Region:Middle East

Author(s):Dev

Product Code:KRAC1954

Pages:86

Published On:October 2025

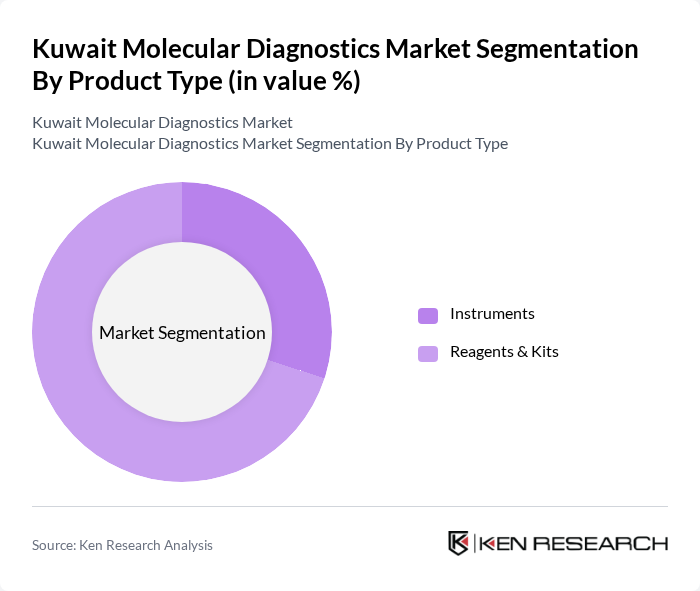

By Product Type:

The product type segmentation of the market includes Instruments and Reagents & Kits. Among these, Reagents & Kits dominate the market due to their essential role in molecular testing procedures. The increasing demand for accurate and rapid diagnostic results, particularly in clinical laboratories, has led to a surge in the use of various reagents and kits. Instruments, while crucial, are often seen as complementary to the reagents, which are the primary consumables in molecular diagnostics.

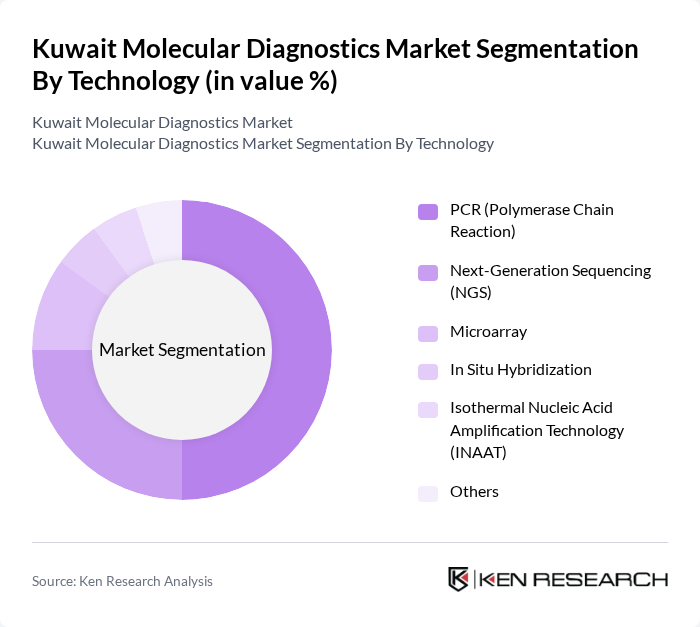

By Technology:

The technology segmentation includes PCR (Polymerase Chain Reaction), Next-Generation Sequencing (NGS), Microarray, In Situ Hybridization, Isothermal Nucleic Acid Amplification Technology (INAAT), and Others. PCR technology leads the market due to its widespread application in various diagnostic tests, including infectious diseases and genetic testing. Its reliability, speed, and cost-effectiveness make it the preferred choice among healthcare providers, while NGS is gaining traction for its ability to provide comprehensive genomic information, particularly in oncology and personalized medicine.

The Kuwait Molecular Diagnostics Market is characterized by a dynamic mix of regional and international players. Leading participants such as Roche Diagnostics, Abbott Laboratories, Qiagen N.V., Danaher Corporation, Bio-Rad Laboratories Inc., Agilent Technologies Inc., bioMérieux SA, Bayer AG, Nova Biomedical, Nipro Corporation, OraSure Technologies Inc., Mylab Discovery Solutions, AstraGene, HealthTec Logix, Abaxis (Zoetis) contribute to innovation, geographic expansion, and service delivery in this space.

The future of the molecular diagnostics market in Kuwait appears promising, driven by ongoing technological advancements and increasing healthcare investments. The government is expected to enhance healthcare infrastructure, facilitating the integration of innovative diagnostic solutions. Additionally, the growing trend of telemedicine is likely to expand access to molecular diagnostics, allowing for remote testing and consultations. As awareness increases, the adoption of these technologies will likely accelerate, improving patient outcomes and overall healthcare efficiency.

| Segment | Sub-Segments |

|---|---|

| By Product Type | Instruments Reagents & Kits |

| By Technology | PCR (Polymerase Chain Reaction) Next-Generation Sequencing (NGS) Microarray In Situ Hybridization Isothermal Nucleic Acid Amplification Technology (INAAT) Others |

| By Application | Infectious Diseases Oncology Genetic Testing Prenatal Testing Hematology Endocrinology Others |

| By End-User | Hospitals Diagnostic Laboratories Research Institutions Point-of-Care Settings Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Clinical Laboratories | 65 | Laboratory Managers, Clinical Pathologists |

| Hospitals and Healthcare Providers | 55 | Healthcare Administrators, Medical Directors |

| Diagnostic Equipment Suppliers | 45 | Sales Managers, Product Specialists |

| Research Institutions | 40 | Research Scientists, Lab Technicians |

| Regulatory Bodies | 30 | Policy Makers, Regulatory Affairs Specialists |

The Kuwait Molecular Diagnostics Market is valued at approximately USD 20 million, reflecting a significant growth driven by the increasing prevalence of chronic diseases, advancements in diagnostic technologies, and a heightened focus on personalized medicine.