Region:Middle East

Author(s):Dev

Product Code:KRAA9588

Pages:91

Published On:November 2025

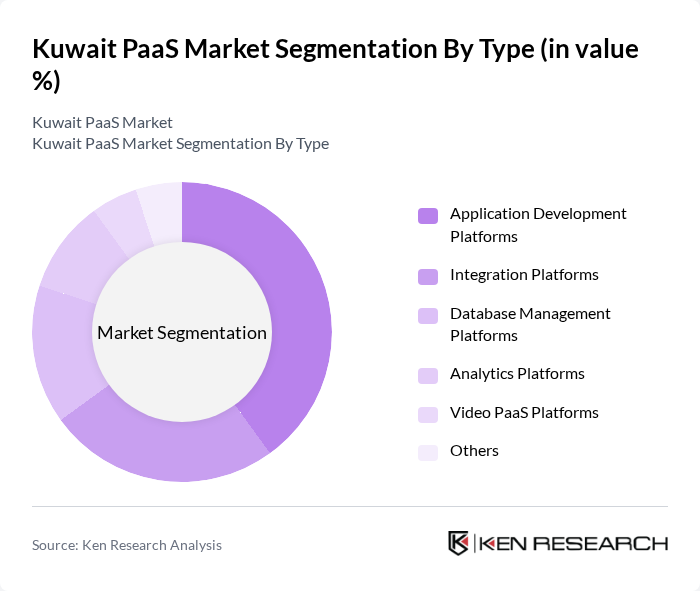

By Type:The PaaS market in Kuwait is segmented into various types, including Application Development Platforms, Integration Platforms, Database Management Platforms, Analytics Platforms, Video PaaS Platforms, and Others. Among these, Application Development Platforms are leading the market due to the increasing demand for rapid application development and deployment. Businesses are increasingly adopting these platforms to streamline their development processes and reduce time-to-market. The trend is reinforced by the need for agile IT infrastructure to support digital transformation and the growing adoption of cloud-native applications .

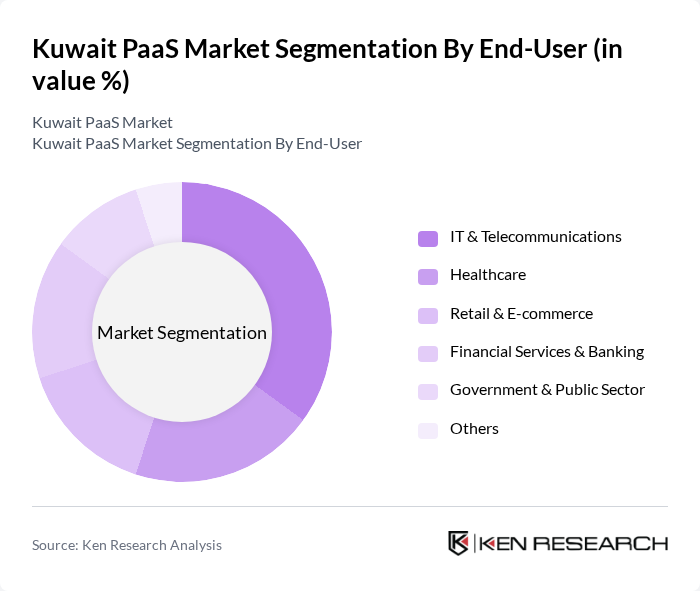

By End-User:The end-user segmentation of the PaaS market includes IT & Telecommunications, Healthcare, Retail & E-commerce, Financial Services & Banking, Government & Public Sector, and Others. The IT & Telecommunications sector is the largest end-user, driven by the need for innovative solutions to enhance service delivery and operational efficiency. The increasing reliance on cloud-based services in this sector is propelling the growth of PaaS solutions. Other sectors, such as healthcare and financial services, are also witnessing rapid adoption due to the need for secure, compliant, and scalable digital platforms .

The Kuwait PaaS market is characterized by a dynamic mix of regional and international players. Leading participants such as Zain Group, Gulf Business Machines (GBM), KNET (Kuwait National Electronic Payment Company), Ooredoo Kuwait, STC Kuwait (Saudi Telecom Company Kuwait), Microsoft Kuwait, Oracle Kuwait, IBM Kuwait, SAP Kuwait, Cisco Systems Kuwait, Huawei Technologies Kuwait, Amazon Web Services (AWS) Kuwait, Google Cloud Kuwait, DigitalOcean Kuwait, Alibaba Cloud Kuwait contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Kuwait PaaS market appears promising, driven by technological advancements and increasing digitalization across sectors. As businesses prioritize agility and innovation, the adoption of PaaS solutions is expected to rise significantly. The integration of AI and IoT technologies will further enhance service offerings, enabling companies to develop customized applications. Additionally, the growing trend towards hybrid cloud solutions will provide businesses with the flexibility needed to optimize their IT infrastructure while ensuring data security and compliance.

| Segment | Sub-Segments |

|---|---|

| By Type | Application Development Platforms Integration Platforms Database Management Platforms Analytics Platforms Video PaaS Platforms Others |

| By End-User | IT & Telecommunications Healthcare Retail & E-commerce Financial Services & Banking Government & Public Sector Others |

| By Deployment Model | Public Cloud Private Cloud Hybrid Cloud Community Cloud Others |

| By Industry Vertical | Government Education Manufacturing Transportation and Logistics Energy & Utilities Others |

| By Service Model | Managed PaaS Self-Service PaaS Open PaaS Others |

| By Customer Size | Large Enterprises Small and Medium Enterprises (SMEs) Startups Others |

| By Geographic Presence | Urban Areas Rural Areas Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Enterprise PaaS Adoption | 100 | IT Managers, CTOs, Business Analysts |

| SME Cloud Solutions | 70 | Small Business Owners, IT Consultants |

| Government Cloud Initiatives | 50 | Public Sector IT Directors, Policy Makers |

| Industry-Specific PaaS Applications | 60 | Sector Specialists, Application Developers |

| Cloud Security and Compliance | 40 | Security Officers, Compliance Managers |

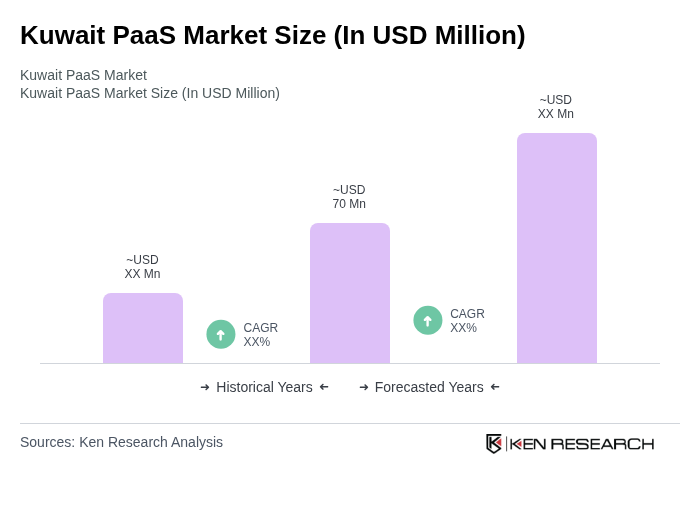

The Kuwait PaaS market is valued at approximately USD 70 million, driven by the increasing adoption of cloud computing solutions and digital transformation initiatives across various sectors, including healthcare, finance, and retail.