Region:Middle East

Author(s):Shubham

Product Code:KRAA8822

Pages:99

Published On:November 2025

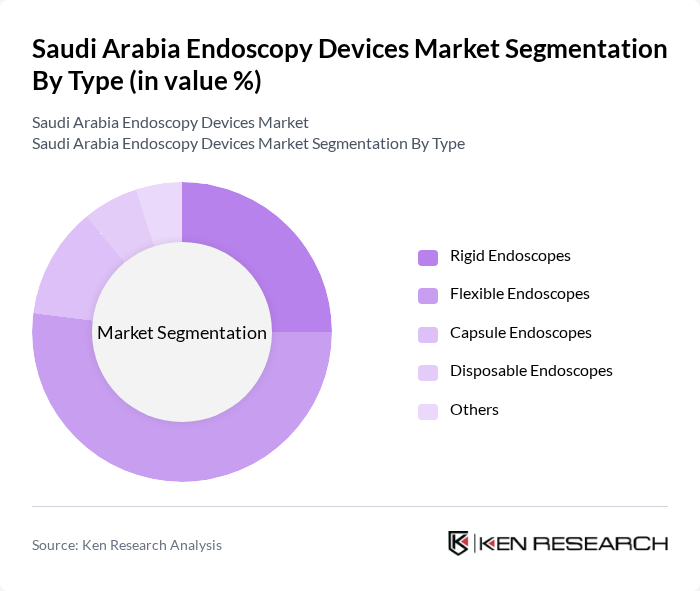

By Type:The endoscopy devices market is segmented into various types, including rigid endoscopes, flexible endoscopes, capsule endoscopes, disposable endoscopes, and others. Flexible endoscopes are the most widely used due to their versatility and ability to navigate complex anatomical structures, capturing over half of the market share. Rigid endoscopes remain essential for surgical precision, especially in orthopedics and ENT. Capsule endoscopes are gaining traction for non-invasive gastrointestinal diagnostics, while disposable endoscopes are increasingly adopted to reduce infection risk and support infection control protocols.

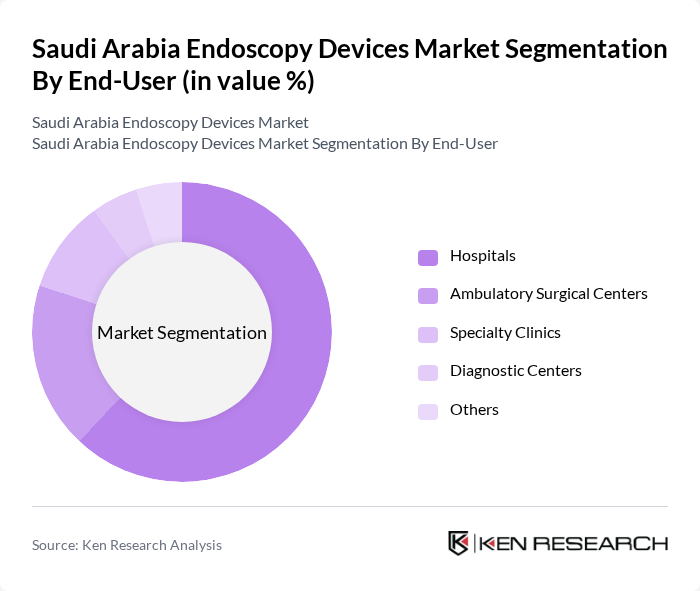

By End-User:The endoscopy devices market is categorized by end-users, including hospitals, ambulatory surgical centers, specialty clinics, diagnostic centers, and others. Hospitals are the primary end-users, accounting for the largest market share due to comprehensive facilities, high patient volumes, and the ability to perform advanced procedures. Ambulatory surgical centers are rapidly adopting endoscopic technologies for outpatient and day-care procedures. Specialty clinics and diagnostic centers are expanding their endoscopy offerings, contributing to the market’s growth.

The Saudi Arabia Endoscopy Devices Market is characterized by a dynamic mix of regional and international players. Leading participants such as Olympus Corporation, Medtronic plc, Boston Scientific Corporation, Stryker Corporation, KARL STORZ SE & Co. KG, FUJIFILM Holdings Corporation, HOYA Corporation (PENTAX Medical), CONMED Corporation, Ambu A/S, Richard Wolf GmbH, Cook Medical LLC, B. Braun Melsungen AG, Teleflex Incorporated, Medline Industries, LP, Smith & Nephew plc contribute to innovation, geographic expansion, and service delivery in this space.

The future of the endoscopy devices market in Saudi Arabia appears promising, driven by ongoing technological advancements and increasing healthcare investments. The integration of artificial intelligence in endoscopic procedures is expected to enhance diagnostic capabilities significantly. Additionally, the expansion of healthcare facilities, particularly in underserved regions, will facilitate greater access to endoscopic services. As the government continues to prioritize healthcare infrastructure, the market is poised for substantial growth, addressing both patient needs and technological demands.

| Segment | Sub-Segments |

|---|---|

| By Type | Rigid Endoscopes Flexible Endoscopes Capsule Endoscopes Disposable Endoscopes Others |

| By End-User | Hospitals Ambulatory Surgical Centers Specialty Clinics Diagnostic Centers Others |

| By Application | Gastroenterology (Gastroscopy, Colonoscopy) Laparoscopy Arthroscopy Urology Endoscopy Bronchoscopy Laryngoscopy Otoscopy Cardiology (e.g., TEE, EVH) Gynecology Others |

| By Region | Central Region (Riyadh and surroundings) Eastern Region (Dammam, Al Khobar) Western Region (Jeddah, Makkah) Southern Region (Abha, Jazan) Northern Region |

| By Device Type | Endoscopes Visualization Systems Accessories Surgical Instruments Others |

| By Distribution Channel | Direct Sales Distributors Online Sales Others |

| By Technology | Digital Endoscopy Traditional Endoscopy Robotic Endoscopy AI-Assisted Endoscopy Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Gastroenterology Departments | 100 | Consultants, Surgeons, and Medical Directors |

| Hospital Procurement Teams | 60 | Procurement Managers, Supply Chain Officers |

| Medical Device Distributors | 40 | Sales Managers, Product Specialists |

| Healthcare Policy Makers | 40 | Health Economists, Regulatory Affairs Managers |

| Endoscopy Device Users | 50 | Healthcare Practitioners, Nurses, Technicians |

The Saudi Arabia Endoscopy Devices Market is valued at approximately USD 465 million, driven by the rising prevalence of chronic diseases, advancements in technology, and a focus on minimally invasive surgical procedures.