Region:Middle East

Author(s):Geetanshi

Product Code:KRAC3821

Pages:87

Published On:October 2025

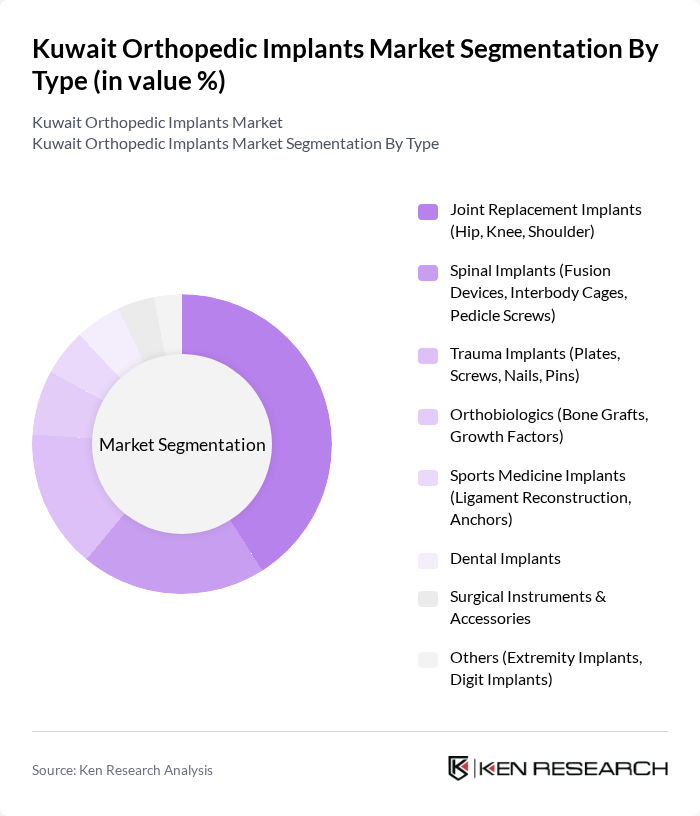

By Type:The market is segmented into various types of orthopedic implants, including Joint Replacement Implants, Spinal Implants, Trauma Implants, Orthobiologics, Sports Medicine Implants, Dental Implants, Surgical Instruments & Accessories, and Others. Among these, Joint Replacement Implants, particularly for hip and knee surgeries, dominate the market due to the rising incidence of osteoarthritis and other degenerative joint diseases. The increasing awareness of advanced surgical techniques, adoption of robotic-assisted and minimally invasive procedures, and the availability of high-performance biomaterials further drive the demand for these implants .

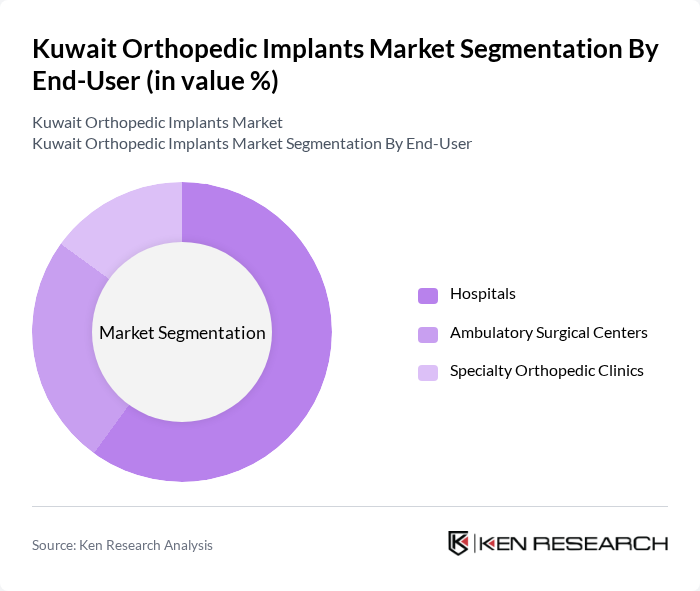

By End-User:The end-user segmentation includes Hospitals, Ambulatory Surgical Centers, and Specialty Orthopedic Clinics. Hospitals are the leading end-user segment, accounting for a significant share of the market. This is attributed to the comprehensive services they offer, including advanced surgical procedures and post-operative care, which are essential for orthopedic surgeries. The increasing number of orthopedic surgeries performed in hospitals, coupled with the availability of specialized orthopedic departments and multidisciplinary care teams, drives this segment's growth .

The Kuwait Orthopedic Implants Market is characterized by a dynamic mix of regional and international players. Leading participants such as Johnson & Johnson (DePuy Synthes), Stryker Corporation, Zimmer Biomet Holdings Inc., Medtronic PLC, Smith & Nephew PLC, B. Braun Melsungen AG (Aesculap), NuVasive Inc., Arthrex Inc., Orthofix Medical Inc., Exactech Inc., Medacta International SA, Conmed Corporation, Enovis Corporation, Acumed LLC, Paragon 28 Inc. contribute to innovation, geographic expansion, and service delivery in this space .

The Kuwait orthopedic implants market is poised for significant growth, driven by technological advancements and an increasing geriatric population. As healthcare infrastructure expands, the demand for minimally invasive surgical techniques is expected to rise, enhancing patient outcomes. Additionally, the integration of digital technologies in surgical procedures will likely streamline operations and improve efficiency. These trends indicate a robust future for the orthopedic implants market, with opportunities for innovation and improved patient care on the horizon.

| Segment | Sub-Segments |

|---|---|

| By Type | Joint Replacement Implants (Hip, Knee, Shoulder) Spinal Implants (Fusion Devices, Interbody Cages, Pedicle Screws) Trauma Implants (Plates, Screws, Nails, Pins) Orthobiologics (Bone Grafts, Growth Factors) Sports Medicine Implants (Ligament Reconstruction, Anchors) Dental Implants Surgical Instruments & Accessories Others (Extremity Implants, Digit Implants) |

| By End-User | Hospitals Ambulatory Surgical Centers Specialty Orthopedic Clinics |

| By Distribution Channel | Direct Sales Distributors Online Sales |

| By Material | Metal Implants (Titanium, Stainless Steel) Polymer Implants (PEEK, UHMWPE) Ceramic Implants Composite Materials |

| By Region | Central Kuwait Southern Kuwait Northern Kuwait |

| By Price Range | Low Price Range Mid Price Range High Price Range |

| By Application | Orthopedic Surgery Trauma Surgery Dental Surgery Sports Medicine Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Orthopedic Surgeons | 50 | Orthopedic Surgeons, Medical Directors |

| Hospital Procurement Managers | 40 | Procurement Managers, Supply Chain Coordinators |

| Medical Device Distributors | 40 | Sales Managers, Distribution Heads |

| Healthcare Policy Makers | 40 | Health Ministry Officials, Regulatory Affairs Managers |

| Patients with Orthopedic Implants | 50 | Patients, Caregivers, Rehabilitation Specialists |

The Kuwait Orthopedic Implants Market is valued at approximately USD 160 million, reflecting a significant growth driven by the increasing prevalence of orthopedic disorders and advancements in implant technology.