Region:Middle East

Author(s):Geetanshi

Product Code:KRAD4795

Pages:95

Published On:December 2025

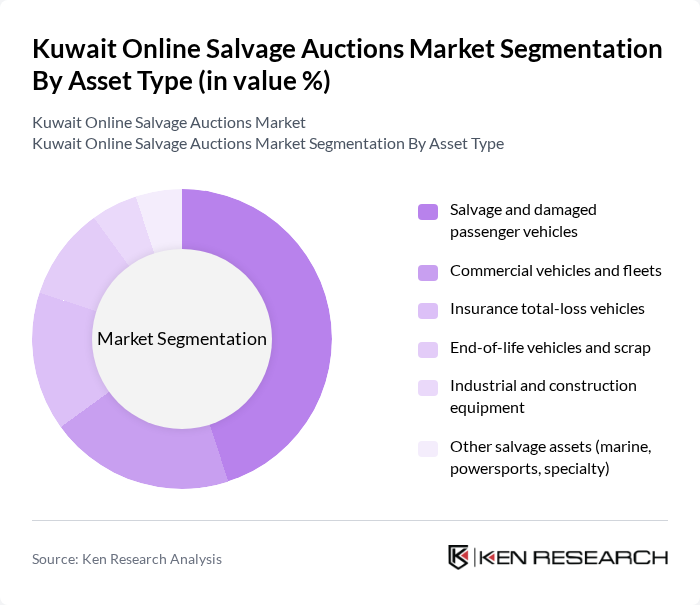

By Asset Type:The asset type segmentation includes various categories of salvageable assets that are auctioned online. The primary subsegments are salvage and damaged passenger vehicles, commercial vehicles and fleets, insurance total-loss vehicles, end-of-life vehicles and scrap, industrial and construction equipment, and other salvage assets such as marine and specialty vehicles. Among these, salvage and damaged passenger vehicles dominate the market due to the high volume of personal vehicles involved in accidents, the strong underlying used?car demand in Kuwait, and the growing trend of recycling and parts harvesting for cost?efficient repairs.

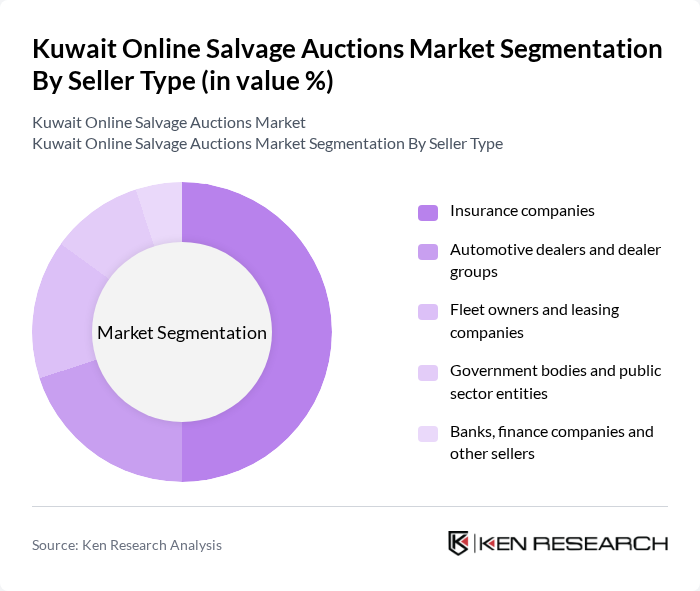

By Seller Type:This segmentation focuses on the various entities that sell salvage assets through online auctions. The key subsegments include insurance companies, automotive dealers and dealer groups, fleet owners and leasing companies, government bodies and public sector entities, and banks, finance companies, and other sellers. Insurance companies are the leading sellers in this market, as they frequently auction total-loss vehicles and damaged assets, driven by the need to recover claims costs, accelerate settlement cycles, and manage inventory efficiently, in line with global online salvage auction practices.

The Kuwait Online Salvage Auctions Market is characterized by a dynamic mix of regional and international players. Leading participants such as Copart Inc. (Copart Middle East and Kuwait operations), Insurance Auto Auctions, Inc. (IAA, a Ritchie Bros. company), Kuwait Public Authority for Industry – eAuction platform, Ministry of Justice Kuwait – Online Judicial Auctions Portal, Kuwait Municipality – Online Vehicle & Asset Auction Platform, Kuwait Finance House – Mazaya Online Auctions, Gulf Bank – Online Asset & Repossessed Vehicle Auctions, Kuwait Automotive Imports Co. (Al Shaya & Al Sagar) – online auction channels, Ali Alghanim & Sons Automotive – used and salvage vehicle auction initiatives, Al Mulla Group – automotive division auction and remarketing platforms, NBK Capital – distressed and repossessed asset sale channels, Kuwait Clearing Company – electronic auction and settlement services, OnlineAuctionKuwait.com (local multi-seller salvage marketplace), Q8Car.com – Kuwait online automotive classifieds and auction listings, Mourjan.com Kuwait – regional classifieds with salvage and damaged vehicle listings contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Kuwait online salvage auctions market appears promising, driven by technological advancements and changing consumer behaviors. As mobile auction applications gain traction, they are expected to enhance user experience and accessibility. Additionally, partnerships with insurance companies could streamline the auction process, providing a steady supply of salvage vehicles. The increasing focus on sustainability will likely encourage the development of eco-friendly auction practices, further attracting environmentally conscious consumers to the market.

| Segment | Sub-Segments |

|---|---|

| By Asset Type | Salvage and damaged passenger vehicles Commercial vehicles and fleets Insurance total?loss vehicles End?of?life vehicles and scrap Industrial and construction equipment Other salvage assets (marine, powersports, specialty) |

| By Seller Type | Insurance companies Automotive dealers and dealer groups Fleet owners and leasing companies Government bodies and public sector entities Banks, finance companies and other sellers |

| By Buyer Type | Licensed dismantlers and recyclers Used?car dealers and resellers Workshops, garages and body shops Individual buyers Export?oriented traders |

| By Auction Format | Online?only timed auctions Live webcast auctions (simulcast) Buy?now and fixed?price listings Sealed?bid and tender auctions |

| By Channel & Access | Web?based platforms Mobile app?based platforms Hybrid access (web + app) Third?party and B2B marketplaces |

| By Vehicle Condition & Title Status | Repairable vehicles Non?repairable / parts?only vehicles Flood / fire / major accident vehicles Unregistered and deregistered vehicles |

| By Geography (Within Kuwait) | Capital Governorate (Kuwait City) Hawalli & Farwaniya Governorates Ahmadi & Mubarak Al?Kabeer Governorates Jahra Governorate and border zones |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| General Salvage Auction Participants | 150 | Individual Buyers, Small Business Owners |

| Corporate Buyers in Salvage Auctions | 120 | Procurement Managers, Supply Chain Executives |

| Online Auction Platform Operators | 90 | Business Development Managers, Operations Directors |

| Regulatory Bodies and Policy Makers | 60 | Government Officials, Industry Regulators |

| Logistics and Transportation Providers | 70 | Logistics Managers, Freight Coordinators |

The Kuwait Online Salvage Auctions Market is valued at approximately USD 160 million, driven by factors such as increasing vehicle numbers, rising motorization rates, and the digital transformation of auction processes, enhancing market participation and liquidity.