Region:Middle East

Author(s):Rebecca

Product Code:KRAC3916

Pages:85

Published On:October 2025

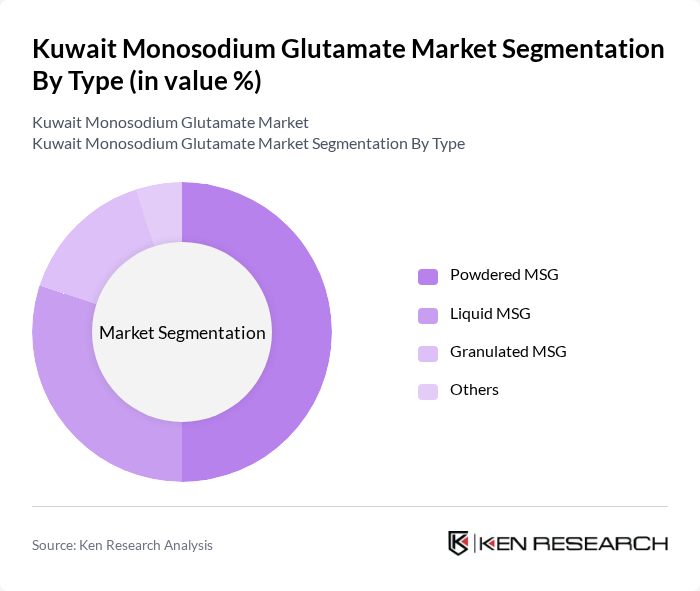

By Type:The market is segmented into various types of Monosodium Glutamate, including Powdered MSG, Liquid MSG, Granulated MSG, and Others. Powdered MSG remains the most widely used form due to its versatility and ease of use in various culinary applications across Kuwait's expanding processed food sector, which includes high-growth categories such as ready meals, instant noodles, and snack foods. Liquid MSG is gaining significant traction, particularly in the foodservice sector where quick-service restaurants account for 62% of all outlets, as it is preferred for its quick dissolving properties and ease of incorporation into large-scale food preparation. Granulated MSG and other forms are used less frequently but still contribute to the overall market, particularly in specialty seasonings and industrial food processing applications.

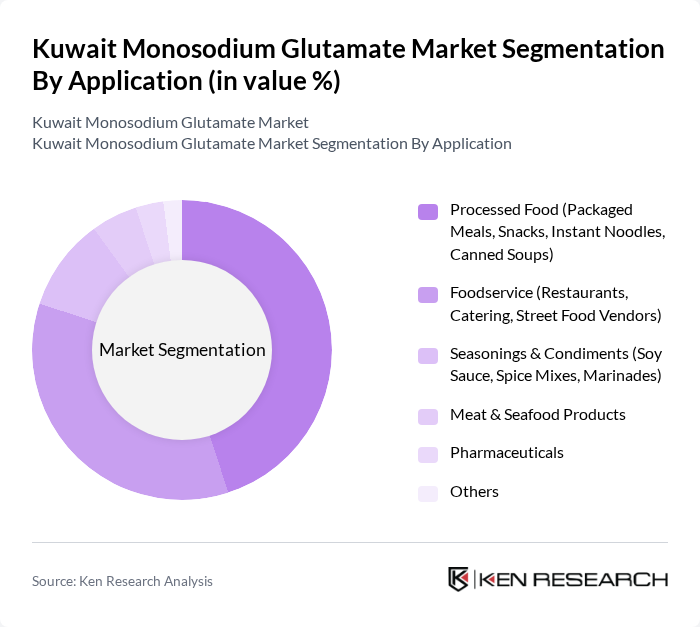

By Application:The applications of Monosodium Glutamate are diverse, including processed food, foodservice, seasonings & condiments, meat & seafood products, pharmaceuticals, and others. The processed food segment, particularly packaged meals, snacks, and instant noodles, dominates the market due to the increasing consumer demand for convenience foods, supported by Kuwait's packaged food market reaching USD 4 billion in 2024. The foodservice sector is also significant, driven by the growing number of restaurants and catering services that utilize MSG to enhance flavor, with the foodservice market valued at USD 3.54 billion in 2025. The expansion of cloud kitchens, projected to grow at approximately 14% annually, and the dominance of meat-based cuisines in quick-service restaurants have further strengthened MSG demand in foodservice applications. The seasonings and condiments segment benefits from growing demand for sauces, dips, and spice mixes, which are forecast as high-growth products.

The Kuwait Monosodium Glutamate market is characterized by a dynamic mix of regional and international players. Leading participants such as Ajinomoto Co., Inc., Fufeng Group Company Limited, Meihua Holdings Group Co., Ltd., CJ CheilJedang Corp., Tate & Lyle PLC contribute to innovation, geographic expansion, and service delivery in this space.

The future of the monosodium glutamate market in Kuwait appears promising, driven by evolving consumer preferences and industry innovations. As the food and beverage sector continues to expand, the demand for MSG is expected to rise, particularly in processed and convenience foods. Additionally, the trend towards clean label products may encourage manufacturers to explore MSG alternatives while maintaining flavor quality. Strategic partnerships and investments in research and development will be crucial for adapting to these market dynamics and consumer expectations.

| Segment | Sub-Segments |

|---|---|

| By Type | Powdered MSG Liquid MSG Granulated MSG Others |

| By Application | Processed Food (Packaged Meals, Snacks, Instant Noodles, Canned Soups) Foodservice (Restaurants, Catering, Street Food Vendors) Seasonings & Condiments (Soy Sauce, Spice Mixes, Marinades) Meat & Seafood Products Pharmaceuticals Others |

| By End-User | Commercial Food Producers HoReCa (Hotels, Restaurants, Catering) Household Users Others |

| By Distribution Channel | Direct Sales Online Retail (Company Websites, E-Commerce Platforms) Supermarkets/Hypermarkets Traditional Trade (Convenience Stores, Grocery Stores) Others |

| By Packaging Type | Bulk Packaging Retail Packaging Eco-friendly Packaging Others |

| By Price Range | Economy Mid-range Premium Others |

| By Brand | Local Brands International Brands Private Labels Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Food Manufacturing Sector | 80 | Production Managers, Quality Control Officers |

| Retail Food Outlets | 65 | Store Managers, Purchasing Agents |

| Consumer Insights | 120 | General Consumers, Health-Conscious Shoppers |

| Food Service Industry | 60 | Restaurant Owners, Chefs |

| Health and Nutrition Experts | 45 | Dietitians, Food Scientists |

The Kuwait Monosodium Glutamate market is valued at approximately USD 155 million, driven by the increasing demand for flavor enhancers in processed foods and the foodservice sector, which is projected to grow significantly in the coming years.