 2025

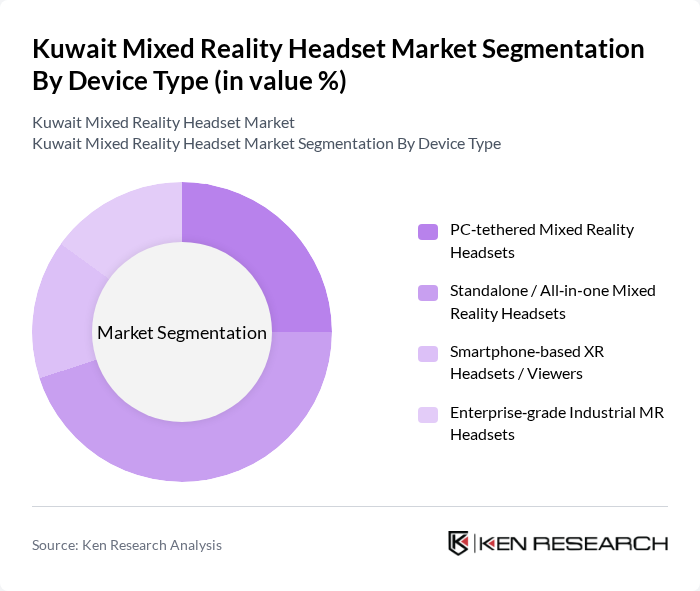

By Device Type:The device type segmentation of the market includes various categories such as PC-tethered mixed reality headsets, standalone/all-in-one mixed reality headsets, smartphone-based XR headsets/viewers, and enterprise-grade industrial MR headsets. Among these, standalone/all-in-one mixed reality headsets are currently dominating the market due to their ease of use, portability, and affordability, making them highly appealing to consumers and businesses alike. The trend towards mobile and user-friendly devices is driving the adoption of these headsets across various applications.

By Form Factor:The form factor segmentation includes head-mounted displays (HMD), smart glasses/smart visors, helmet-integrated MR systems, and others. Head-mounted displays (HMD) are leading the market due to their immersive capabilities and widespread use in gaming and training applications. The increasing demand for high-quality visual experiences in both consumer and enterprise sectors is propelling the growth of HMDs, making them a preferred choice among users.

The Kuwait Mixed Reality Headset Market is characterized by a dynamic mix of regional and international players. Leading participants such as Microsoft Corporation (HoloLens), Meta Platforms, Inc. (Meta Quest), Apple Inc. (Apple Vision Pro), Sony Group Corporation (PlayStation VR / XR), HTC Corporation (VIVE), Magic Leap, Inc., Varjo Technologies Oy, Lenovo Group Limited, Samsung Electronics Co., Ltd., Google LLC, Pico Interactive, Inc. (ByteDance Ltd.), Xreal Inc. (formerly Nreal), LG Electronics Inc., HP Inc., AsusTek Computer Inc. contribute to innovation, geographic expansion, and service delivery in this space.

The future of the mixed reality headset market in Kuwait appears promising, driven by technological advancements and increasing consumer interest. As the local gaming and entertainment sectors continue to grow, the demand for immersive experiences will likely rise. Additionally, partnerships with educational institutions and enterprises are expected to foster innovative applications, enhancing the market's appeal. The integration of artificial intelligence and IoT technologies will further enhance user experiences, paving the way for a more dynamic and engaging mixed reality landscape in the region.

| Segment | Sub-Segments |

|---|---|

| By Device Type | PC?tethered Mixed Reality Headsets Standalone / All?in?one Mixed Reality Headsets Smartphone?based XR Headsets / Viewers Enterprise?grade Industrial MR Headsets |

| By Form Factor | Head?Mounted Displays (HMD) Smart Glasses / Smart Visors Helmet?integrated MR Systems Others |

| By End?Use Industry | Gaming & Location?based Entertainment Education & Training (Schools, Universities, Institutes) Healthcare & Medical Simulation Oil & Gas, Utilities & Industrial Government, Defense & Public Safety Real Estate, Architecture & Construction Retail & Hospitality Others |

| By Application | Immersive Gaming & eSports Remote Collaboration & Virtual Meetings Industrial Training & Field Service Guidance Design, Prototyping & Architectural Visualization Medical & Surgical Simulation Customer Experience & Retail Showcasing Others |

| By Technology | Inside?out Tracking Outside?in / Optical Tracking Hybrid Tracking (Sensor Fusion) Others |

| By Connectivity | Wired Wireless (Wi?Fi) G?enabled Others |

| By Price Range | Entry?level / Consumer Mid?range Professional / Enterprise?grade Ultra?premium |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Consumer Electronics Retailers | 120 | Store Managers, Sales Representatives |

| Educational Institutions Using Mixed Reality | 70 | IT Coordinators, Curriculum Developers |

| Corporate Training Departments | 55 | Training Managers, HR Directors |

| Gaming Industry Stakeholders | 85 | Game Developers, Marketing Managers |

| Healthcare Providers Implementing Mixed Reality | 45 | Medical Professionals, IT Specialists |

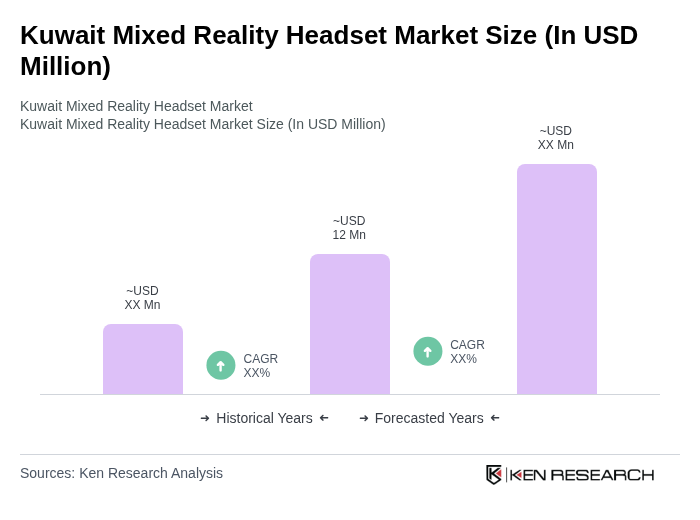

The Kuwait Mixed Reality Headset Market is valued at approximately USD 12 million, reflecting a five-year historical analysis. This growth is driven by the increasing adoption of mixed reality technologies across various sectors, including gaming, healthcare, and education.