Region:Middle East

Author(s):Dev

Product Code:KRAD7786

Pages:96

Published On:December 2025

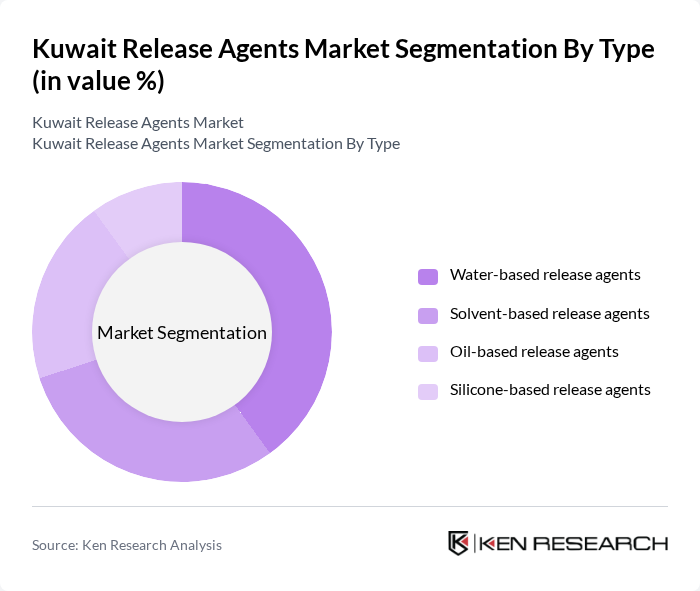

By Type:The market is segmented into various types of release agents, including water-based, solvent-based, oil-based, and silicone-based formulations. Each type serves different applications and industries, catering to specific needs such as environmental compliance and performance efficiency.

The water-based release agents segment is currently dominating the market due to their eco-friendliness and compliance with government regulations promoting low-VOC products. These agents are widely used in construction and food processing, where safety and environmental impact are critical considerations. The trend towards sustainable practices has led to increased adoption of water-based formulations, making them the preferred choice among manufacturers and end-users alike.

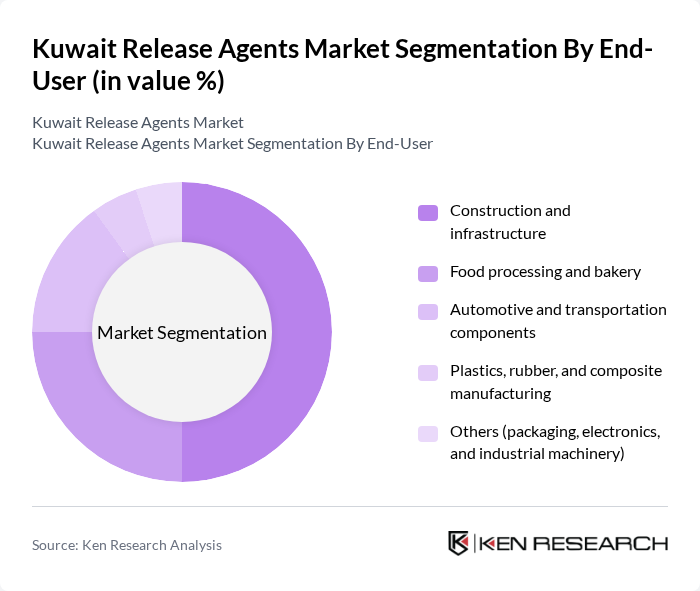

By End-User:The market is segmented based on end-users, including construction and infrastructure, food processing and bakery, automotive and transportation components, plastics, rubber, and composite manufacturing, and others such as packaging and electronics.

The construction and infrastructure segment leads the market due to the ongoing development projects in Kuwait, which require effective release agents for concrete and other materials. The demand from the food processing sector is also significant, driven by the need for efficient production processes and compliance with health regulations. As a result, these two sectors are the primary consumers of release agents in the region.

The Kuwait Release Agents Market is characterized by a dynamic mix of regional and international players. Leading participants such as BASF SE, Dow Chemical Company, Evonik Industries AG, Wacker Chemie AG, Huntsman Corporation, Clariant AG, Momentive Performance Materials Inc., KCC Corporation, Chem-Trend L.P., Henkel AG & Co. KGaA, Sika AG, Foseco (Vesuvius Group), Croda International Plc, Lasenor Emul, S.L., Associated Chemicals Enterprises Co. W.L.L. (Kuwait) contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Kuwait release agents market appears promising, driven by a combination of technological advancements and a shift towards sustainable practices. As the construction industry continues to expand, the demand for innovative and eco-friendly release agents is expected to rise. Additionally, strategic partnerships with local manufacturers can enhance distribution channels, while the exploration of export opportunities to neighboring markets may further bolster growth. Overall, the market is poised for significant evolution in the coming years.

| Segment | Sub-Segments |

|---|---|

| By Type | Water-based release agents Solvent-based release agents Oil-based release agents Silicone-based release agents |

| By End-User | Construction and infrastructure Food processing and bakery Automotive and transportation components Plastics, rubber, and composite manufacturing Others (packaging, electronics, and industrial machinery) |

| By Application | Concrete formwork and precast products Bakery and confectionery processing Mold release for plastics, rubber, and composites Metal casting and die-casting Others |

| By Distribution Channel | Direct sales to industrial end-users Local chemical distributors and traders Specialized construction and building-material dealers Online and e-procurement platforms Others |

| By Region | Capital Governorate (Kuwait City) Hawalli Governorate Al Ahmadi Governorate Farwaniya and Al Jahra Governorates Mubarak Al-Kabeer Governorate |

| By Product Formulation | Conventional solvent-based formulations Water-based and low-VOC formulations Silicone- and wax-based formulations Bio-based and eco-friendly formulations Others |

| By Packaging Type | Bulk packaging (drums, IBCs, tankers) Medium packaging (pails and cans) Small and retail packaging (aerosols and bottles) Custom and private-label packaging |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Construction Industry Release Agents | 100 | Project Managers, Site Supervisors |

| Food Processing Sector Applications | 80 | Quality Assurance Managers, Production Supervisors |

| Automotive Manufacturing Usage | 70 | Manufacturing Engineers, Supply Chain Managers |

| Plastic and Rubber Industries | 60 | Product Development Managers, Technical Directors |

| General Chemical Distributors | 90 | Sales Managers, Distribution Coordinators |

The Kuwait Release Agents Market is valued at approximately USD 140 million, driven by increasing demand from the construction and food processing sectors, which are essential for ensuring smooth operations and high-quality outputs in these industries.