Region:Asia

Author(s):Geetanshi

Product Code:KRAE0686

Pages:80

Published On:December 2025

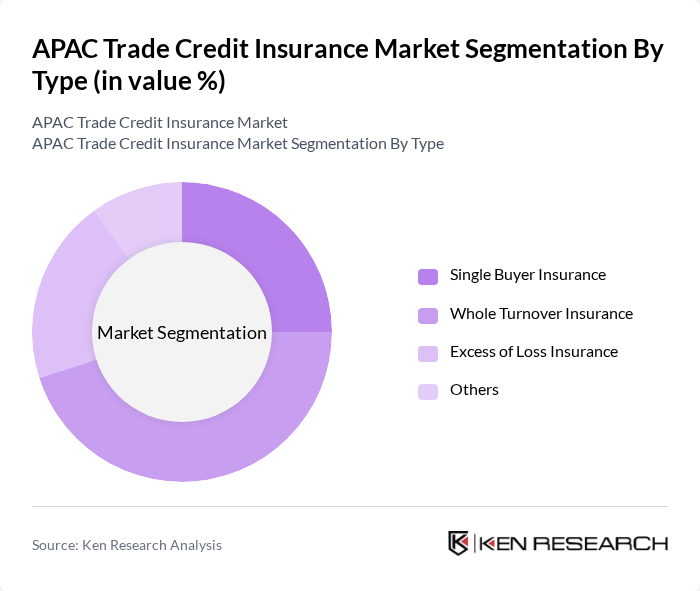

By Type:The market is segmented into various types of trade credit insurance, including Single Buyer Insurance, Whole Turnover Insurance, Excess of Loss Insurance, and Others. Among these, Whole Turnover Insurance is the most dominant segment, as it provides comprehensive coverage for all sales made by a business, making it particularly attractive for companies with high sales volumes. This type of insurance allows businesses to manage their credit risk more effectively, especially in volatile markets.

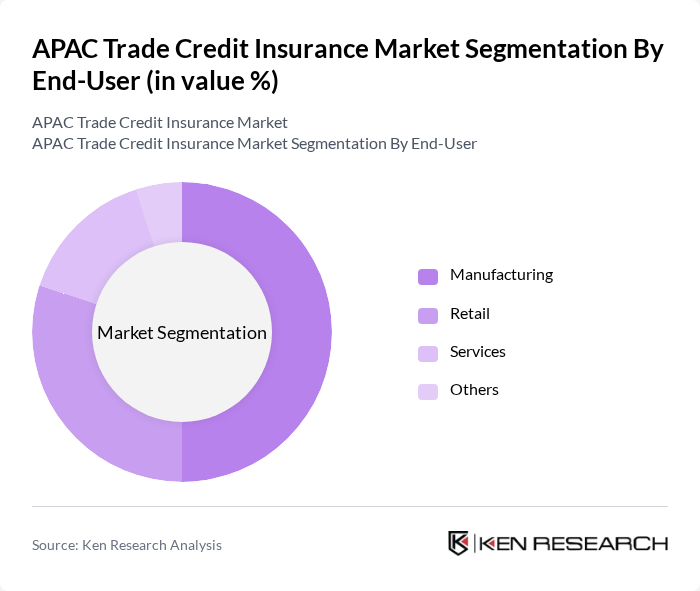

By End-User:The end-user segmentation includes Manufacturing, Retail, Services, and Others. The Manufacturing sector is the leading end-user of trade credit insurance, driven by the need to protect against payment defaults in a highly competitive and often unpredictable market. Manufacturers often engage in large transactions, making them particularly vulnerable to credit risks, thus increasing their reliance on trade credit insurance.

The APAC Trade Credit Insurance Market is characterized by a dynamic mix of regional and international players. Leading participants such as Euler Hermes, Coface, Atradius, Zurich Insurance Group, Chubb Limited, AIG, QBE Insurance Group, Tokio Marine Holdings, Berkshire Hathaway, Allianz Trade, Credendo Group, Liberty Mutual, AXA, Sompo International, and HDI Global contribute to innovation, geographic expansion, and service delivery in this space.

The APAC trade credit insurance market is poised for significant evolution, driven by technological advancements and increasing cross-border trade activities. As businesses adopt digital solutions for underwriting and claims processing, efficiency and customer satisfaction are expected to improve. Additionally, the growing emphasis on sustainability will likely lead to the development of eco-friendly insurance products, aligning with global trends. These factors will create a more robust and responsive market, catering to the diverse needs of businesses in the region.

| Segment | Sub-Segments |

|---|---|

| By Type | Single Buyer Insurance Whole Turnover Insurance Excess of Loss Insurance Others |

| By End-User | Manufacturing Retail Services Others |

| By Industry | Construction Agriculture Technology Others |

| By Coverage Type | Domestic Coverage International Coverage Multi-Currency Coverage Others |

| By Distribution Channel | Direct Sales Brokers Online Platforms Others |

| By Policy Duration | Short-term Policies Medium-term Policies Long-term Policies Others |

| By Risk Assessment Methodology | Credit Scoring Models Financial Statement Analysis Industry Risk Assessment Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Manufacturing Sector Trade Credit Insurance | 150 | Risk Managers, CFOs |

| Retail Industry Insurance Needs | 100 | Insurance Brokers, Retail Operations Managers |

| SME Trade Credit Insurance Adoption | 80 | Business Owners, Financial Advisors |

| Export-Import Trade Insurance Insights | 120 | Trade Compliance Officers, Logistics Managers |

| Financial Services Sector Perspectives | 90 | Underwriters, Risk Assessment Analysts |

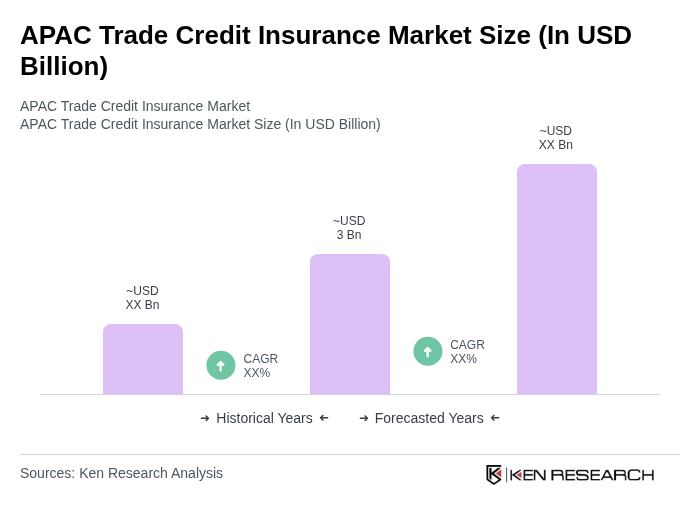

The APAC Trade Credit Insurance Market is valued at approximately USD 3 billion, driven by increasing insolvency risks and the rising volume of cross-border trade, which encourages businesses to secure their receivables through trade credit insurance.