Region:Middle East

Author(s):Shubham

Product Code:KRAA8808

Pages:87

Published On:November 2025

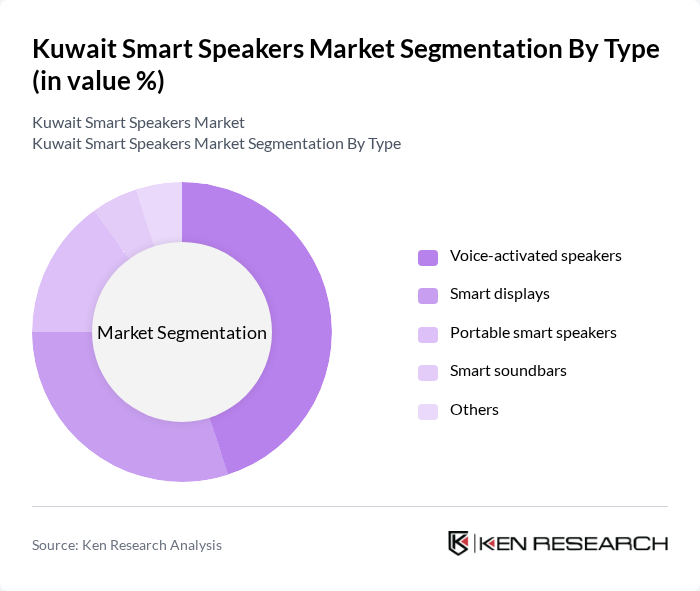

By Type:The market can be segmented into various types of smart speakers, including voice-activated speakers, smart displays, portable smart speakers, smart soundbars, and others. Among these, voice-activated speakers are the most popular due to their convenience and integration with smart home systems. Smart displays are gaining traction as they offer visual feedback and enhanced interactivity, appealing to consumers looking for multifunctional devices. The demand for portable smart speakers is also increasing, driven by consumer preference for mobility and wireless connectivity .

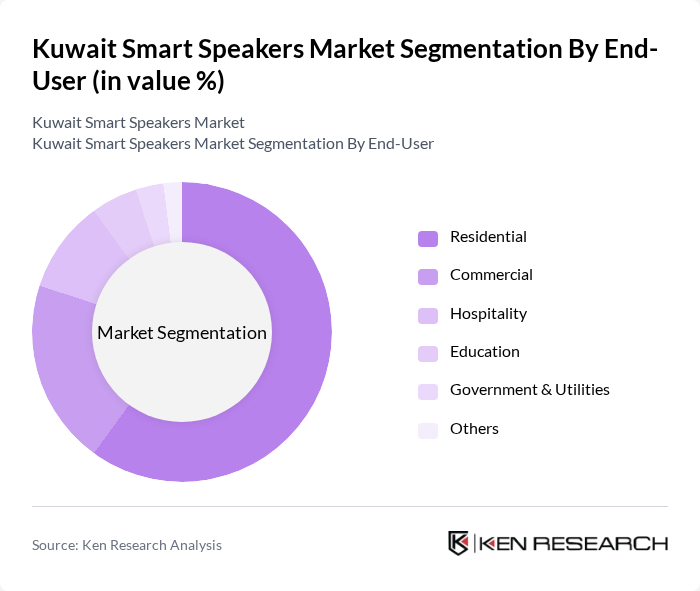

By End-User:The smart speakers market is segmented by end-user into residential, commercial, hospitality, education, government & utilities, and others. The residential segment dominates the market as consumers increasingly seek smart home solutions for convenience and automation. The commercial sector is also growing, driven by businesses adopting smart technologies to enhance customer experiences and operational efficiency. The hospitality industry is leveraging smart speakers to improve guest services, while educational institutions are exploring interactive learning applications .

The Kuwait Smart Speakers Market is characterized by a dynamic mix of regional and international players. Leading participants such as Amazon (Echo, Alexa-enabled devices), Google (Nest Audio, Google Assistant), Apple (HomePod, Siri integration), Sonos, JBL (by Harman), Bose Corporation, Samsung Electronics, Xiaomi Corporation, Harman Kardon, Lenovo Group Limited, LG Electronics, Philips (Signify NV), Anker Innovations, Ultimate Ears (Logitech), Bang & Olufsen contribute to innovation, geographic expansion, and service delivery in this space .

The future of the Kuwait smart speakers market appears promising, driven by technological advancements and increasing consumer acceptance. As AI and machine learning technologies continue to evolve, smart speakers will become more intuitive and user-friendly. Additionally, the integration of smart speakers with home automation systems is expected to enhance their functionality, making them indispensable in modern households. This trend will likely lead to a broader adoption of smart speakers across various demographics, including younger consumers and tech-savvy households.

| Segment | Sub-Segments |

|---|---|

| By Type | Voice-activated speakers Smart displays Portable smart speakers Smart soundbars Others |

| By End-User | Residential Commercial Hospitality Education Government & Utilities Others |

| By Region | Capital Governorate Hawalli Governorate Al Ahmadi Governorate Farwaniya Governorate Mubarak Al-Kabeer Governorate Jahra Governorate Others |

| By Technology | Wi-Fi enabled Bluetooth enabled Multi-room audio technology Voice recognition technology Integration with smart home platforms (e.g., Alexa, Google Assistant, Siri) Others |

| By Application | Home automation Entertainment Personal assistance Education Hospitality Others |

| By Investment Source | Domestic investment Foreign Direct Investment (FDI) Public-Private Partnerships (PPP) Government schemes Others |

| By Policy Support | Subsidies for smart technology Tax exemptions for electronic goods Regulatory support for innovation Grants for research and development Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Consumer Smart Speaker Usage | 120 | Homeowners, Renters, Tech Enthusiasts |

| Retailer Insights on Smart Speakers | 60 | Store Managers, Electronics Sales Representatives |

| Market Trends from Industry Experts | 40 | Market Analysts, Technology Consultants |

| Consumer Preferences and Feedback | 100 | General Consumers, Early Adopters |

| Smart Home Integration Insights | 50 | Home Automation Specialists, Interior Designers |

The Kuwait Smart Speakers Market is valued at approximately USD 20 million, reflecting a growing interest in smart home technologies and voice-activated devices among consumers in the region.