Region:Middle East

Author(s):Dev

Product Code:KRAD5088

Pages:100

Published On:December 2025

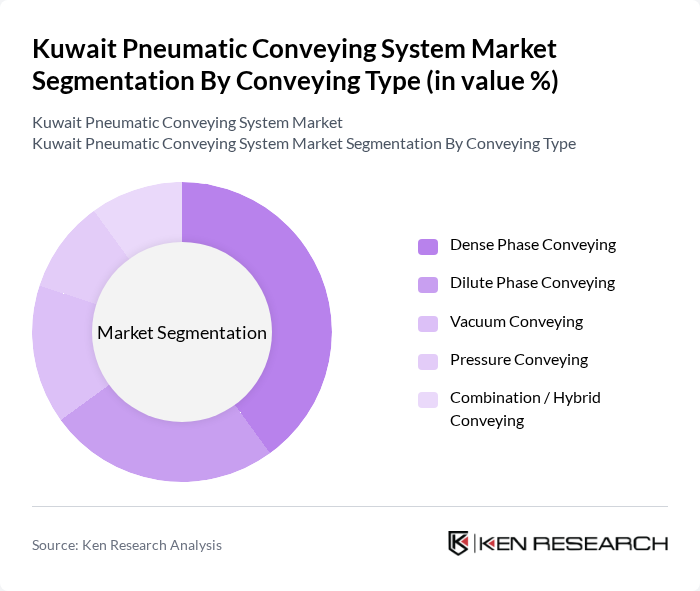

By Conveying Type:

The pneumatic conveying system market is segmented by conveying type into Dense Phase Conveying, Dilute Phase Conveying, Vacuum Conveying, Pressure Conveying, and Combination / Hybrid Conveying. Among these, Dense Phase Conveying is positioned as the leading sub-segment in Kuwait for high-value and fragile bulk materials due to its ability to transport products at low velocities with minimal degradation and reduced wear, which is particularly important in food, dairy ingredients, specialty chemicals, and pharmaceutical applications. Globally, dilute phase conveying systems still account for the largest share of installed pneumatic conveying capacity because of their lower initial cost and flexibility, but in Kuwait’s process industries the growing trend towards automation, product quality assurance, and energy-efficient, low-dust handling is strengthening the preference for dense phase and hybrid systems in critical applications.

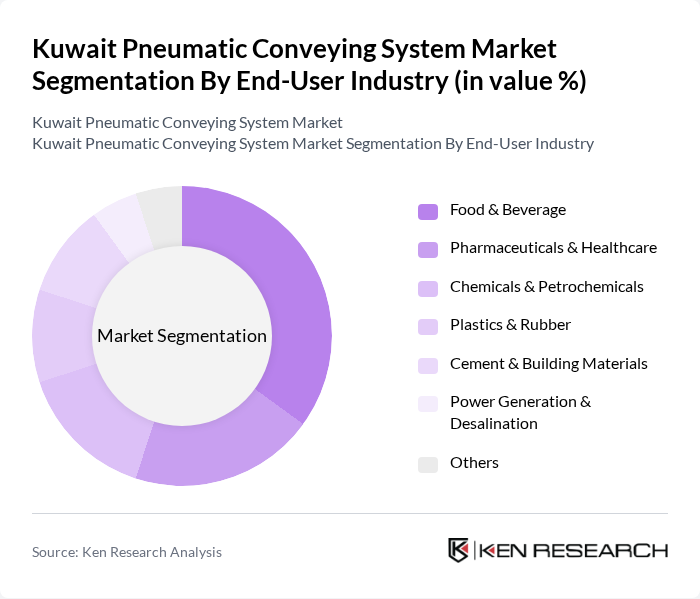

By End-User Industry:

The market is also segmented by end-user industry, including Food & Beverage, Pharmaceuticals & Healthcare, Chemicals & Petrochemicals, Plastics & Rubber, Cement & Building Materials, Power Generation & Desalination, and Others. In line with global patterns where the food industry is one of the largest end-users of pneumatic conveying systems, the Food & Beverage sector represents a leading segment in Kuwait, driven by the increasing demand for efficient, enclosed, and hygienic material handling solutions in flour mills, bakeries, snacks, dairy powders, and beverage plants. The need for compliance with stringent health, safety, and food-quality regulations, including Hazard Analysis and Critical Control Point (HACCP) and Gulf/KS standards applicable to food processing facilities, further enhances the adoption of stainless steel, clean-in-place capable pneumatic conveying systems in this industry.

The Kuwait Pneumatic Conveying System Market is characterized by a dynamic mix of regional and international players, reflecting the broader global competitive landscape where European and North American manufacturers hold significant shares. Leading participants such as Schenck Process Holding GmbH, Coperion GmbH, Flexicon Corporation, VAC-U-MAX, Nilfisk A/S (Industrial Vacuum & Pneumatic Conveying), WAMGROUP S.p.A., AUMUND Fördertechnik GmbH, Kreyenborg GmbH & Co. KG, Gericke AG, Zeppelin Systems GmbH, Piab AB, CLYDE Process (FLSmidth Pneumatic Transport), Kongskilde Industries A/S, Dynamic Air Inc., KWS Manufacturing Company, Ltd. contribute to innovation, geographic expansion, and service delivery in this space through integrated systems for powders and granules, customized solutions for petrochemicals and plastics, and hygienic conveying equipment for food and pharma applications.

The future of the pneumatic conveying system market in Kuwait appears promising, driven by technological advancements and increasing industrial automation. As industries continue to prioritize efficiency and sustainability, the integration of IoT and AI technologies is expected to enhance system performance and predictive maintenance capabilities. Furthermore, the expansion of the food and beverage sector, alongside ongoing infrastructure projects, will likely create new opportunities for market growth, positioning Kuwait as a regional leader in advanced material handling solutions.

| Segment | Sub-Segments |

|---|---|

| By Conveying Type | Dense Phase Conveying Dilute Phase Conveying Vacuum Conveying Pressure Conveying Combination / Hybrid Conveying |

| By End-User Industry | Food & Beverage (flour mills, sugar, dairy, bakeries) Pharmaceuticals & Healthcare Chemicals & Petrochemicals Plastics & Rubber Cement & Building Materials Power Generation & Desalination Others (metals, recycling, specialty industries) |

| By Material Characteristics | Free-flowing Powders Cohesive / Abrasive Powders Granules & Pellets Fragile / Specialty Materials |

| By System Layout | Single-Line Systems Multi-Line / Manifold Systems Centralized Vacuum Systems Point-to-Point Systems |

| By Operating Pressure | Low-Pressure Systems (<1 bar) Medium-Pressure Systems (1–3 bar) High-Pressure Systems (>3 bar) |

| By Technology | Positive Pressure Systems Vacuum Systems Combination Systems Smart / Automated Systems (IoT-enabled, PLC/SCADA integrated) |

| By Region | Kuwait City & Al Asimah Governorate Al Ahmadi (oil, gas & petrochemicals cluster) Al Farwaniya & Hawalli Al Jahra & Mubarak Al-Kabeer |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Food Processing Industry | 100 | Production Managers, Quality Assurance Heads |

| Chemical Manufacturing | 80 | Process Engineers, Operations Directors |

| Pharmaceutical Sector | 70 | Regulatory Affairs Managers, Supply Chain Coordinators |

| Construction Materials | 60 | Logistics Managers, Plant Supervisors |

| Plastic and Polymer Industries | 90 | Technical Directors, R&D Managers |

The Kuwait Pneumatic Conveying System market is valued at approximately USD 10 million, reflecting a five-year historical analysis. This growth is driven by the increasing demand for efficient material handling solutions across various industries.