Region:Middle East

Author(s):Dev

Product Code:KRAD5204

Pages:80

Published On:December 2025

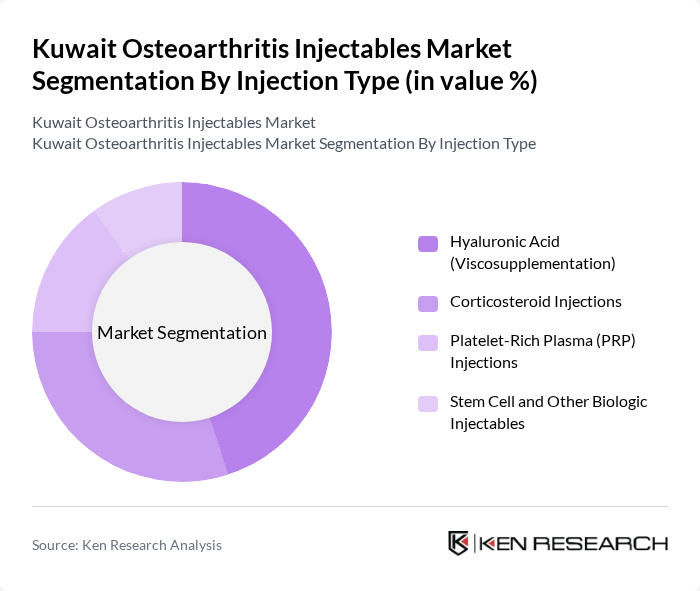

By Injection Type:The market is segmented into various injection types, including Hyaluronic Acid (Viscosupplementation), Corticosteroid Injections, Platelet-Rich Plasma (PRP) Injections, and Stem Cell and Other Biologic Injectables. Among these, Hyaluronic Acid injectables dominate the market due to their widespread acceptance and effectiveness in alleviating joint pain. The increasing preference for minimally invasive procedures and the growing awareness of the benefits of viscosupplementation contribute to its leading position. Corticosteroid injections also hold a significant share, particularly for their rapid anti-inflammatory effects.

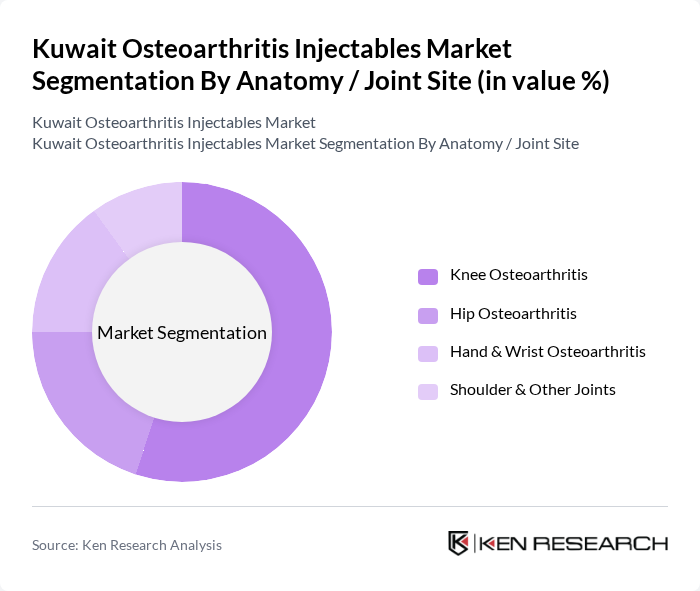

By Anatomy / Joint Site:The market is further segmented by joint site, including Knee Osteoarthritis, Hip Osteoarthritis, Hand & Wrist Osteoarthritis, and Shoulder & Other Joints. Knee Osteoarthritis is the leading segment, primarily due to the high incidence of knee-related issues among the aging population. The increasing number of knee surgeries and the effectiveness of injectables in managing pain and improving mobility contribute to its dominance. The hip and hand joints also represent significant segments, driven by rising awareness and treatment options.

The Kuwait Osteoarthritis Injectables Market is characterized by a dynamic mix of regional and international players. Leading participants such as Sanofi, Johnson & Johnson (Including DePuy Synthes), Ferring Pharmaceuticals, Bioventus, Zimmer Biomet, Seikagaku Corporation, Anika Therapeutics, Inc., Fidia Farmaceutici S.p.A., Mylan N.V. (Viatris Inc.), Teva Pharmaceutical Industries Ltd., Pfizer Inc., Bayer AG, Novartis AG, Hikma Pharmaceuticals PLC, Kuwait Saudi Pharmaceutical Industries Co. (KSPICO) contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Kuwait osteoarthritis injectables market appears promising, driven by demographic shifts and technological advancements. As the population ages and the prevalence of osteoarthritis increases, the demand for effective injectable therapies is expected to rise. Additionally, the integration of telemedicine and personalized treatment plans will enhance patient engagement and adherence. The government’s commitment to improving healthcare infrastructure will further facilitate access to innovative therapies, ensuring that patients receive timely and effective care for osteoarthritis management.

| Segment | Sub-Segments |

|---|---|

| By Injection Type | Hyaluronic Acid (Viscosupplementation) Corticosteroid Injections Platelet-Rich Plasma (PRP) Injections Stem Cell and Other Biologic Injectables |

| By Anatomy / Joint Site | Knee Osteoarthritis Hip Osteoarthritis Hand & Wrist Osteoarthritis Shoulder & Other Joints |

| By End-User | Public Hospitals (MOH and Government Hospitals) Private Hospitals Specialized Orthopedic & Rheumatology Clinics Ambulatory Surgical Centers & Daycare Centers |

| By Distribution Channel | Hospital Pharmacies Retail Pharmacies Online Pharmacies & E?Commerce Direct Tender & Institutional Sales |

| By Patient Demographics | Adults (40–64 Years) Seniors (65 Years and Above) By Gender (Male, Female) |

| By Treatment Line / Stage | First?Line Injectables Second?Line / Adjunct Injectables Late?Stage / Pre?Surgical Injectables |

| By Payer & Reimbursement Type | Ministry of Health & Other Public Payers Private Health Insurance Self?Pay / Out?of?Pocket |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Orthopedic Clinics | 100 | Orthopedic Surgeons, Clinic Managers |

| Rheumatology Practices | 80 | Rheumatologists, Nurse Practitioners |

| Pharmaceutical Distributors | 60 | Sales Managers, Product Managers |

| Patient Advocacy Groups | 50 | Patient Representatives, Healthcare Advocates |

| Healthcare Policy Makers | 40 | Health Economists, Policy Analysts |

The Kuwait Osteoarthritis Injectables Market is valued at approximately USD 25 million, reflecting a five-year historical analysis. This growth is attributed to the increasing prevalence of osteoarthritis, advancements in injectable therapies, and rising healthcare expenditures.