Kuwait Used Car Market Overview

- The Kuwait Used Car Market is valued at USD 1.55 billion, based on a five-year historical analysis. This growth is primarily driven by increasing consumer demand for affordable transportation options, high vehicle ownership rates, and demographic shifts including a substantial expatriate population. Market expansion is further supported by rising new-car prices, economic sensitivity, and the growing popularity of certified pre-owned vehicles and online platforms, which have streamlined the transaction process and increased transparency. The market continues to see a steady rise in transactions as consumers seek value in pre-owned vehicles, which offer lower prices compared to new cars .

- Kuwait City remains the dominant hub in the used car market, attributed to its high population density and economic activity. Other notable areas include Hawalli and Salmiya, where a concentration of dealerships and digital platforms facilitate easy access to a variety of used vehicles. The urban infrastructure and consumer preferences in these regions significantly contribute to their market dominance, with digital transformation accelerating the shift to online research and transactions .

- In 2023, the Kuwaiti government implemented the "Kuwait Vehicle Emissions Control Regulation, 2023" issued by the Environment Public Authority (EPA). This regulation mandates stricter emissions standards for used vehicles, requiring all used cars sold in the market to meet defined emission criteria for nitrogen oxides (NOx), hydrocarbons, and particulate matter. Dealers must provide certified emissions test results before sale, and vehicles failing to meet standards are prohibited from registration. This initiative is part of Kuwait's broader strategy to promote sustainable transportation and encourage the adoption of cleaner vehicles .

Kuwait Used Car Market Segmentation

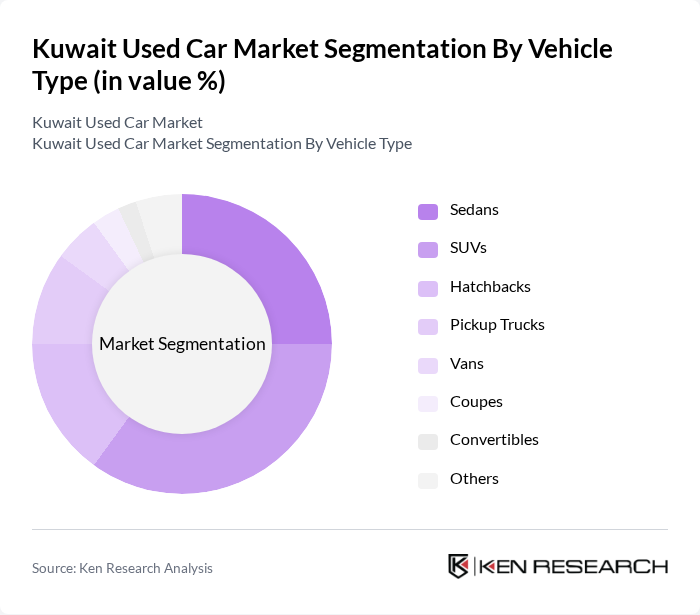

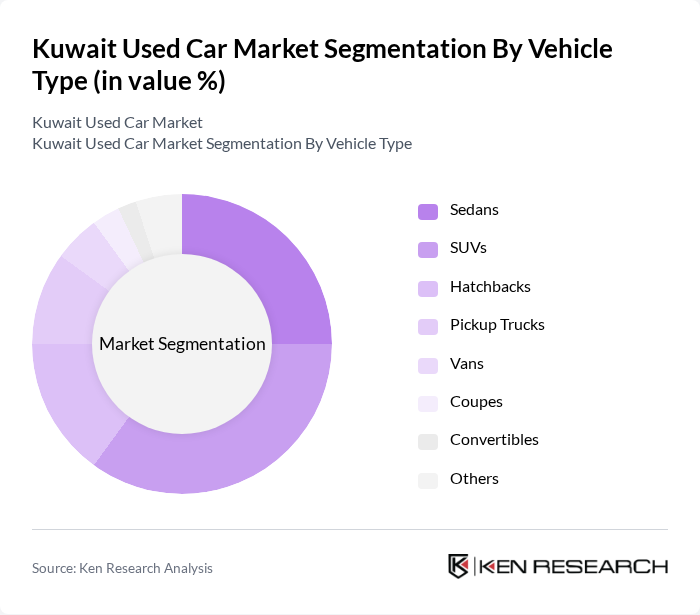

By Vehicle Type:The used car market in Kuwait is segmented by vehicle type, including sedans, SUVs, hatchbacks, pickup trucks, vans, coupes, convertibles, and others. SUVs have gained significant popularity due to their versatility, comfort, and suitability for both urban and off-road driving, reflecting consumer preferences for larger vehicles and family use. Sedans remain a strong contender, appealing to consumers seeking economical and fuel-efficient options. The demand for pickup trucks is driven by commercial use and lifestyle preferences, while hatchbacks cater to younger buyers seeking compact and affordable vehicles. The market also sees increased interest in hybrid and electric models, reflecting broader environmental trends .

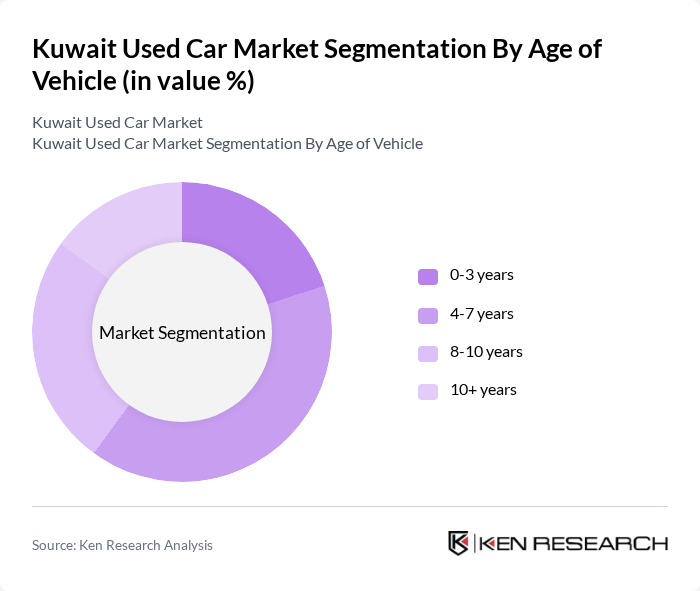

By Age of Vehicle:The segmentation by age of vehicle includes categories such as 0-3 years, 4-7 years, 8-10 years, and 10+ years. Vehicles aged 4-7 years dominate the market, offering a balance of affordability, reliability, and lower depreciation, which appeals to budget-conscious consumers. Vehicles aged 0-3 years are popular among first-time buyers seeking nearly new options with warranty coverage, while older vehicles (8-10 years and 10+ years) attract buyers seeking lower prices, though they may face higher maintenance costs. The market also reflects a growing preference for certified pre-owned vehicles, which provide added assurance on quality and service history .

Kuwait Used Car Market Competitive Landscape

The Kuwait Used Car Market is characterized by a dynamic mix of regional and international players. Leading participants such as Alghanim Automotive, Al-Mulla Group, Al-Sayer Group Holding, Al-Futtaim Automotive, Al-Mansour Automotive, Al-Jazeera Automotive, Al-Mazaya Holding, Al-Watania for Cars, Al-Hamra Group, Al-Qabas Automotive, Al-Majed Group, Al-Sabhan Group, Al-Khaldi Group, Al-Mutawa Group, Al-Bahar Group, YallaMotor.com, Dubizzle Group contribute to innovation, geographic expansion, and service delivery in this space.

Kuwait Used Car Market Industry Analysis

Growth Drivers

- Increasing Disposable Income:The average disposable income in Kuwait is projected to reach approximately KWD 1,500 per month in future, reflecting a 5% increase from the previous year. This rise in income enables consumers to allocate more funds towards purchasing used vehicles. As more individuals can afford to buy cars, the demand for used vehicles is expected to grow significantly, particularly among middle-income families seeking affordable transportation options.

- Rising Demand for Affordable Transportation:With the cost of living in Kuwait increasing, many consumers are turning to used cars as a cost-effective alternative to new vehicles. In future, the average price of a used car is estimated to be around KWD 4,000, making it a more accessible option for many. This trend is further supported by a growing population, which is projected to reach approximately 4.5 million, increasing the overall demand for affordable transportation solutions.

- Expansion of Online Car Sales Platforms:The digital transformation in Kuwait has led to a significant increase in online car sales, with platforms like CarSwitch and Yallamotor reporting a rise in user engagement in future. This shift allows consumers to browse a wider selection of used cars conveniently, enhancing the purchasing experience. As more buyers turn to online platforms, the used car market is expected to benefit from increased visibility and accessibility.

Market Challenges

- High Competition from New Car Sales:The used car market in Kuwait faces stiff competition from new car sales, which are projected to reach 50,000 units in future. Many consumers prefer the latest models with advanced features, which can hinder the growth of the used car segment. This competition is exacerbated by attractive financing options offered by dealerships for new vehicles, making it challenging for used car dealers to attract buyers.

- Regulatory Hurdles in Vehicle Imports:Import regulations for used vehicles in Kuwait are stringent, with a limit of 5 years for vehicle age. In future, the government is expected to enforce stricter compliance checks, which may slow down the importation process. This can lead to a reduced supply of quality used cars in the market, ultimately affecting sales and consumer choices, as well as increasing prices for available vehicles.

Kuwait Used Car Market Future Outlook

The Kuwait used car market is poised for significant transformation, driven by technological advancements and changing consumer preferences. The increasing shift towards online purchasing is expected to reshape how consumers engage with the market, enhancing convenience and transparency. Additionally, the growing interest in electric vehicles will likely create new segments within the used car market, as consumers seek sustainable options. As these trends evolve, the market is anticipated to adapt, presenting both challenges and opportunities for stakeholders.

Market Opportunities

- Growth of E-commerce in Vehicle Sales:The rise of e-commerce platforms is creating new opportunities for used car sales in Kuwait. With an estimated 60% of the population engaging in online shopping, dealers can leverage this trend to reach a broader audience, enhancing sales potential and customer engagement through digital marketing strategies.

- Increasing Interest in Electric Used Vehicles:As environmental awareness grows, the demand for electric used vehicles is expected to rise. In future, the number of electric vehicles in Kuwait is projected to increase by 20%, creating a niche market for used electric cars. This trend presents an opportunity for dealers to cater to eco-conscious consumers seeking affordable, sustainable transportation options.