Region:Middle East

Author(s):Geetanshi

Product Code:KRAC2349

Pages:89

Published On:October 2025

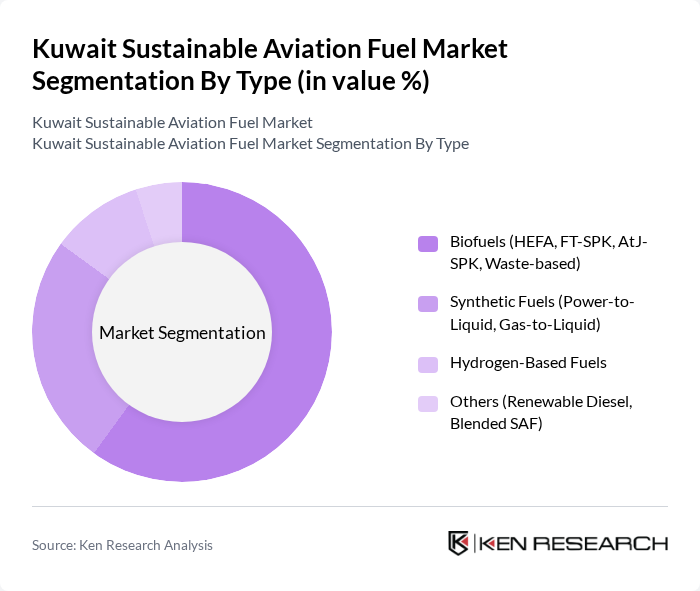

By Type:The market is segmented into various types of sustainable aviation fuels, including biofuels, synthetic fuels, hydrogen-based fuels, and others. Among these, biofuels—particularly Hydroprocessed Esters and Fatty Acids (HEFA)—lead due to their established production processes and compatibility with existing jet engines. Synthetic fuels, such as Power-to-Liquid and Gas-to-Liquid, are gaining traction but remain in developmental phases. Hydrogen-based fuels are emerging as a long-term solution for decarbonizing aviation, supported by ongoing pilot projects and research initiatives. Other fuel types, including renewable diesel and blended SAF, contribute to diversification but currently hold a smaller market share.

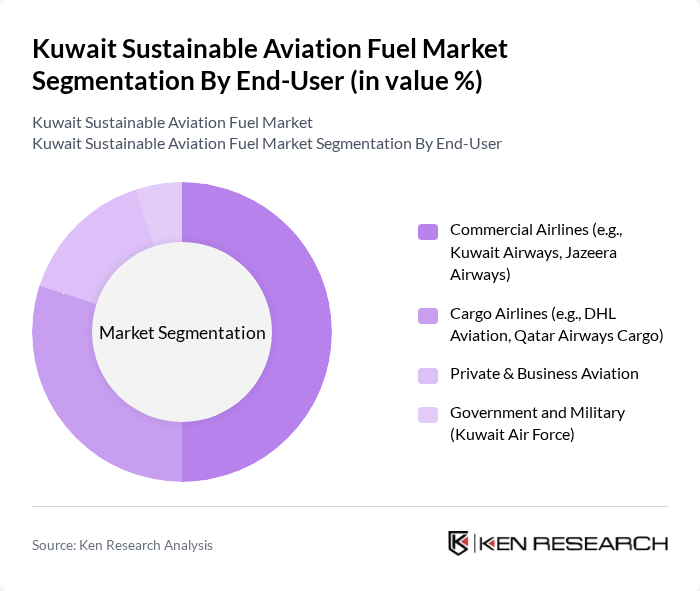

By End-User:The sustainable aviation fuel market is segmented by end-users, including commercial airlines, cargo airlines, private and business aviation, and government and military. Commercial airlines dominate the market due to their large fuel consumption and commitment to sustainability initiatives. Cargo airlines are significant users, driven by the need to meet corporate sustainability goals and regulatory requirements. Private and business aviation is increasingly adopting SAF, supported by aircraft manufacturers certifying compatibility and operators integrating SAF into their operations. Government and military aviation are gradually adopting sustainable fuels as part of broader environmental strategies and compliance with national mandates.

The Kuwait Sustainable Aviation Fuel Market is characterized by a dynamic mix of regional and international players. Leading participants such as Neste Corporation, TotalEnergies SE, LanzaTech, Inc., Gevo, Inc., World Energy LLC, Velocys PLC, Fulcrum BioEnergy, Inc., SkyNRG B.V., Air BP, Shell Aviation, Honeywell UOP, Aemetis, Inc., Red Rock Biofuels, Avfuel Corporation, and Kuwait Petroleum Corporation (KPC) contribute to innovation, geographic expansion, and service delivery in this space.

The future of the sustainable aviation fuel market in Kuwait appears promising, driven by increasing environmental awareness and regulatory pressures. As the aviation sector seeks to achieve carbon neutrality in future, investments in innovative fuel technologies and infrastructure development are expected to rise. Collaborative efforts among stakeholders, including government bodies, airlines, and fuel producers, will be crucial in overcoming existing challenges and fostering a robust market for sustainable aviation fuels in the region.

| Segment | Sub-Segments |

|---|---|

| By Type | Biofuels (HEFA, FT-SPK, AtJ-SPK, Waste-based) Synthetic Fuels (Power-to-Liquid, Gas-to-Liquid) Hydrogen-Based Fuels Others (Renewable Diesel, Blended SAF) |

| By End-User | Commercial Airlines (e.g., Kuwait Airways, Jazeera Airways) Cargo Airlines (e.g., DHL Aviation, Qatar Airways Cargo) Private & Business Aviation Government and Military (Kuwait Air Force) |

| By Application | Domestic Flights International Flights Charter Services Others |

| By Distribution Channel | Direct Sales (Producer to Airline) Partnerships with Airlines & Airports Fuel Supply Agreements (Long-term Contracts) Others (Third-party Distributors) |

| By Investment Source | Private Investments (Local & International) Government Funding (Kuwait Petroleum Corporation, Ministry of Oil) International Grants (UN, IATA, ICAO) Others |

| By Policy Support | Subsidies Tax Incentives Research Grants Others |

| By Technology | Fischer-Tropsch Synthesis (FT-SPK) Hydroprocessed Esters and Fatty Acids (HEFA) Alcohol-to-Jet Technology (AtJ-SPK) Others (Renewable Diesel, Co-processing) |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Airline Fuel Procurement | 60 | Fuel Managers, Procurement Officers |

| SAF Production Facilities | 50 | Plant Managers, Operations Directors |

| Regulatory Compliance in Aviation | 40 | Regulatory Affairs Specialists, Environmental Compliance Officers |

| Research & Development in SAF Technologies | 50 | R&D Managers, Innovation Leads |

| Market Trends in Sustainable Aviation | 60 | Market Analysts, Industry Consultants |

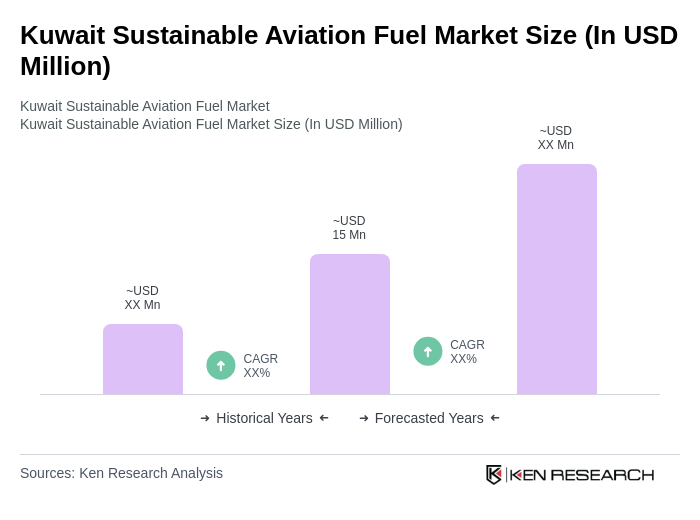

The Kuwait Sustainable Aviation Fuel market is valued at approximately USD 15 million, reflecting a growing trend driven by environmental regulations and the demand for cleaner aviation fuels.