Region:Middle East

Author(s):Rebecca

Product Code:KRAC8607

Pages:94

Published On:November 2025

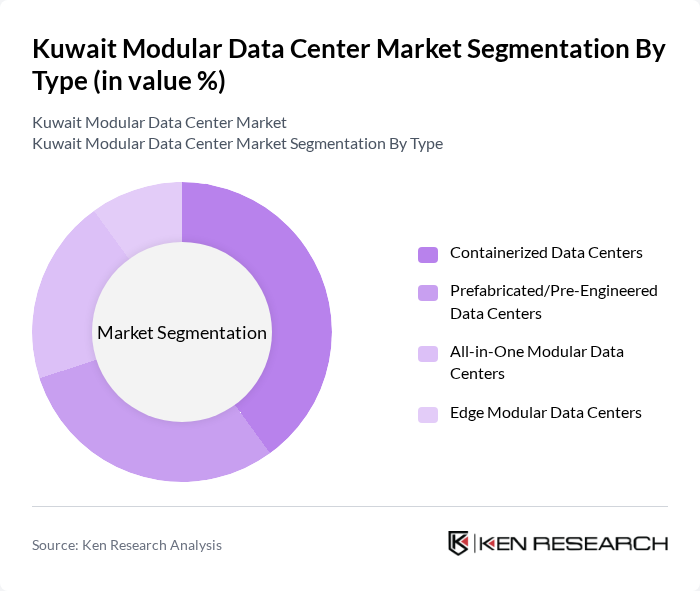

By Type:The modular data center market can be segmented into four main types: Containerized Data Centers, Prefabricated/Pre-Engineered Data Centers, All-in-One Modular Data Centers, and Edge Modular Data Centers. Among these,Containerized Data Centersare gaining traction due to their flexibility and rapid deployment, making them particularly appealing for businesses seeking quick scalability.Prefabricated/Pre-Engineered Data Centersare also widely adopted, offering reduced construction time and cost efficiencies.Edge Modular Data Centersare emerging as critical infrastructure to support IoT and edge computing applications, especially in urban and remote locations where low latency is essential.

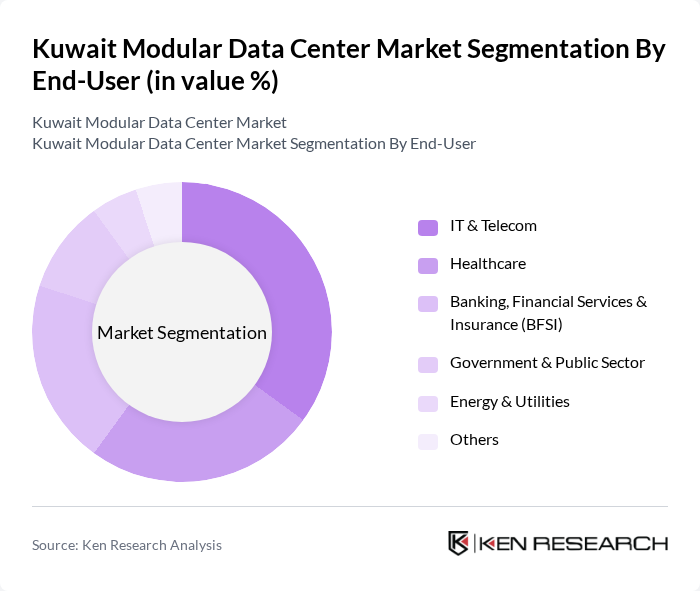

By End-User:The end-user segmentation includes IT & Telecom, Healthcare, Banking, Financial Services & Insurance (BFSI), Government & Public Sector, Energy & Utilities, and Others. TheIT & Telecomsector is the leading end-user, driven by the increasing demand for data storage, processing, and network expansion. TheHealthcaresector is experiencing rapid growth due to the need for secure, scalable, and compliant data management solutions.BFSIorganizations are increasingly adopting modular data centers to enhance operational efficiency, ensure regulatory compliance, and strengthen data security frameworks.

The Kuwait Modular Data Center Market is characterized by a dynamic mix of regional and international players. Leading participants such as Gulf Data Hub, Zain Group, KEMS Zajil Telecom, Ooredoo Kuwait, stc Kuwait, Agility Public Warehousing Company, Khazna Data Centers, Equinix, Schneider Electric, Huawei Technologies, Dell Technologies, IBM, Vertiv, NTT Global Data Centers, Digital Realty, ZEUUS, CyrusOne, Rackspace Technology, Interxion, Atos contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Kuwait modular data center market appears promising, driven by technological advancements and increasing digitalization. As businesses continue to embrace digital transformation, the demand for flexible and scalable data solutions will rise. Furthermore, the integration of AI and machine learning technologies is expected to enhance operational efficiency. With government support for infrastructure development, the market is poised for significant growth, fostering innovation and attracting investments in the coming years.

| Segment | Sub-Segments |

|---|---|

| By Type | Containerized Data Centers Prefabricated/Pre-Engineered Data Centers All-in-One Modular Data Centers Edge Modular Data Centers |

| By End-User | IT & Telecom Healthcare Banking, Financial Services & Insurance (BFSI) Government & Public Sector Energy & Utilities Others |

| By Deployment Model | On-Premises Colocation/Hosted Hybrid |

| By Cooling Method | Air-Cooled Liquid-Cooled Direct-to-Chip Cooling Others |

| By Power Capacity | Up to 500 kW kW to 1 MW Above 1 MW |

| By Service Type | Managed Services Professional Services Support & Maintenance |

| By Industry Vertical | Government Education Retail Oil & Gas Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Enterprise IT Infrastructure | 60 | IT Managers, CTOs, Infrastructure Architects |

| Modular Data Center Providers | 40 | Sales Directors, Product Managers, Technical Engineers |

| Telecommunications Sector | 45 | Network Operations Managers, Data Center Managers |

| Government and Regulatory Bodies | 40 | Policy Makers, Regulatory Affairs Managers |

| Cloud Service Providers | 50 | Cloud Architects, Business Development Managers |

The Kuwait Modular Data Center Market is valued at approximately USD 160 million, driven by the increasing demand for efficient data storage solutions, cloud computing, and scalable infrastructure to support digital transformation initiatives across various sectors.