Region:Middle East

Author(s):Geetanshi

Product Code:KRAD5893

Pages:81

Published On:December 2025

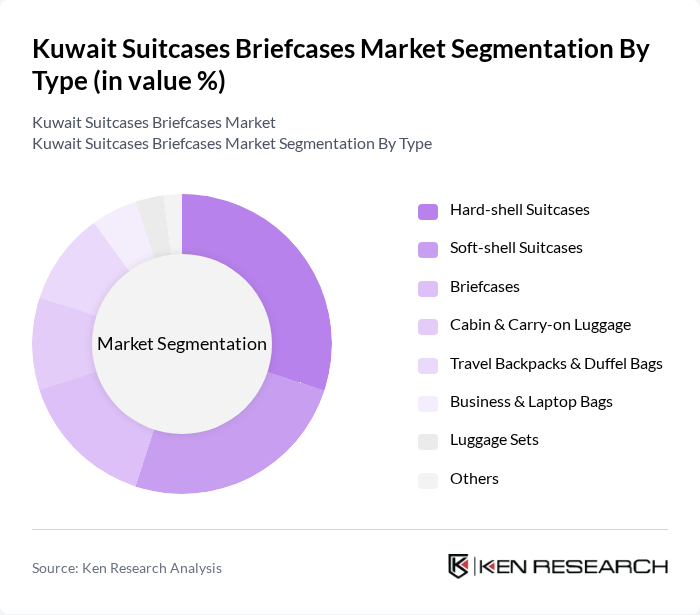

By Type:The market is segmented into various types of luggage, including hard-shell suitcases, soft-shell suitcases, briefcases, cabin & carry-on luggage, travel backpacks & duffel bags, business & laptop bags, luggage sets, and others. Among these, hard-shell suitcases are gaining popularity due to their durability and security features, appealing to both business and leisure travelers. Soft-shell suitcases also remain popular for their lightweight and flexible nature, catering to a diverse consumer base.

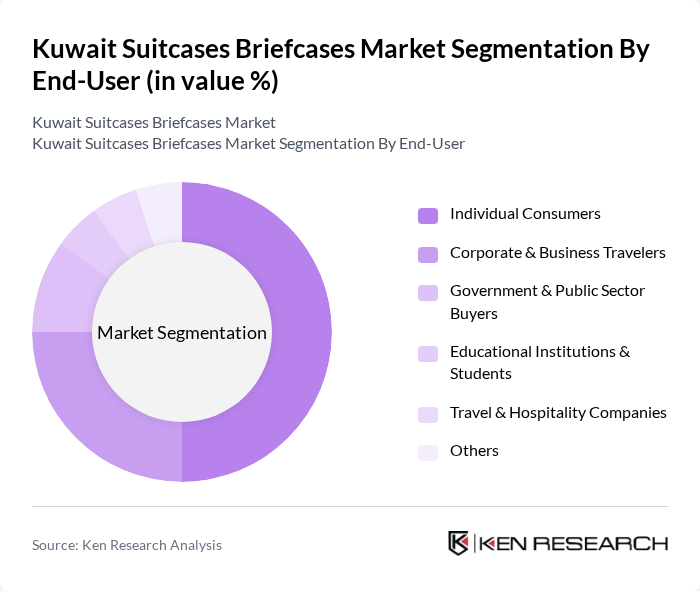

By End-User:The end-user segmentation includes individual consumers, corporate & business travelers, government & public sector buyers, educational institutions & students, travel & hospitality companies, and others. Individual consumers dominate the market, driven by the increasing trend of personal travel and the growing emphasis on quality and style in luggage choices. Corporate travelers also represent a significant segment, seeking durable and professional-looking briefcases and business bags.

The Kuwait Suitcases Briefcases Market is characterized by a dynamic mix of regional and international players. Leading participants such as Samsonite International S.A., American Tourister, Delsey Paris, Tumi Inc., Rimowa GmbH, VIP Industries Ltd, Carlton (VIP Industries), Swissgear (Wenger / Victorinox), Skybags, Pierre Cardin, Giordano, Antler Luggage, Polo Club (U.S. Polo Assn. / Beverly Hills Polo Club), Parfois, Local & Private Label Brands (e.g., Centrepoint, Max, Hypermarket Labels) contribute to innovation, geographic expansion, and service delivery in this space.

The Kuwait suitcases and briefcases market is poised for significant growth, driven by increasing travel activities and rising disposable incomes. As consumers become more environmentally conscious, brands are likely to focus on sustainable materials and eco-friendly practices. Additionally, the expansion of e-commerce platforms will facilitate easier access to a wider range of products, enhancing consumer choice. Companies that adapt to these trends and invest in innovative designs will likely capture a larger market share in the coming years.

| Segment | Sub-Segments |

|---|---|

| By Type | Hard-shell Suitcases Soft-shell Suitcases Briefcases Cabin & Carry-on Luggage Travel Backpacks & Duffel Bags Business & Laptop Bags Luggage Sets Others |

| By End-User | Individual Consumers Corporate & Business Travelers Government & Public Sector Buyers Educational Institutions & Students Travel & Hospitality Companies Others |

| By Distribution Channel | Specialty Luggage & Bag Stores Department Stores & Hypermarkets Travel Retail (Airports & Duty-Free) Online Marketplaces & Brand E-commerce Wholesale & B2B Distributors Others |

| By Material | Polycarbonate & ABS Nylon Polyester Leather & Faux Leather Fabric & Canvas Others |

| By Price Range | Budget Mid-range Premium Luxury / Designer Others |

| By Brand | International Mass Brands International Premium & Luxury Brands Regional GCC Brands Private Labels & Retailer Brands Others |

| By Usage Occasion | Business Travel Leisure & Holiday Travel Weekend & Short Trips Pilgrimage & Religious Travel Long-term & Expatriate Travel Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Retail Luggage Sales | 120 | Store Managers, Sales Associates |

| Business Professionals' Briefcase Preferences | 100 | Corporate Executives, Frequent Travelers |

| Tourist Luggage Purchasing Behavior | 80 | International Tourists, Travel Agents |

| Online vs. Offline Shopping Trends | 100 | eCommerce Managers, Retail Analysts |

| Consumer Insights on Luxury Luggage | 70 | Luxury Brand Consumers, Fashion Influencers |

The Kuwait Suitcases Briefcases Market is valued at approximately USD 35 million, reflecting a five-year historical analysis. This growth is driven by increasing travel activities and a rising demand for high-quality luggage products.