Region:North America

Author(s):Shubham

Product Code:KRAD0617

Pages:89

Published On:August 2025

By Type:The commercial construction market can be segmented into various types, including office buildings, retail and mixed-use developments, hospitality and entertainment facilities, institutional buildings, industrial and logistics spaces, restaurants and foodservice establishments, and sports and recreational facilities. Each of these segments plays a crucial role in shaping the overall market landscape, driven by specific consumer needs and industry trends. Recent activity has favored industrial/logistics, data centers, and institutional builds, while office has shifted toward renovations and adaptive reuse amid elevated vacancy rates.

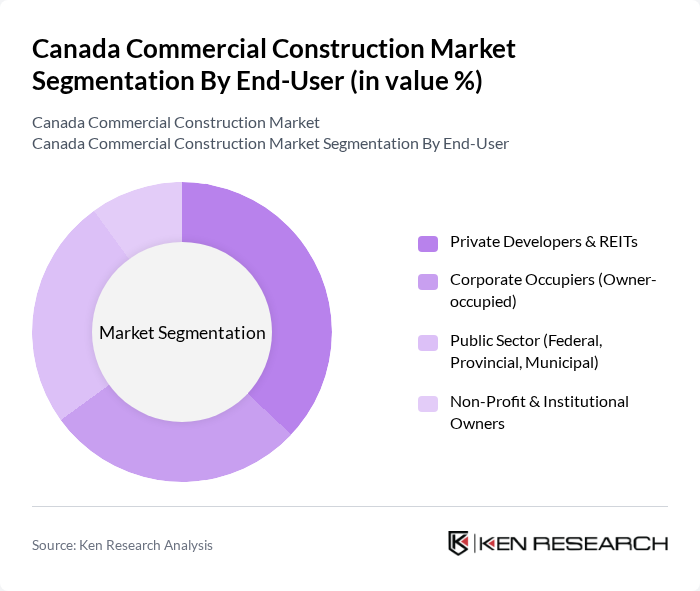

By End-User:The end-user segmentation of the commercial construction market includes private developers and REITs, corporate occupiers, public sector entities, and non-profit and institutional owners. Each of these end-users has distinct requirements and motivations that influence their construction projects, from investment returns to community service. Institutional and public-sector pipelines have remained resilient due to funded health/education builds and transit-oriented community investments, while private capital has increasingly targeted logistics and select experiential retail/mixed-use.

The Canada Commercial Construction Market is characterized by a dynamic mix of regional and international players. Leading participants such as PCL Constructors Inc., EllisDon Corporation, Ledcor Group, Aecon Group Inc., Graham Group Ltd. (Graham Construction), Bird Construction Inc., Kiewit Canada Group, Pomerleau Inc., Broccolini Construction Inc., Maple Reinders Constructors Ltd., Chandos Construction Ltd., Flynn Group of Companies, Stuart Olson Inc. (a Bird company), Turner Construction Company (Canada), Flatiron Construction Canada Ltd. contribute to innovation, geographic expansion, and service delivery in this space. Recent industry drivers include transit megaprojects, hospital and education builds, industrial/logistics hubs, and green building programs that emphasize electrification, mass timber, and low-carbon materials.

The future of the Canadian commercial construction market appears promising, driven by ongoing infrastructure investments and urbanization trends. As cities expand, the demand for innovative construction solutions will grow, particularly in sustainable and smart building technologies. The integration of digital tools and advanced construction methods will enhance project efficiency. However, addressing labor shortages and material costs will be crucial for sustaining growth. Overall, the market is poised for transformation, with opportunities for innovation and collaboration across sectors.

| Segment | Sub-Segments |

|---|---|

| By Type | Office Buildings (Class A, B, C) Retail & Mixed-Use (Malls, Power Centres, High Street) Hospitality & Entertainment (Hotels, Convention, Cinemas) Institutional (Healthcare, Education, Government) Industrial & Logistics (Warehouses, Fulfillment, Light Mfg.) Restaurants & Foodservice Sports & Recreational Facilities |

| By End-User | Private Developers & REITs Corporate Occupiers (Owner-occupied) Public Sector (Federal, Provincial, Municipal) Non-Profit & Institutional Owners |

| By Project Size | Small Scale Projects (? CAD 25 million) Medium Scale Projects (CAD 25–150 million) Large Scale Projects (? CAD 150 million) |

| By Construction Method | Design-Bid-Build (Traditional) Design-Build Construction Management (CM at Risk/Agency) Modular/Prefabricated Construction |

| By Financing Source | Private Equity & Debt (Banks, Project Finance) Government Funding & PPP REITs & Pension Funds Owner Equity |

| By Geographic Distribution | Ontario Quebec British Columbia Alberta Prairies & Atlantic Canada |

| By Sustainability Certification | LEED (Canada Green Building Council) Zero Carbon Building (ZCB) Standard Green Globes (GBI Canada) WELL/Fitwel (Health & Wellness) |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Commercial Office Construction | 120 | Project Managers, Construction Executives |

| Retail Space Development | 100 | Architects, Real Estate Developers |

| Industrial Facility Projects | 80 | Operations Managers, Facility Planners |

| Public Infrastructure Initiatives | 70 | Government Officials, Urban Planners |

| Green Building Projects | 60 | Sustainability Consultants, Engineers |

The Canada Commercial Construction Market is valued at approximately CAD 9095 billion. This figure is based on a five-year analysis of total construction output, highlighting the significant share of non-residential and commercial activities within the sector.