Region:Middle East

Author(s):Dev

Product Code:KRAA9635

Pages:91

Published On:November 2025

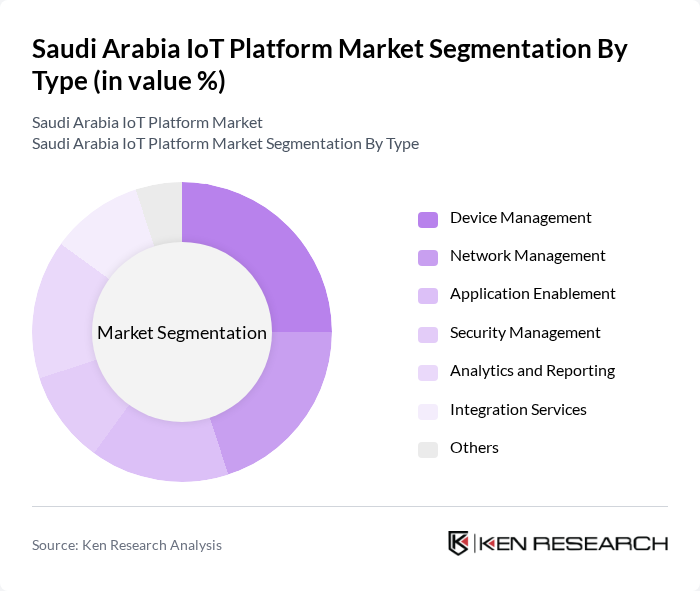

By Type:The market is segmented into various types, including Device Management, Network Management, Application Enablement, Security Management, Analytics and Reporting, Integration Services, and Others. Each of these segments plays a crucial role in the overall functionality and efficiency of IoT platforms, with platform services accounting for the largest share due to their central role in device connectivity, data integration, and management .

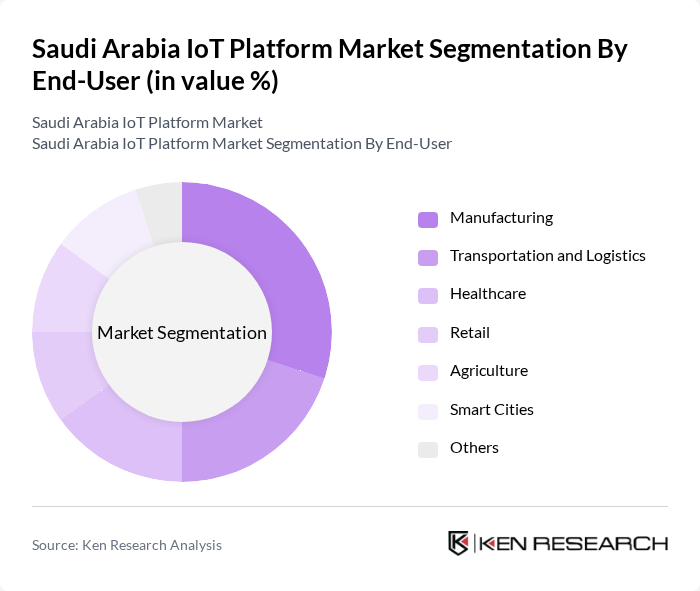

By End-User:The end-user segmentation includes Manufacturing, Transportation and Logistics, Healthcare, Retail, Agriculture, Smart Cities, and Others. Each sector utilizes IoT platforms to enhance operational efficiency and improve service delivery. Manufacturing and smart cities are leading adopters, reflecting the Kingdom’s focus on industrial automation and urban digital transformation .

The Saudi Arabia IoT Platform Market is characterized by a dynamic mix of regional and international players. Leading participants such as STC Group (Saudi Telecom Company), Mobily (Etihad Etisalat Company), Zain KSA, SAP Saudi Arabia, Cisco Systems Saudi Arabia, IBM Saudi Arabia, Microsoft Arabia, Oracle Saudi Arabia, Siemens Saudi Arabia, Huawei Tech Investment Saudi Arabia Co. Ltd., Schneider Electric Saudi Arabia, Ericsson Saudi Arabia, Honeywell Saudi Arabia, GE Digital Saudi Arabia, Nokia Saudi Arabia contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Saudi Arabia IoT platform market appears promising, driven by technological advancements and government initiatives. The integration of AI and machine learning into IoT applications is expected to enhance data analytics capabilities, leading to more informed decision-making. Additionally, the focus on sustainability will likely spur innovations in energy-efficient IoT solutions, aligning with global environmental goals. As these trends continue to evolve, the market is poised for significant growth and transformation in the coming years.

| Segment | Sub-Segments |

|---|---|

| By Type | Device Management Network Management Application Enablement Security Management Analytics and Reporting Integration Services Others |

| By End-User | Manufacturing Transportation and Logistics Healthcare Retail Agriculture Smart Cities Others |

| By Industry Vertical | Smart Cities Energy and Utilities Agriculture Automotive Healthcare Manufacturing Others |

| By Deployment Model | On-Premises Cloud-Based Hybrid Others |

| By Connectivity Technology | Cellular LPWAN Wi-Fi Bluetooth Wired Others |

| By Geographic Region | Central Region Eastern Region Western Region Southern Region Northern Region Others |

| By Application Area | Smart Home Wearable Technology Industrial Automation Smart Healthcare Smart Metering Asset Tracking Predictive Maintenance Environmental Monitoring Fleet Management Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Healthcare IoT Solutions | 60 | Healthcare IT Managers, Medical Device Manufacturers |

| Smart City Initiatives | 50 | Urban Planners, City Officials, Technology Consultants |

| Industrial IoT Applications | 55 | Manufacturing Engineers, Operations Managers |

| Telecommunications Infrastructure | 45 | Network Engineers, Telecom Executives |

| Energy Management Systems | 40 | Energy Analysts, Sustainability Managers |

The Saudi Arabia IoT Platform Market is valued at approximately USD 220 million, reflecting significant growth driven by the adoption of smart technologies across various sectors, including manufacturing, healthcare, and smart cities.