Region:Middle East

Author(s):Shubham

Product Code:KRAD3682

Pages:85

Published On:November 2025

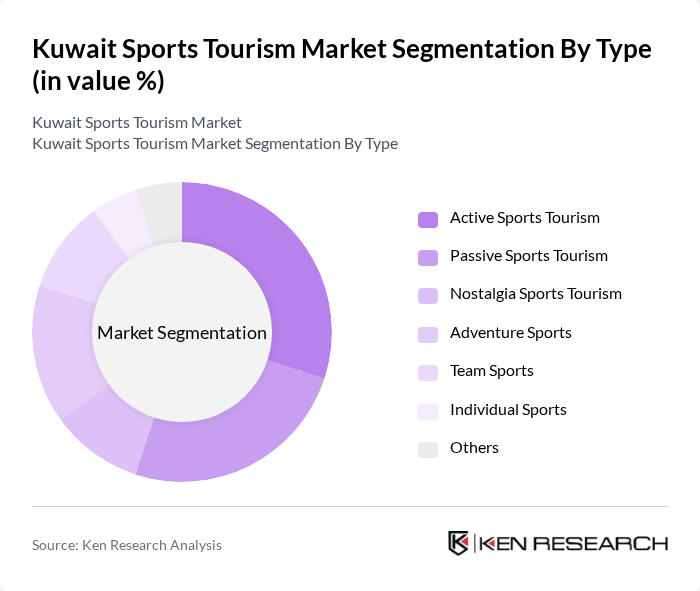

By Type:The market can be segmented into various types, including Active Sports Tourism, Passive Sports Tourism, Nostalgia Sports Tourism, Adventure Sports, Team Sports, Individual Sports, and Others. Each of these segments caters to different consumer preferences and behaviors, with Active Sports Tourism being particularly popular among younger demographics seeking adventure and engagement in sports activities. Passive Sports Tourism, on the other hand, appeals to those who prefer to spectate rather than participate.

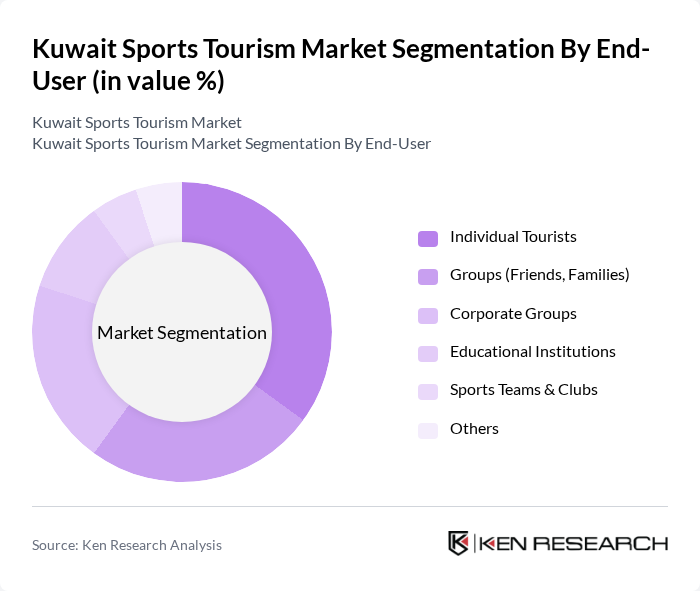

By End-User:The end-user segmentation includes Individual Tourists, Groups (Friends, Families), Corporate Groups, Educational Institutions, Sports Teams & Clubs, and Others. Individual tourists are increasingly seeking personalized experiences, while corporate groups often look for team-building activities through sports. Educational institutions are also engaging in sports tourism to enhance student experiences, making this segment vital for market growth.

The Kuwait Sports Tourism Market is characterized by a dynamic mix of regional and international players. Leading participants such as Kuwait Sports Club, Al Ahli Sporting Club, Kuwait Football Association, Kuwait Olympic Committee, Gulf Bank, National Bank of Kuwait, Kuwait Airways, Al Kout Mall, Al Qabas Newspaper, KIPCO (Kuwait Projects Company Holding K.S.C.P.), Zain Group, Boubyan Bank, Agility Public Warehousing Company K.S.C.P., Al Mulla Group, Alghanim Industries, Touristic Enterprises Company (TEC), Radisson Blu Hotel, Kuwait, Jumeirah Messilah Beach Hotel & Spa, Crowne Plaza Kuwait, City Centre Kuwait contribute to innovation, geographic expansion, and service delivery in this space.

The future of Kuwait's sports tourism market appears promising, driven by ongoing investments in infrastructure and a strategic focus on hosting international events. As the government continues to enhance facilities and promote local sports, the influx of tourists is expected to rise. Additionally, the integration of technology in event management and marketing will likely improve visitor experiences, making Kuwait a more attractive destination for sports enthusiasts and families alike, fostering sustainable growth in the sector.

| Segment | Sub-Segments |

|---|---|

| By Type | Active Sports Tourism Passive Sports Tourism Nostalgia Sports Tourism Adventure Sports Team Sports Individual Sports Others |

| By End-User | Individual Tourists Groups (Friends, Families) Corporate Groups Educational Institutions Sports Teams & Clubs Others |

| By Sports Type | Football/Soccer Motorsports Basketball Tennis Cricket Water Sports Others |

| By Event Type | International Tournaments Local Competitions Sports Festivals Training Camps Others |

| By Booking Channel | Online Booking Platforms Direct Bookings Travel Agencies Social Media Platforms Others |

| By Seasonality | Peak Season Off-Peak Season Year-Round Events Others |

| By Demographics | Age Groups Gender Income Levels Others |

| By Travel Purpose | Leisure Business Educational Others |

| By Geographic Region | Urban Areas Rural Areas Coastal Regions Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Local Sports Event Attendees | 120 | Sports Enthusiasts, Event Participants |

| International Sports Tourists | 60 | Travelers, Sports Fans |

| Hotel and Accommodation Providers | 40 | Hotel Managers, Marketing Directors |

| Sports Event Organizers | 50 | Event Coordinators, Sponsorship Managers |

| Local Government Officials | 40 | Tourism Development Officers, Policy Makers |

The Kuwait Sports Tourism Market is valued at approximately USD 1.1 billion, reflecting a significant growth driven by increased popularity of sports events, government initiatives, and rising disposable income among the population.