Region:Middle East

Author(s):Dev

Product Code:KRAD3955

Pages:97

Published On:December 2025

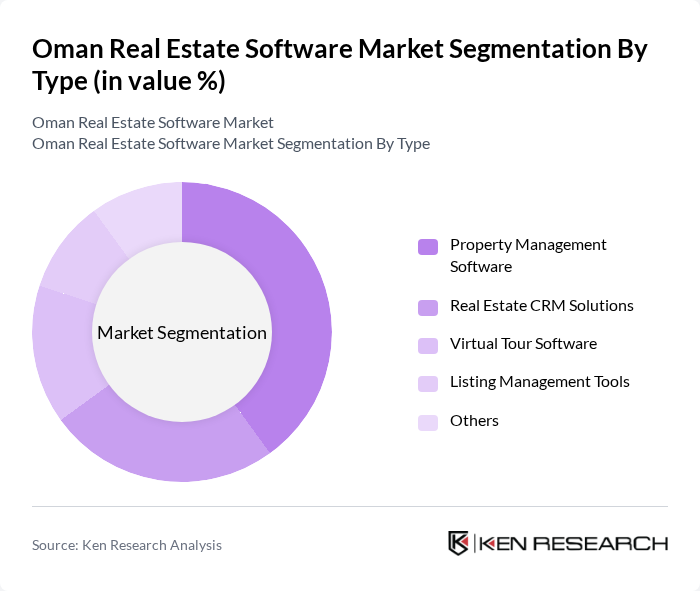

By Type:The market is segmented into various types of software solutions that cater to different needs within the real estate sector. The primary subsegments include Property Management Software, Real Estate CRM Solutions, Virtual Tour Software, Listing Management Tools, and Others. Among these, Property Management Software is the most dominant due to its essential role in managing rental properties, tenant relations, and maintenance tasks efficiently. The increasing number of rental properties and the need for streamlined operations are driving the demand for this software.

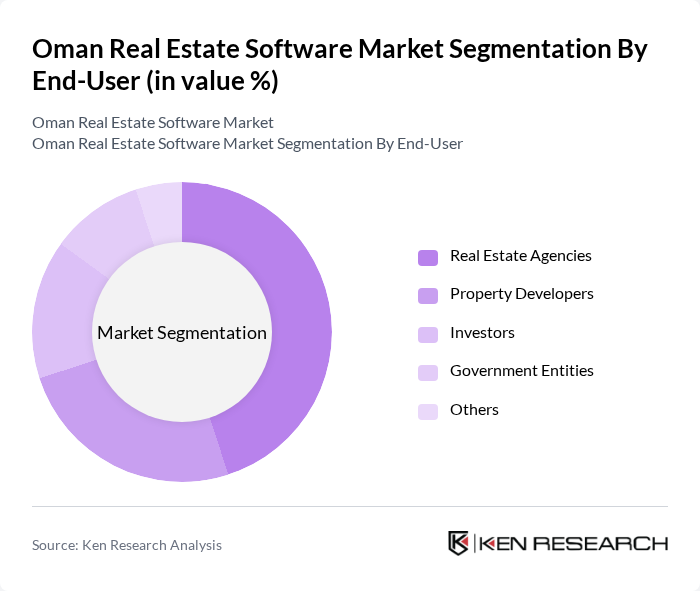

By End-User:The end-user segmentation includes Real Estate Agencies, Property Developers, Investors, Government Entities, and Others. Real Estate Agencies are the leading end-users, as they require comprehensive software solutions to manage listings, client interactions, and transactions effectively. The growing number of real estate transactions and the need for efficient client management are key factors contributing to the dominance of this segment.

The Oman Real Estate Software Market is characterized by a dynamic mix of regional and international players. Leading participants such as Muscat Real Estate Software Solutions, Oman Property Management Systems, Real Estate Tech Oman, Smart Realty Solutions, Gulf Real Estate Software, Oman Realty Technologies, PropertyPro Oman, RealEstateHub Oman, Oman Realty Solutions, Digital Realty Solutions, PropTech Oman, RealtySoft Oman, Oman Real Estate Innovations, Real Estate Cloud Solutions Oman, Oman Property Solutions contribute to innovation, geographic expansion, and service delivery in this space.

The Oman real estate software market is poised for transformative growth, driven by technological advancements and increasing urbanization. As the government continues to invest in smart city initiatives, the integration of AI and machine learning into real estate operations will become more prevalent. Additionally, the rising demand for sustainable solutions will encourage software developers to innovate, creating user-friendly platforms that enhance property management efficiency and customer engagement, ultimately shaping the future landscape of the industry.

| Segment | Sub-Segments |

|---|---|

| By Type | Property Management Software Real Estate CRM Solutions Virtual Tour Software Listing Management Tools Others |

| By End-User | Real Estate Agencies Property Developers Investors Government Entities Others |

| By Deployment Model | On-Premises Cloud-Based Hybrid Others |

| By Functionality | Marketing Automation Transaction Management Financial Management Reporting and Analytics Others |

| By Geographic Focus | Muscat Salalah Sohar Nizwa Others |

| By Business Model | B2B B2C C2C Others |

| By Integration Capability | API Integration Third-Party Software Compatibility Data Migration Services Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Residential Real Estate Market | 120 | Real Estate Agents, Home Buyers |

| Commercial Property Sector | 100 | Property Managers, Business Owners |

| Real Estate Development Projects | 80 | Developers, Urban Planners |

| Investment Trends in Real Estate | 70 | Investors, Financial Analysts |

| Market Sentiment and Consumer Preferences | 90 | Potential Buyers, Market Researchers |

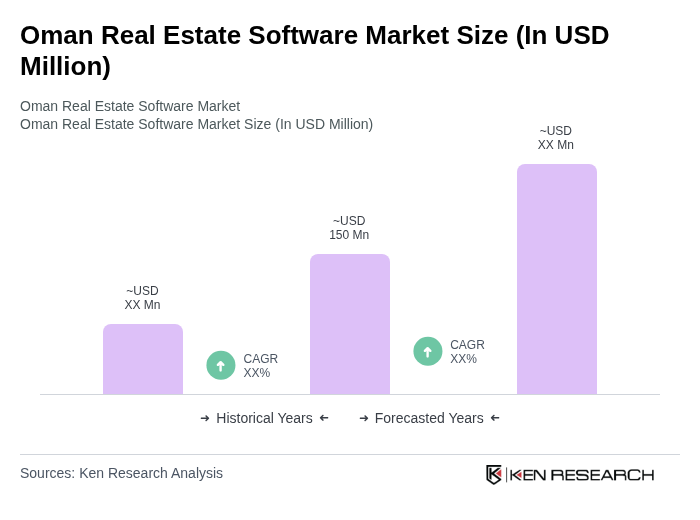

The Oman Real Estate Software Market is valued at approximately USD 150 million, reflecting a five-year historical analysis. This growth is driven by the increasing demand for efficient property management solutions and the rise of digital transformation in the real estate sector.