Region:Middle East

Author(s):Rebecca

Product Code:KRAD6190

Pages:100

Published On:December 2025

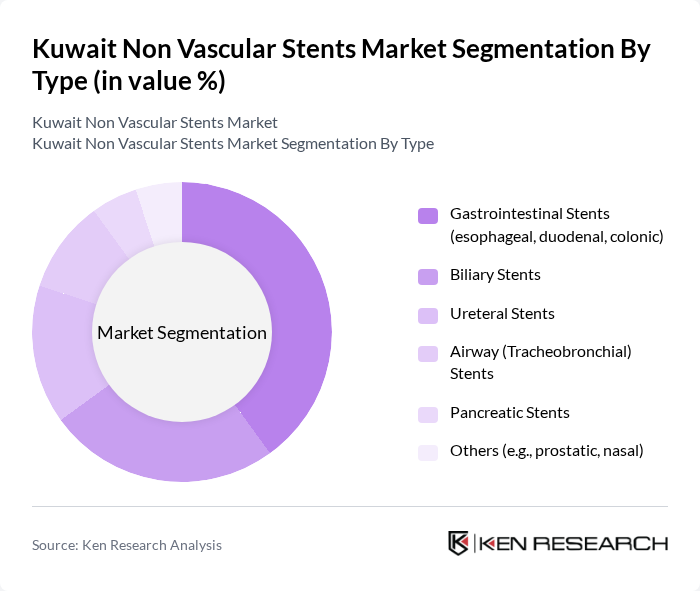

By Type:The market is segmented into various types of non-vascular stents, including gastrointestinal stents, biliary stents, ureteral stents, airway stents, pancreatic stents, and others. Among these, gastrointestinal stents, which include esophageal, duodenal, and colonic stents, dominate the market due to the rising incidence of gastrointestinal disorders and the increasing preference for minimally invasive procedures. The demand for biliary and ureteral stents is also significant, driven by the growing prevalence of biliary obstructions and urological conditions.

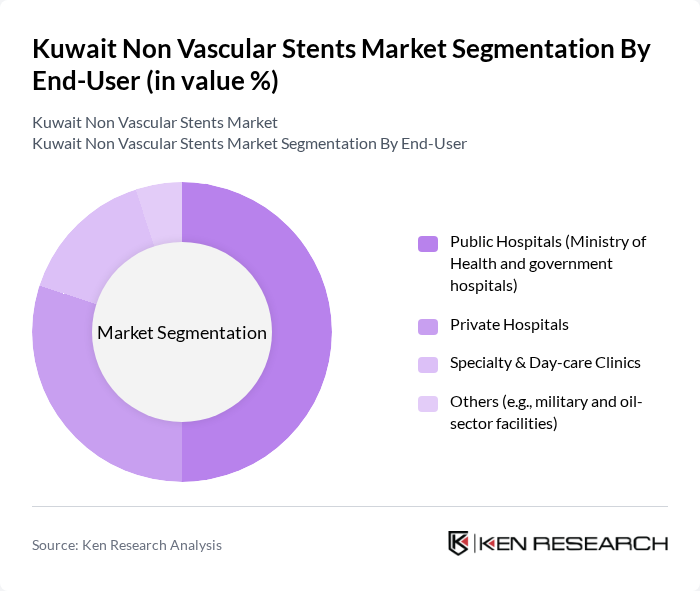

By End-User:The end-user segmentation includes public hospitals, private hospitals, specialty and day-care clinics, and others. Public hospitals, particularly those operated by the Ministry of Health, are the leading end-users due to their extensive patient base and government support for healthcare services. Private hospitals are also significant players, catering to patients seeking advanced medical treatments. Specialty clinics focusing on specific conditions further contribute to the market's growth.

The Kuwait Non Vascular Stents Market is characterized by a dynamic mix of regional and international players. Leading participants such as Boston Scientific Corporation, Cook Medical LLC, Olympus Corporation, Taewoong Medical Co., Ltd., Merit Medical Systems, Inc., Becton, Dickinson and Company (BD), CONMED Corporation, Medtronic plc, Teleflex Incorporated, S&G Biotech Inc., Micro-Tech (Nanjing) Co., Ltd., Endo-Flex GmbH, ENDO-FLEX Middle East / local GCC distributor partners, Local Kuwaiti & GCC Distributors (e.g., Gulf Medical Co., Al Essa Medical & Scientific Equipment Co.), Other Emerging Regional Manufacturers Supplying Kuwait contribute to innovation, geographic expansion, and service delivery in this space.

The future of the non-vascular stents market in Kuwait appears promising, driven by increasing healthcare investments and technological advancements. As the government continues to enhance healthcare infrastructure, the accessibility of stenting procedures is expected to improve. Furthermore, the integration of digital health solutions and telemedicine for follow-up care will likely enhance patient management and satisfaction, fostering a more robust market environment. The focus on patient-centric care will also drive innovation in stent technologies, ensuring better outcomes for patients.

| Segment | Sub-Segments |

|---|---|

| By Type | Gastrointestinal Stents (esophageal, duodenal, colonic) Biliary Stents Ureteral Stents Airway (Tracheobronchial) Stents Pancreatic Stents Others (e.g., prostatic, nasal) |

| By End-User | Public Hospitals (Ministry of Health and government hospitals) Private Hospitals Specialty & Day-care Clinics Others (e.g., military and oil-sector facilities) |

| By Material | Metallic Stents (stainless steel, nitinol) Polymer / Plastic Stents (polyurethane, silicone, polyethylene) Fully Covered & Partially Covered Stents Biodegradable / Bioabsorbable Stents |

| By Application | Gastrointestinal Obstruction & Strictures Biliary Obstruction Urological Obstruction (ureteral, urethral) Airway Obstruction Pancreatic & Other Indications |

| By Distribution Channel | Direct Tendering to Public Hospitals Local Medical Device Distributors / Importers Direct Sales to Private Hospitals & Clinics Others |

| By Region | Al Asimah (Kuwait City) Governorate Hawalli & Farwaniya Governorates Al Ahmadi & Mubarak Al-Kabeer Governorates Al Jahra Governorate |

| By Patient Demographics | Age Group Gender Comorbidities (e.g., diabetes, CKD, cancer) Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Cardiology Departments in Hospitals | 60 | Cardiologists, Interventional Radiologists |

| Healthcare Procurement Units | 50 | Procurement Managers, Supply Chain Coordinators |

| Medical Device Distributors | 40 | Sales Managers, Product Specialists |

| Patient Advocacy Groups | 40 | Patient Representatives, Healthcare Advocates |

| Regulatory Bodies | 40 | Regulatory Affairs Specialists, Compliance Officers |

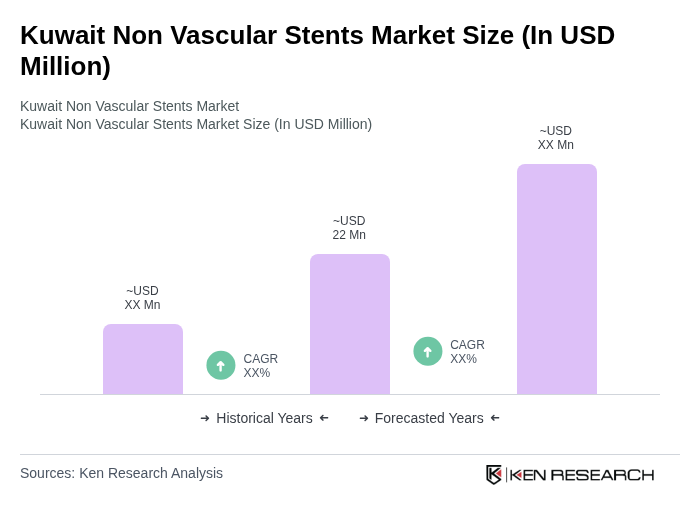

The Kuwait Non Vascular Stents Market is valued at approximately USD 22 million, reflecting a five-year historical analysis. This growth is attributed to the rising prevalence of chronic diseases and advancements in medical technology.