Region:Middle East

Author(s):Dev

Product Code:KRAA8407

Pages:87

Published On:November 2025

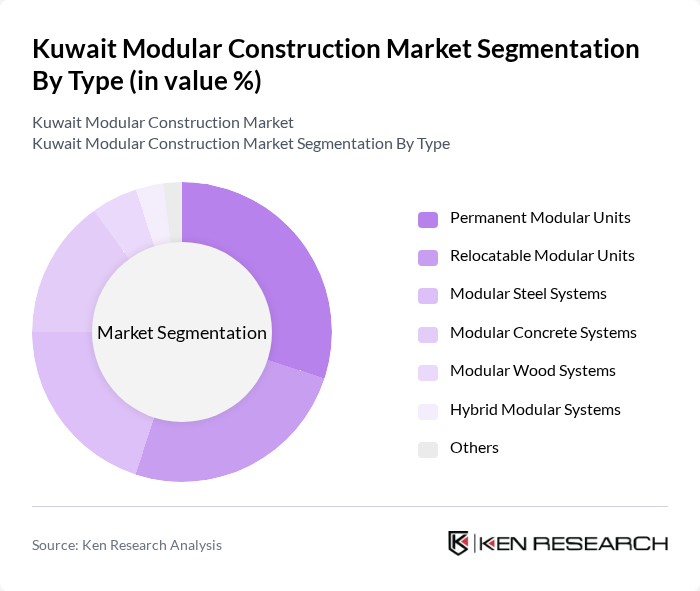

By Type:The modular construction market can be segmented into various types, including Permanent Modular Units, Relocatable Modular Units, Modular Steel Systems, Modular Concrete Systems, Modular Wood Systems, Hybrid Modular Systems, and Others. Each type serves different construction needs and preferences, with specific advantages in terms of design flexibility, cost, and application. Research indicates that fiberglass modular blocks consume more cooling energy than concrete buildings in Kuwait's hyper-arid climate, pushing designers to integrate advanced insulation and reflective façades.

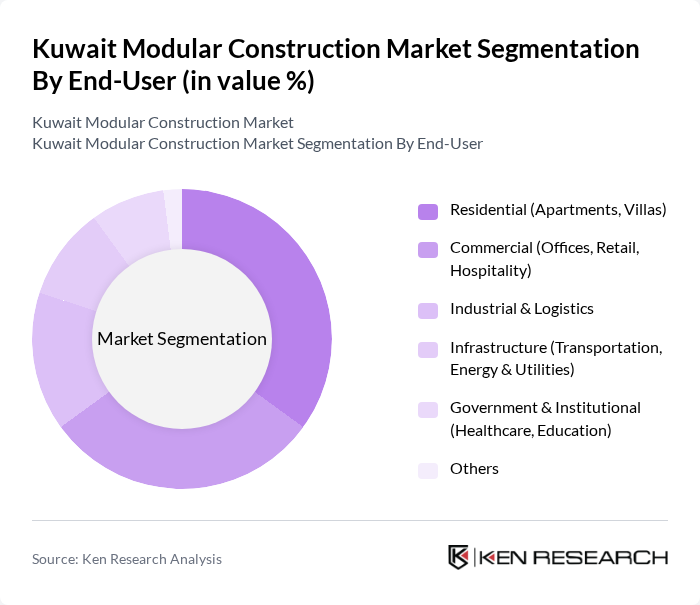

By End-User:The end-user segmentation includes Residential (Apartments, Villas), Commercial (Offices, Retail, Hospitality), Industrial & Logistics, Infrastructure (Transportation, Energy & Utilities), Government & Institutional (Healthcare, Education), and Others. Each segment reflects the diverse applications of modular construction across different sectors, catering to specific needs and preferences. Residential construction retained the largest slice of the Kuwait construction market at 35% in 2024, powered by an acute housing backlog and welfare grants that subsidize land and mortgages for nationals.

The Kuwait Modular Construction Market is characterized by a dynamic mix of regional and international players. Leading participants such as Alghanim International, United Building Company (UBC), SSH Design, KEO International Consultants, NBK Contracting Company, Al Hani Construction & Trading Company, Combined Group Contracting Company, Al Mulla Group, Alghanim Engineering, Limak Insaat Kuwait SPC, Al Dhow Engineering, Al Ahmadiah Contracting & Trading Co., Alghanim Industries, Al Ghanim & Nass General Trading & Contracting, Kharafi National contribute to innovation, geographic expansion, and service delivery in this space.

The future of the modular construction market in Kuwait appears promising, driven by increasing government support and a growing emphasis on sustainability. As the demand for affordable housing continues to rise, modular solutions are expected to play a crucial role in meeting these needs. Additionally, advancements in technology will likely enhance efficiency and customization, making modular construction more appealing to a wider range of stakeholders. The market is poised for significant growth as these trends unfold, creating new opportunities for innovation and collaboration.

| Segment | Sub-Segments |

|---|---|

| By Type | Permanent Modular Units Relocatable Modular Units Modular Steel Systems Modular Concrete Systems Modular Wood Systems Hybrid Modular Systems Others |

| By End-User | Residential (Apartments, Villas) Commercial (Offices, Retail, Hospitality) Industrial & Logistics Infrastructure (Transportation, Energy & Utilities) Government & Institutional (Healthcare, Education) Others |

| By Region | Capital Governorate Hawalli Governorate Al Ahmadi Governorate Farwaniya Governorate Mubarak Al-Kabeer Governorate Jahra Governorate Others |

| By Technology | Modular Steel Construction Modular Wood Construction Modular Concrete Construction Hybrid Modular Construction Others |

| By Application | New Construction Renovation Maintenance Others |

| By Investment Source | Domestic Investment Foreign Direct Investment (FDI) Public-Private Partnerships (PPP) Government Schemes Others |

| By Policy Support | Subsidies for Modular Construction Tax Exemptions for Sustainable Practices Regulatory Support for Modular Approvals Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Residential Modular Construction | 100 | Architects, Project Managers |

| Commercial Modular Projects | 70 | Construction Firm Executives, Developers |

| Industrial Modular Solutions | 50 | Operations Managers, Facility Planners |

| Regulatory Compliance in Modular Construction | 40 | Regulatory Officials, Compliance Officers |

| Market Trends and Innovations | 60 | Industry Analysts, Technology Experts |

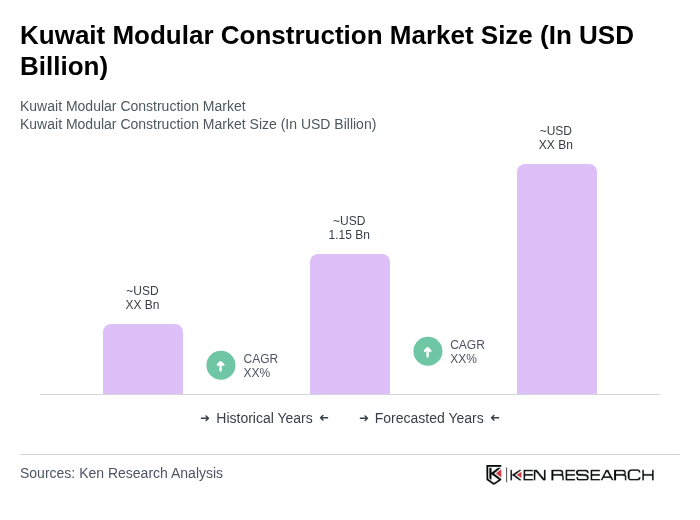

The Kuwait Modular Construction Market is valued at approximately USD 1.15 billion, reflecting a significant growth trend driven by urbanization, government initiatives, and the demand for efficient construction methods.