Region:Middle East

Author(s):Geetanshi

Product Code:KRAD3929

Pages:99

Published On:November 2025

Market.png)

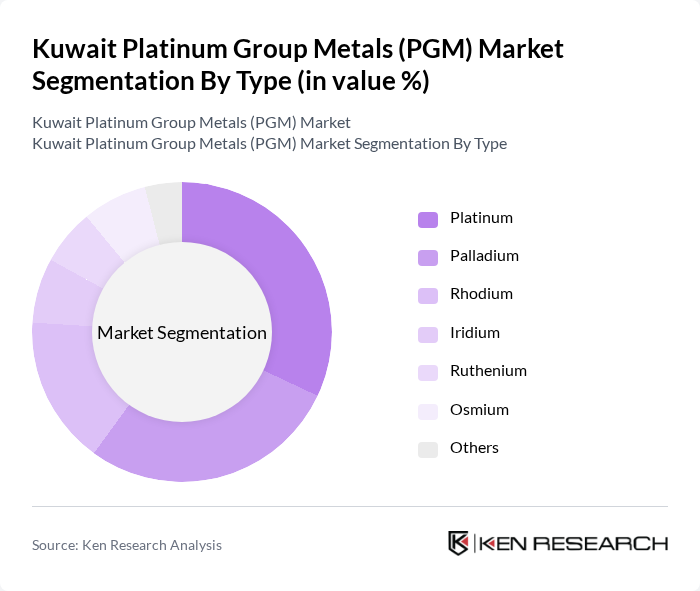

By Type:The market is segmented into various types of platinum group metals, including Platinum, Palladium, Rhodium, Iridium, Ruthenium, Osmium, and Others. Among these, Platinum and Palladium are the most prominent due to their extensive use in automotive catalytic converters and electronics. The demand for Rhodium has also surged due to its critical role in reducing vehicle emissions. The increasing focus on environmental regulations and the automotive industry's shift towards cleaner technologies are driving the growth of these subsegments .

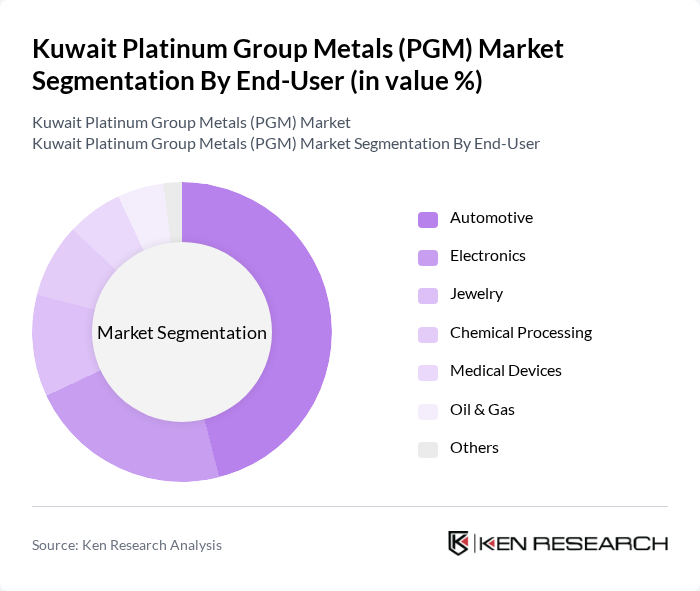

By End-User:The end-user segmentation includes Automotive, Electronics, Jewelry, Chemical Processing, Medical Devices, Oil & Gas, and Others. The automotive sector is the leading end-user, driven by the increasing production of vehicles and stringent emission regulations. The electronics industry also significantly contributes to the demand for PGMs, particularly in the manufacturing of electronic components. The growing trend towards sustainable practices in various industries is further propelling the use of PGMs .

The Kuwait Platinum Group Metals (PGM) Market is characterized by a dynamic mix of regional and international players. Leading participants such as Johnson Matthey, Anglo American Platinum, Impala Platinum Holdings, Norilsk Nickel, Sibanye Stillwater, Heraeus, BASF, Umicore, Sumitomo Metal Mining, Platinum Group Metals Ltd., Royal Gold, Ajlan & Bros Mining Company, Wheaton Precious Metals, Kuwait Catalyst Company, Sandstorm Gold Ltd. contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Kuwait PGM market appears promising, driven by technological advancements and a shift towards sustainable practices. As industries increasingly adopt renewable energy technologies, the demand for PGMs in energy storage and conversion applications is expected to rise. Furthermore, the growing emphasis on recycling PGMs will likely enhance resource availability, supporting a circular economy. Strategic partnerships with international firms may also facilitate knowledge transfer and innovation, positioning Kuwait as a competitive player in the global PGM landscape.

| Segment | Sub-Segments |

|---|---|

| By Type | Platinum Palladium Rhodium Iridium Ruthenium Osmium Others |

| By End-User | Automotive Electronics Jewelry Chemical Processing Medical Devices Oil & Gas Others |

| By Application | Catalytic Converters Electronic Components Chemical Catalysts Jewelry Manufacturing Fuel Cells & Hydrogen Technologies Others |

| By Source | Primary Mining Recycling Secondary Sources Others |

| By Distribution Channel | Direct Sales Distributors Online Sales Others |

| By Geography | Local Market Export Markets Others |

| By Pricing Model | Fixed Pricing Dynamic Pricing Subscription Models Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Automotive Catalysts Market | 100 | Procurement Managers, Automotive Engineers |

| Electronics Manufacturing Sector | 60 | Product Managers, Supply Chain Analysts |

| Jewelry and Luxury Goods | 50 | Jewelry Designers, Retail Buyers |

| Industrial Applications of PGMs | 50 | Operations Managers, Process Engineers |

| Research and Development in PGM Technologies | 40 | R&D Directors, Innovation Managers |

The Kuwait Platinum Group Metals (PGM) Market is valued at approximately USD 210 million, reflecting its share within the broader Middle East and Africa PGM market, driven by demand in automotive, electronics, and industrial applications.