Region:Middle East

Author(s):Rebecca

Product Code:KRAD1396

Pages:84

Published On:November 2025

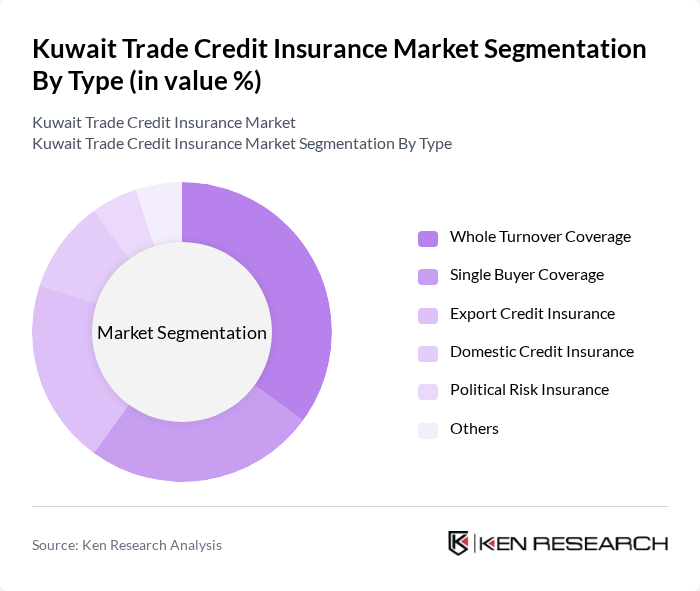

By Type:The market is segmented into various types of coverage, including Whole Turnover Coverage, Single Buyer Coverage, Export Credit Insurance, Domestic Credit Insurance, Political Risk Insurance, and Others. Each type serves different business needs, with Whole Turnover Coverage being particularly popular among companies with diverse customer bases, while Single Buyer Coverage is favored by businesses dealing with specific clients. Export Credit Insurance is increasingly adopted by firms involved in cross-border transactions, and Political Risk Insurance is sought by companies operating in regions with heightened geopolitical risks .

The Whole Turnover Coverage segment leads the market due to its comprehensive nature, allowing businesses to insure all their trade receivables under a single policy. This type of coverage is particularly appealing to companies with a large number of customers, as it simplifies the insurance process and provides extensive protection against defaults. The increasing trend of businesses seeking to streamline their risk management strategies, along with the adoption of digital platforms for policy management, has further solidified the dominance of this segment .

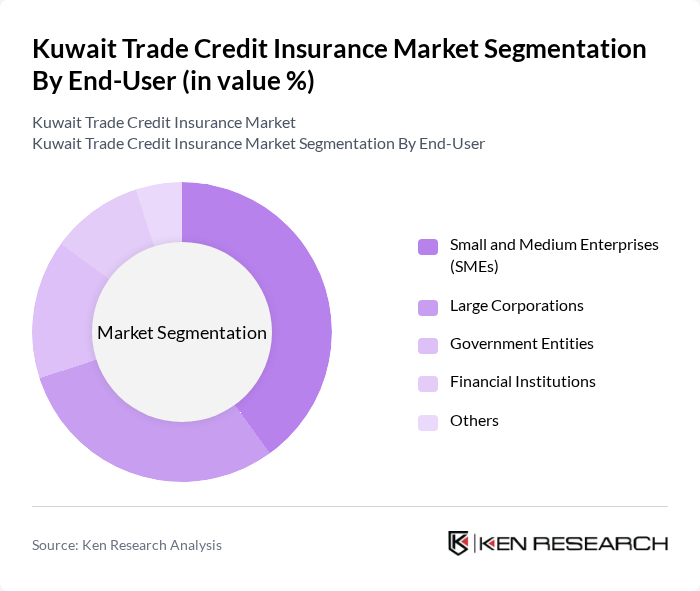

By End-User:The market is segmented by end-users, including Small and Medium Enterprises (SMEs), Large Corporations, Government Entities, Financial Institutions, and Others. SMEs are increasingly adopting trade credit insurance to safeguard their receivables, while large corporations utilize it to manage extensive credit risks associated with their operations. Government entities and financial institutions are also expanding their use of credit insurance to support public-private partnerships and secure lending portfolios .

Small and Medium Enterprises (SMEs) dominate the end-user segment, driven by their growing awareness of the importance of credit insurance in mitigating financial risks. As SMEs increasingly engage in international trade, they seek protection against potential defaults, making trade credit insurance a vital tool for their financial stability. The trend of digitalization and the availability of tailored insurance products for SMEs have further enhanced their market presence. Large corporations continue to leverage credit insurance for risk management across complex supply chains, while government entities and financial institutions are expanding coverage to support economic diversification and lending activities .

The Kuwait Trade Credit Insurance Market is characterized by a dynamic mix of regional and international players. Leading participants such as Kuwait Insurance Company S.A.K.P., Gulf Insurance Group K.S.C.P., Al Ahleia Insurance Company S.A.K.P., Warba Insurance Company K.S.C., Kuwait Reinsurance Company K.S.C.P., Al Fajer Reinsurance Company K.S.C., Takaful International Company B.S.C., Euler Hermes (Allianz Trade), Coface, Atradius, Export Credit Guarantee Company of Egypt (ECGE), Al Sagr National Insurance Company, Zurich Insurance Group, American International Group (AIG), QIC Insured (Qatar Insurance Company) contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Kuwait trade credit insurance market appears promising, driven by technological advancements and increasing awareness among businesses. As digital transformation continues, insurers are expected to leverage data analytics for better risk assessment and customer engagement. Additionally, the growing emphasis on sustainability will likely influence product offerings, aligning with global trends. With government initiatives supporting SMEs, the market is poised for growth, fostering a more resilient business environment in Kuwait.

| Segment | Sub-Segments |

|---|---|

| By Type | Whole Turnover Coverage Single Buyer Coverage Export Credit Insurance Domestic Credit Insurance Political Risk Insurance Others |

| By End-User | Small and Medium Enterprises (SMEs) Large Corporations Government Entities Financial Institutions Others |

| By Industry Sector | Food & Beverage IT & Telecom Metals & Mining Healthcare Energy & Utilities Automotive Construction Retail & Wholesale Others |

| By Coverage Type | Whole Turnover Insurance Single Buyer Insurance Multi-Buyer Insurance Political Risk Insurance Others |

| By Distribution Channel | Direct Sales Brokers Online Platforms Agents Others |

| By Policy Duration | Short-Term Policies Medium-Term Policies Long-Term Policies Others |

| By Risk Assessment Methodology | Credit Scoring Models Financial Statement Analysis Market Analysis External Credit Agency Ratings Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Manufacturing Sector Trade Credit Users | 100 | Financial Managers, Risk Officers |

| Retail Sector Trade Credit Insurance Clients | 60 | Operations Managers, Business Development Heads |

| Service Industry Trade Credit Insurance Stakeholders | 50 | Insurance Brokers, Financial Analysts |

| Exporters Utilizing Trade Credit Insurance | 40 | Export Managers, Compliance Officers |

| SMEs Engaged in Trade Credit Insurance | 70 | Business Owners, Financial Controllers |

The Kuwait Trade Credit Insurance Market is valued at approximately USD 160 million, reflecting a significant growth driven by the increasing need for businesses to mitigate trade credit risks, especially in a volatile economic environment.