Region:Middle East

Author(s):Rebecca

Product Code:KRAD4905

Pages:94

Published On:December 2025

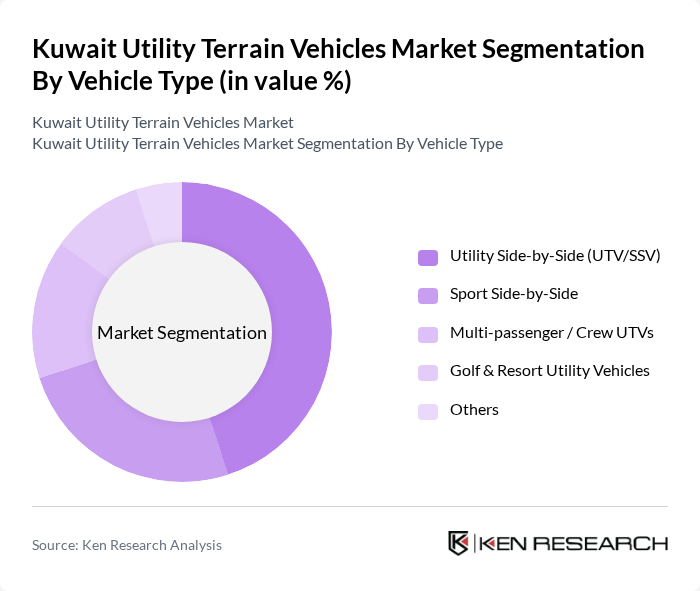

By Vehicle Type:The vehicle type segmentation includes various categories of utility terrain vehicles, each catering to different consumer needs and preferences. The dominant sub-segment in this category is the Utility Side-by-Side (UTV/SSV), which is favored for its versatility and ability to accommodate multiple passengers. This segment is particularly popular among recreational users and in agricultural applications, where functionality and capacity are crucial. Other segments, such as Sport Side-by-Side and Multi-passenger/Crew UTVs, also contribute to the market but do not match the UTV/SSV's popularity. The Golf & Resort Utility Vehicles segment serves niche markets such as hospitality and leisure resorts.

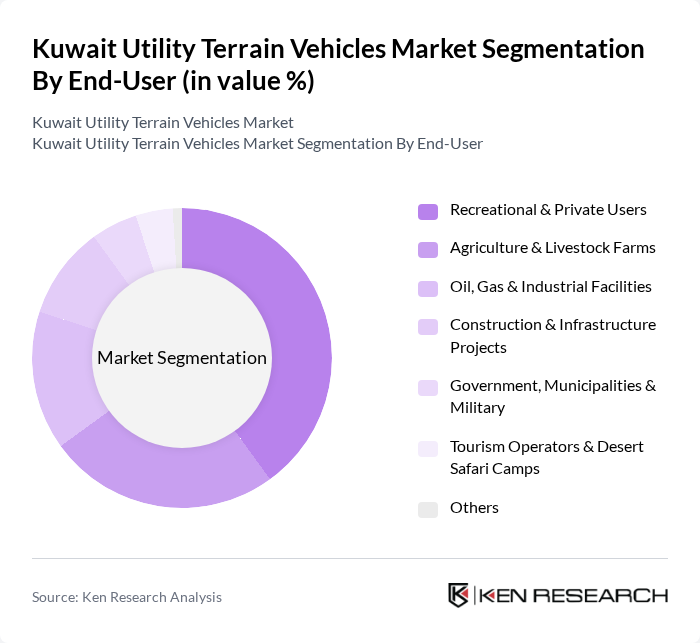

By End-User:The end-user segmentation highlights the various sectors utilizing utility terrain vehicles, with Recreational & Private Users being the leading segment. This group is driven by the increasing popularity of outdoor activities and tourism in Kuwait, particularly in desert safari experiences. Agriculture & Livestock Farms also represent a significant portion of the market, as these vehicles are essential for transporting goods and personnel in rural areas. Other sectors, including Oil, Gas & Industrial Facilities, and Government, Municipalities & Military, contribute to the market but are secondary to recreational use. Tourism Operators & Desert Safari Camps are emerging as a distinct segment due to specialized vehicle requirements for desert mobility.

The Kuwait Utility Terrain Vehicles Market is characterized by a dynamic mix of regional and international players. Leading participants such as Polaris Inc., Yamaha Motor Co., Ltd., Honda Motor Co., Ltd., BRP Inc. (Can-Am), Kawasaki Heavy Industries, Ltd., Kubota Corporation, John Deere (Deere & Company), CFMOTO (Hangzhou CFMOTO Power Co., Ltd.), Kwang Yang Motor Co., Ltd. (KYMCO), HISUN Motors Corp., Ltd., Textron Inc. (Textron Off Road / Arctic Cat), Mahindra & Mahindra Ltd., Club Car, LLC, Bad Boy Buggies, Local & Regional Distributors in Kuwait (e.g., Kuwait Auto Parts & Accessories Co., Al Mulla Group, Behbehani Motors) contribute to innovation, geographic expansion, and service delivery in this space.

The future outlook for the Kuwait utility terrain vehicles market appears promising, driven by increasing consumer interest in outdoor activities and government support for tourism. As recreational parks expand and eco-tourism initiatives gain traction, the demand for UTVs is expected to rise. Additionally, advancements in electric vehicle technology and smart features will likely attract environmentally conscious consumers, further enhancing market growth. The combination of these factors positions the UTV market for significant development in future.

| Segment | Sub-Segments |

|---|---|

| By Vehicle Type | Utility Side-by-Side (UTV/SSV) Sport Side-by-Side Multi-passenger / Crew UTVs Golf & Resort Utility Vehicles Others |

| By End-User | Recreational & Private Users Agriculture & Livestock Farms Oil, Gas & Industrial Facilities Construction & Infrastructure Projects Government, Municipalities & Military Tourism Operators & Desert Safari Camps Others |

| By Application | Off-road Recreation & Sports Utility & Cargo Hauling Facility & Site Patrol (industrial, oilfields, campuses) Agriculture & Landscaping Operations Emergency Response & Rescue Tourism, Rental & Safari Operations Others |

| By Propulsion / Engine Type | Gasoline ICE UTVs Diesel ICE UTVs Electric UTVs Hybrid UTVs Others |

| By Payload / Towing Capacity | Up to 300 kg – 600 kg – 1,000 kg Above 1,000 kg Others |

| By Distribution Channel | Authorized OEM Dealerships Independent Powersports & Off-road Dealers Direct Imports & Fleet Sales Online Platforms & Classifieds Rental & Leasing Companies Others |

| By Price Range | Entry-Level / Budget (up to USD 15,000) Mid-Range (USD 15,001 – 30,000) Premium (above USD 30,000) Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Agricultural Utility Terrain Vehicles | 100 | Farm Owners, Agricultural Equipment Managers |

| Construction Utility Terrain Vehicles | 80 | Project Managers, Site Supervisors |

| Military Utility Terrain Vehicles | 60 | Defense Procurement Officers, Military Logistics Coordinators |

| Recreational Utility Terrain Vehicles | 70 | Outdoor Activity Organizers, Rental Service Owners |

| Utility Terrain Vehicle Maintenance Services | 50 | Service Center Managers, Automotive Technicians |

The Kuwait Utility Terrain Vehicles market is valued at approximately USD 165 million, reflecting a five-year historical analysis. This growth is driven by increasing demand for off-road vehicles across recreational, agricultural, and industrial applications.