Region:Middle East

Author(s):Dev

Product Code:KRAD2950

Pages:98

Published On:November 2025

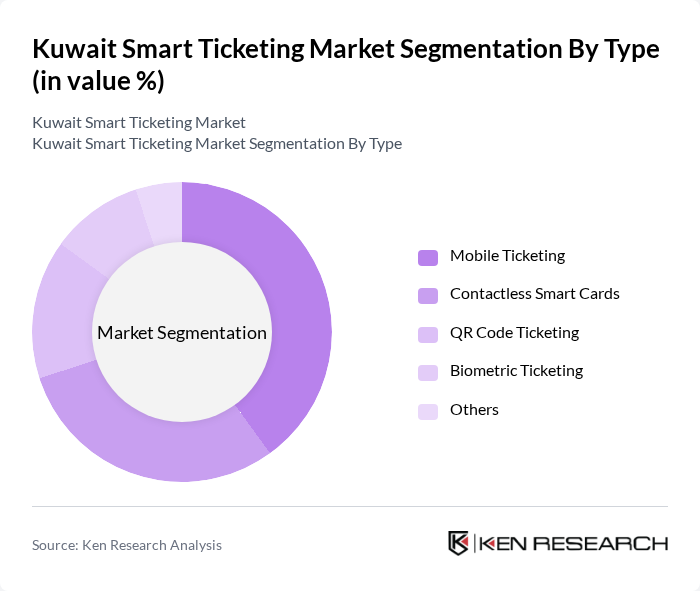

By Type:The smart ticketing market can be segmented into various types, including Mobile Ticketing, Contactless Smart Cards, QR Code Ticketing, Biometric Ticketing, and Others. Among these, Mobile Ticketing is gaining traction due to its convenience and the increasing use of smartphones. Contactless Smart Cards are also popular, especially in public transport systems, as they offer quick and efficient transactions. QR Code Ticketing is emerging as a cost-effective solution for events and transportation, while Biometric Ticketing is still in its nascent stage but shows potential for future growth.

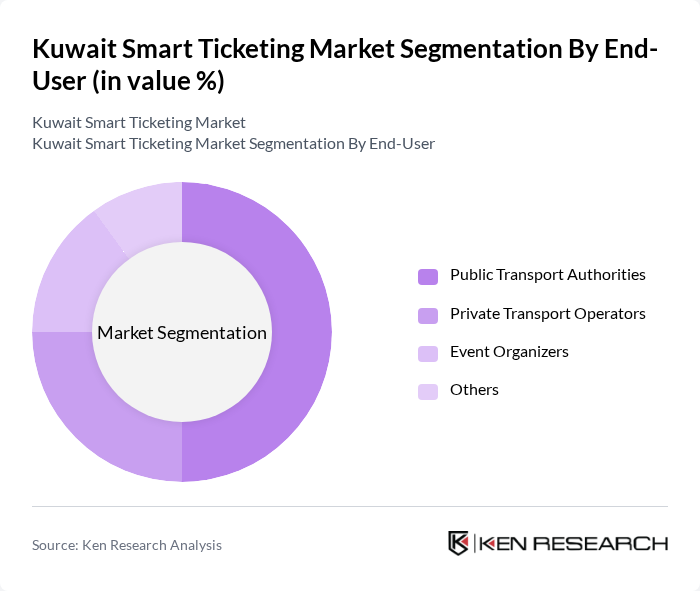

By End-User:The end-user segmentation includes Public Transport Authorities, Private Transport Operators, Event Organizers, and Others. Public Transport Authorities are the largest segment, driven by the need for efficient fare collection systems. Private Transport Operators are also significant users, as they seek to enhance customer experience and streamline operations. Event Organizers are increasingly adopting smart ticketing solutions to manage ticket sales and entry efficiently, while other sectors are gradually recognizing the benefits of smart ticketing.

The Kuwait Smart Ticketing Market is characterized by a dynamic mix of regional and international players. Leading participants such as KNET, Mwasalat, Kuwait Public Transport Company, Ooredoo Kuwait, Zain Kuwait, Talabat, Gulf Bank, National Bank of Kuwait, Boubyan Bank, Al Ahli Bank of Kuwait, Kuwait Finance House, KFH Capital, Al-Mazaya Holding, Al-Dar Properties, Alghanim Industries contribute to innovation, geographic expansion, and service delivery in this space.

The future of the smart ticketing market in Kuwait appears promising, driven by ongoing urbanization and government support for smart city initiatives. As public transportation networks expand, the integration of advanced technologies will enhance user experiences and operational efficiency. The increasing adoption of contactless payment solutions will further facilitate this transition. Additionally, the focus on sustainability will encourage the development of eco-friendly ticketing options, aligning with global trends towards greener urban mobility solutions.

| Segment | Sub-Segments |

|---|---|

| By Type | Mobile Ticketing Contactless Smart Cards QR Code Ticketing Biometric Ticketing Others |

| By End-User | Public Transport Authorities Private Transport Operators Event Organizers Others |

| By Payment Method | Credit/Debit Cards Mobile Wallets Cash Others |

| By Application | Public Transport Events and Entertainment Parking Management Others |

| By Technology | NFC Technology RFID Technology Cloud-Based Solutions Others |

| By User Demographics | Age Groups Income Levels Geographic Distribution Others |

| By Market Maturity | Emerging Markets Established Markets Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Public Transport Authorities | 100 | Transit Managers, Policy Makers |

| Smart Ticketing Technology Providers | 80 | Product Managers, Business Development Executives |

| Commuter Feedback | 150 | Daily Commuters, Occasional Users |

| Tourism Sector Insights | 70 | Tour Operators, Travel Agency Managers |

| Urban Planning Experts | 60 | Urban Planners, Transportation Analysts |

The Kuwait Smart Ticketing Market is valued at approximately USD 150 million, reflecting a significant growth trend driven by urbanization, digital payment adoption, and the need for efficient public transport systems.