Region:Middle East

Author(s):Dev

Product Code:KRAD3239

Pages:92

Published On:November 2025

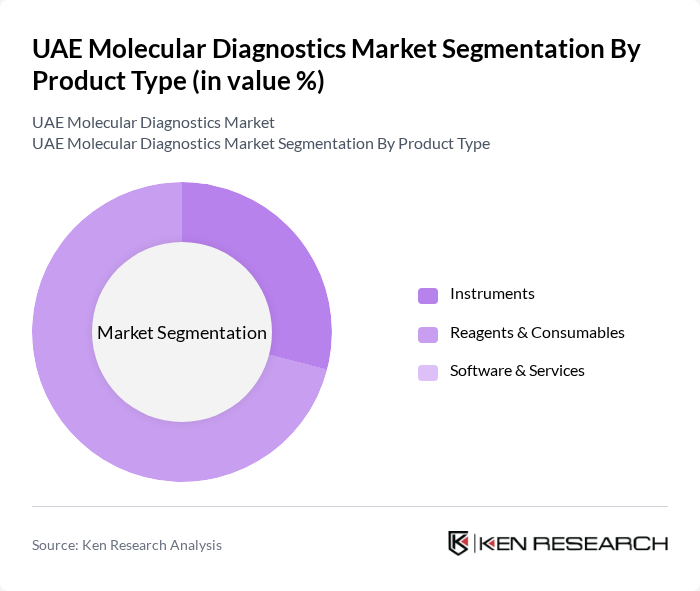

By Product Type:The product type segmentation includes Instruments, Reagents & Consumables, and Software & Services. Among these, Reagents & Consumables dominate the market due to their essential role in molecular testing processes. The increasing number of diagnostic tests being conducted, particularly in hospitals and laboratories, drives the demand for these consumables. As healthcare providers focus on improving diagnostic accuracy and efficiency, the need for high-quality reagents continues to rise, making this sub-segment a critical component of the market. Reagents represented the largest segment with a revenue share of approximately 71 percent in 2024.

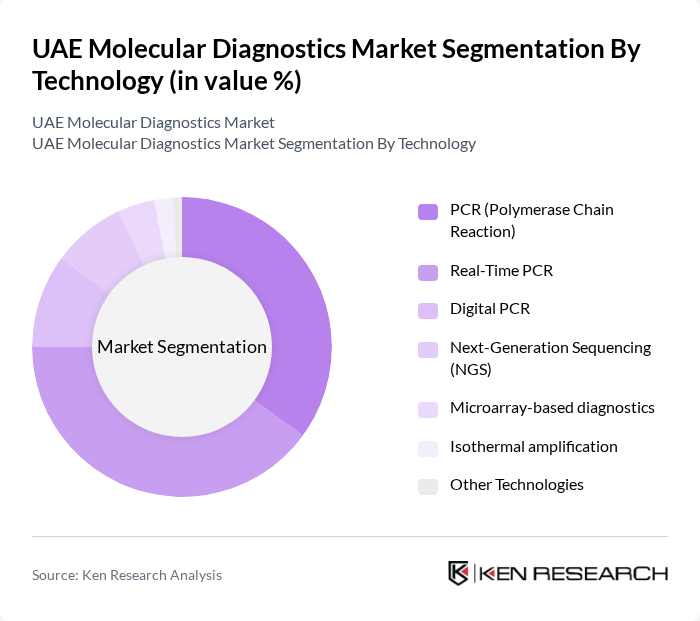

By Technology:The technology segmentation encompasses PCR (Polymerase Chain Reaction), Real-Time PCR, Digital PCR, Next-Generation Sequencing (NGS), Microarray-based diagnostics, Isothermal amplification, and Other Technologies. PCR technologies, particularly Real-Time PCR, are leading the market due to their widespread application in infectious disease diagnostics and genetic testing. The ability to provide rapid and accurate results has made these technologies indispensable in clinical settings, especially during health crises like the COVID-19 pandemic. PCR remains the largest technology segment in the UAE molecular diagnostics services market, with infectious diseases representing the largest application area in point-of-care molecular diagnostics.

The UAE Molecular Diagnostics Market is characterized by a dynamic mix of regional and international players. Leading participants such as Roche Diagnostics Middle East, Abbott Laboratories, Siemens Healthineers, Thermo Fisher Scientific, QIAGEN, Bio-Rad Laboratories, Agilent Technologies, Hologic, PerkinElmer, Illumina, BGI Genomics, Cepheid, Luminex Corporation, Mylab Discovery Solutions, Al Borg Diagnostics, National Reference Laboratory (NRL), Unilabs Middle East, Life Technologies (now part of Thermo Fisher Scientific) contribute to innovation, geographic expansion, and service delivery in this space.

The future of the UAE molecular diagnostics market appears promising, driven by ongoing advancements in technology and increasing healthcare investments. The integration of artificial intelligence in diagnostic processes is expected to enhance accuracy and efficiency, while the expansion of telemedicine will facilitate remote diagnostics. Furthermore, the UAE's strategic initiatives to bolster healthcare infrastructure will likely create a conducive environment for innovation, ultimately improving patient outcomes and accessibility to advanced diagnostic solutions.

| Segment | Sub-Segments |

|---|---|

| By Product Type | Instruments Reagents & Consumables Software & Services |

| By Technology | PCR (Polymerase Chain Reaction) Real-Time PCR Digital PCR Next-Generation Sequencing (NGS) Microarray-based diagnostics Isothermal amplification Other Technologies |

| By Application | Infectious Disease Diagnostics Oncology (Cancer) Diagnostics Genetic Testing Prenatal Testing Other Applications |

| By End-User | Hospitals & Clinics Diagnostic Laboratories & Centers Research & Academic Institutes Home Care Settings Others |

| By Sample Type | Blood Samples Tissue Samples Saliva Samples Urine Samples Other Sample Types |

| By Distribution Channel | Direct Sales Distributors Online Sales Others |

| By Region | Abu Dhabi Dubai Sharjah Ajman Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Clinical Laboratories | 70 | Laboratory Managers, Clinical Pathologists |

| Healthcare Providers | 60 | Physicians, Medical Directors |

| Diagnostic Equipment Suppliers | 40 | Sales Managers, Product Specialists |

| Regulatory Bodies | 40 | Policy Makers, Compliance Officers |

| Research Institutions | 50 | Research Scientists, Academic Professors |

The UAE Molecular Diagnostics Market is valued at approximately USD 157 million, driven by technological advancements, the rising prevalence of infectious diseases, and a growing focus on personalized medicine, particularly highlighted during the COVID-19 pandemic.