Region:Middle East

Author(s):Rebecca

Product Code:KRAD2921

Pages:88

Published On:November 2025

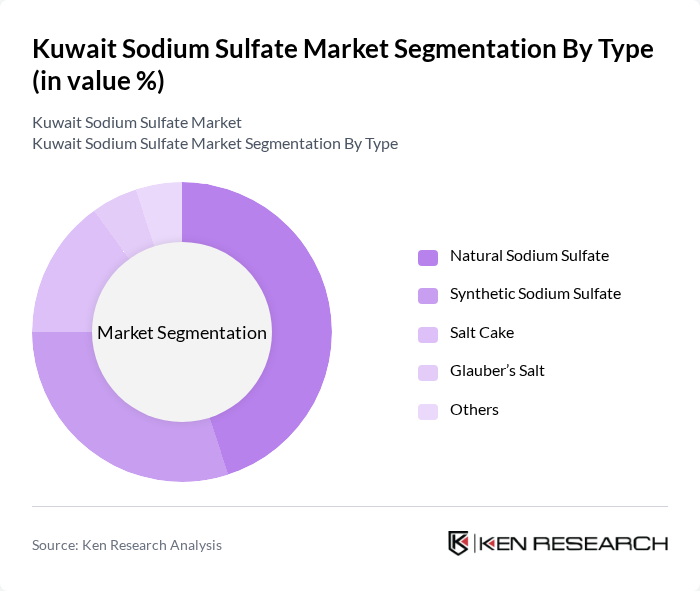

By Type:The sodium sulfate market can be segmented into various types, including Natural Sodium Sulfate, Synthetic Sodium Sulfate, Salt Cake, Glauber’s Salt, and Others. Among these, Natural Sodium Sulfate is the leading subsegment due to its cost-effectiveness and widespread use in detergent manufacturing. Synthetic Sodium Sulfate follows closely, driven by its application in glass production and other industrial processes. The demand for Salt Cake and Glauber’s Salt is also notable, particularly in niche applications.

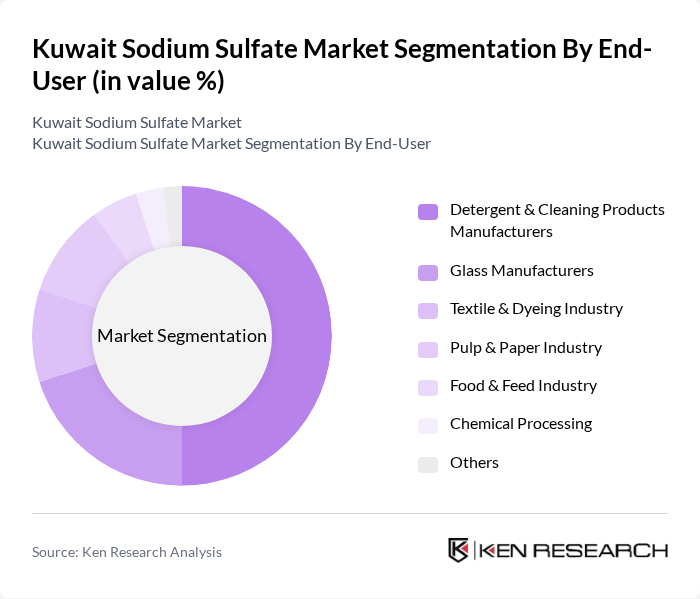

By End-User:The end-user segmentation of the sodium sulfate market includes Detergent & Cleaning Products Manufacturers, Glass Manufacturers, Textile & Dyeing Industry, Pulp & Paper Industry, Food & Feed Industry, Chemical Processing, and Others. The Detergent & Cleaning Products Manufacturers segment holds the largest share, driven by the increasing demand for household and industrial cleaning products. The Glass Manufacturers segment is also significant, as sodium sulfate is essential in glass production processes. The textile and paper industries continue to expand, further supporting the demand for sodium sulfate in these sectors .

The Kuwait Sodium Sulfate Market is characterized by a dynamic mix of regional and international players. Leading participants such as Kuwait Chemical Manufacturing Company (KCMC), Gulf Cryo, United Industrial Gases Co. (UIGC), National Industries Company (NIC), Al-Ahlia Chemical Company, Boubyan Petrochemical Company, Qurain Petrochemical Industries Company (QPIC), Al-Fouzan Trading & General Construction Co., Al-Bahar Group, Al-Kout Industrial Projects Company, Al-Muhalab Group, Al-Sayer Group, Al-Masoud Group, Al-Qatami Global for General Trading, Al-Mansour Group contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Kuwait sodium sulfate market appears promising, driven by increasing demand from various sectors, particularly detergents and glass manufacturing. As sustainability becomes a priority, manufacturers are likely to invest in eco-friendly production methods. Additionally, the expansion of the personal care industry and potential export opportunities to neighboring countries could further enhance market growth. Technological advancements in production processes may also lead to improved efficiency and product quality, positioning the market favorably for the coming years.

| Segment | Sub-Segments |

|---|---|

| By Type | Natural Sodium Sulfate Synthetic Sodium Sulfate Salt Cake Glauber’s Salt Others |

| By End-User | Detergent & Cleaning Products Manufacturers Glass Manufacturers Textile & Dyeing Industry Pulp & Paper Industry Food & Feed Industry Chemical Processing Others |

| By Application | Soaps & Detergents Textile Processing Glass Manufacturing Pulp & Paper Food Additive Others |

| By Distribution Channel | Direct Sales Distributors/Wholesalers Online Sales Others |

| By Packaging Type | Bulk Packaging (Jumbo Bags, Tankers) Retail Packaging (Sacks, Small Bags) Others |

| By Geography | Urban Areas Industrial Zones Rural Areas Others |

| By Product Form | Powder Granules Crystals Liquid Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Detergent Manufacturers | 60 | Production Managers, Product Development Managers |

| Textile Industry Users | 50 | Procurement Managers, Quality Control Supervisors |

| Glass Production Facilities | 40 | Operations Managers, Supply Chain Managers |

| Construction Material Suppliers | 40 | Sales Managers, Product Line Managers |

| Research Institutions | 40 | Research Scientists, Industry Analysts |

The Kuwait Sodium Sulfate Market is valued at approximately USD 150 million, reflecting a five-year historical analysis. This valuation is driven by increasing demand across various industries, including detergents, glass manufacturing, and textiles.